- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- EU session review: Euro advances to three-week high

EU session review: Euro advances to three-week high

Data released:

06:00 Germany Retail sales (May) real adjusted -2.8% - 0.6%

06:00 Germany Retail sales (May) real unadjusted Y/Y 2.2% - 3.6%

06:00 UK Nationwide house price index (June) 0.0% 0.2% 0.3%

06:00 UK Nationwide house price index (June) Y/Y -1.1% -1.3% -1.2%

06:45 France PPI (May) -0.5% 0.4% 0.8%

06:45 France PPI (May) Y/Y 6.0% 6.5% 6.4%

06:45 France Consumer spending (May) -0.8% 0.6% -1.8%

06:45 France Consumer spending (May) Y/Y -1.8% - -0.1%

07:55 Germany Unemployment (June) seasonally adjusted -8K -16K -8K

07:55 Germany Unemployment (June) seasonally adjusted, mln 2.967 - 2.975 (2.974)

07:55 Germany Unemployment rate (June) seasonally adjusted 7.0% 7.0% 7.0%

07:55 Germany Unemployment (June) seasonally unadjusted, mln 2.893 - 2.960

07:55 Germany Unemployment rate (June) seasonally unadjusted 6.9% - 7.0%

08:00 EU(17) M3 money supply (May) adjusted Y/Y 2.4% 2.2% 2.0%

08:00 EU(17) M3 money supply (3 months to May) adjusted Y/Y 2.2% 2.1% 2.1%

09:00 EU(17) Harmonized CPI (June) Y/Y preliminary 2.7% 2.8% 2.7%

09:00 Italy CPI (June) preliminary 0.1% 0.1% 0.1%

09:00 Italy CPI (June) preliminary Y/Y 2.7% 2.7% 2.6%

09:00 Italy HICP (June) preliminary Y/Y 3.0% 3.0% 3.0%

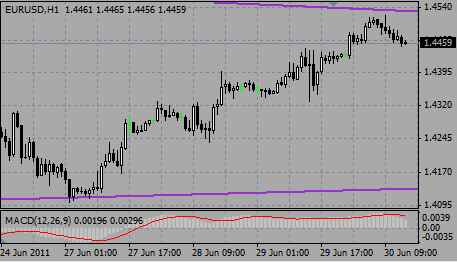

The euro climbed to the highest in almost three weeks against the dollar on prospects the European Central Bank will increase interest rates next week to curb inflation while the risk of an immediate Greek default subsides.

“The euro has been squeezed higher, and that was inevitable, because many people were short going into this,” said Neil Mellor, a currency strategist at Bank of New York Mellon Corp..

ECB President Jean-Claude Trichet today repeated that policy makers are in a state of “strong vigilance” ahead of the July 7 meeting, a phrase he has used before tightening monetary policy in the past.

The case for higher rates was strengthened as data showed European consumer-price growth was above the ECB’s 2% target for a seventh month. The inflation rate remained at an initially estimated 2.7% for a second month in June, statistics showed today.

A separate report showed German unemployment declined for a 24th straight month in June.

“The ECB has entered a cycle of raising interest rates,” said Tsutomu Soma, a bond and currency dealer at Okasan Securities Co.. “I expect the euro to strengthen.”

EUR/USD printed highs around $1.4520/25 before it slowly retreated to $1.4458.

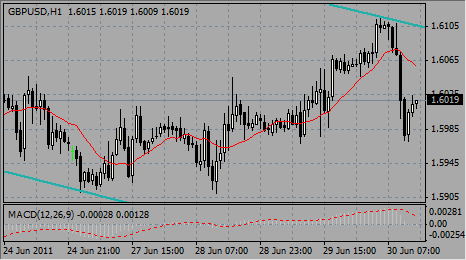

GBP/USD fell from $1.6110 to $1.5970 before it was back to $1.6012.

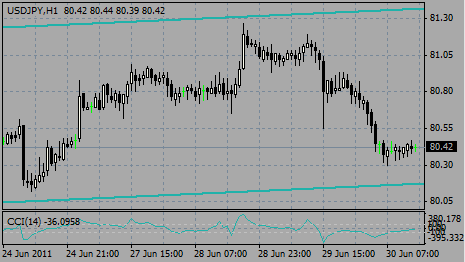

USD/JPY held within the range, limited by Y80.30/46.

The US calendar starts at 1230GMT, with the weekly Jobless Claims data. Claims are expected to fall 9,000 to 420,000 in the June 25 employment survey week.

Also at 1230GMT, the ISM-NY Business Index data is released.

At 1345GMT the June Chicago Purchasers Index data is released. The Chicago PMI is expected to fall to a reading of 53.0 in June after falling more than 10 points in May.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.