- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Forex: Thursday's review

Forex: Thursday's review

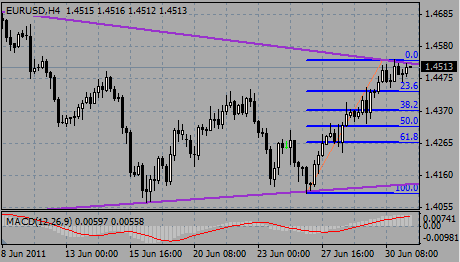

The euro climbed to the highest in almost three weeks against the dollar on prospects the European Central Bank will increase interest rates next week to curb inflation and as European ministers are set to approve the next aid payment due to Greece.

The case for higher rates was strengthened as data showed European consumer-price growth was above the ECB’s 2% target for a seventh month. The inflation rate remained at an initially estimated 2.7% for a second month in June, statistics showed today.

A separate report showed German unemployment declined for a 24th straight month in June.

Greek Prime Minister George Papandreou won approval of a second bill to authorize his 78 billion-euro ($113 billion) package of budget cuts and asset sales, a key to receiving further international financial aid.

German banks have agreed to roll over about 2 billion euros in the Greek bonds they’re holding that mature through 2014, German Finance Minister Wolfgang Schaeuble said.

ECB President Trichet repeated that policy makers are in a state of “strong vigilance” ahead of the July 7 meeting, a phrase he has used before tightening monetary policy in the past.

The pound slid to the least in more than 15 months against the euro as reports showed U.K. consumer confidence fell this month. Moreover, the house prices were little changed, limiting the scope for interest-rate increases.

The average cost of a home was 168,205 pounds ($270,255), compared with 167,208 pounds in May, when it rose 0.3%.

Consumer confidence fell to minus 25 from minus 21 last month, GfK NOP said in a separate report, below the minus 24 median estimate.

Bank of England policy maker Adam Posen on June 27 dismissed a call by the Bank for International Settlements for tighter monetary policy worldwide to curb inflation as “nonsense”.

EUR/USD recovered to $1.4540 following the decline to $1.4445. But later rate corrected to $1.4500.

GBP/USD initially fell to $1.5970 from $1.6110. Later pound back to $1.6100.

USD/JPY sharply rose from Y80.25 to Y80.86 before rate retreated to Y80.40.

Today's focus will be on PMI reports from France, Germany, EMU and UK.

In US today's attention will be on final reading of Michigan sentiment index, ISM Mfg PMI and Construction spending.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.