- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- EU session review: Euro weakens on concern Europe will struggle debts

EU session review: Euro weakens on concern Europe will struggle debts

The euro weakened for the first time in three days against the dollar on concern euro-area leaders will struggle to resolve the debt crisis, damping demand for the region’s assets.

The shared currency weakened after Greek Prime Minister George Papandreou said he’ll press ahead with additional austerity measures even as he failed to win backing from opposition parties.

“There’s still a lot of uncertainty about the possibility of a Greek restructuring and what is going to be done to help it refinance itself,” said You-na Park, a currency strategist at Commerzbank AG. “That’s driving the euro weaker.”

Greece’s Antonis Samaras, leader of the biggest opposition party, New Democracy, rejected Papandreou’s plan at a meeting with him and other opposition leaders in Athens, saying his party wouldn’t be blackmailed.

European Union officials have called for consensus on the package, which includes an extra 6 billion euros ($8.6 billion) of budget cuts and a plan to speed 50 billion euros of state-asset sales.

“There are definitely still peripheral European problems,” said Osao Iizuka at Sumitomo Trust & Banking Co.. “The uncertainty is likely to weigh on the euro.”

The euro has fallen 2.1% in the past month.

The Swiss franc has strengthened 3.8% and the yen has added 2.4%.

Demand for New Zealand’s dollar was bolstered after the nation’s statistics bureau said today that exports outpaced imports by NZ$1.11 billion ($910 million) from a revised NZ$578 million surplus in March. The median estimate was for a NZ$600 million surplus.

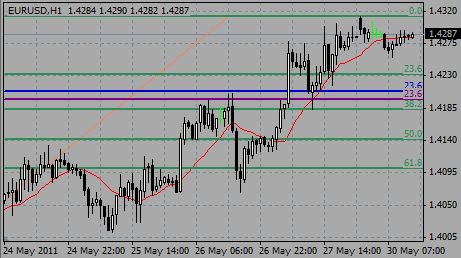

EUR/USD back to $1.4284 after earlier it weakened to $1.4255. Resistance remains between $1.4285/90.

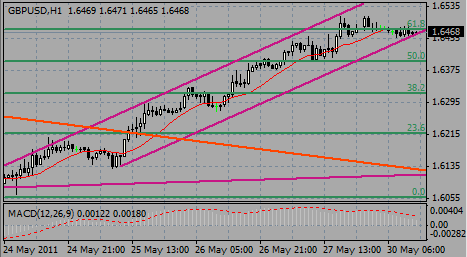

GBP/USD continues to holds under pressure, thus above support at $1.6460/50. Stops noted through $1.6445/40 with further support noted into $1.6430.

USD/JPY still holds within the Y80.75/90.

U.S. markets are closed today for the Memorial Day holiday.

Markets in the U.K. are also closed to observe the Spring Bank Holiday.

Among the figures from Canada investors may digest GDP and Trdae Balance data at 12:30 GMT.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.