- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Asian session: Euro drops aamid EMU leaders meeting

Asian session: Euro drops aamid EMU leaders meeting

01:30 Australia Home Loans (May) 4.4% 4.5% 4.6%

05:00 Japan Consumer Confidence Index (Jun) 35.3 35.5 34.2

The euro fell to a two-week low against the dollar and yen on concern that Europe’s sovereign- debt crisis may spread to Italy as policy makers remain divided on how to structure aid for Greece.

The euro dropped against most major peers after Die Welt reported that the European Central Bank is seeking to expand a fund to include help for Italy, following a coordinated rescue for Greece by the European Union and International Monetary Fund.

A bailout fund may have to be doubled to 1.5 trillion euros ($2.13 trillion) to cover a crisis in Italy, the ECB said, according to the German newspaper Die Welt. The Financial Times cited unidentified senior officials as saying European leaders are prepared to accept that Greece should default on some of its bonds.

“Italy is a very large economy, and if indeed we do see contagion spread toward Italy, then the ECB, EU and IMF will need to come up with a totally different plan to deal with it,” said Khoon Goh at ANZ National Bank Ltd.. “Ongoing concerns are proving to be a real drag on the euro.”

Alcoa Inc., the largest aluminum producer in America, will become the first company on the Dow Jones Industrial Average to report second-quarter earnings today. Corporate profits are forecast to have grown by 13% in the period, according to analyst estimates.

The Australian dollar fell for a second day against the greenback on speculation China, its largest trading partner, will increase efforts to tame inflation even as growth cools.

China’s consumer price index increased 6.4% in June from a year earlier, the National Bureau of Statistics said on July 9, exceeding the 6.2% median estimate. The government will say on July 13 that gross domestic product rose 9.3% in the second quarter from a year before, according to a separate survey, down from 9.7% the previous quarter.

EUR/USD held within the $1.4190/$1.4230 range before weakening to session lows around $1.4130.

GBP/USD still corrects after Friday's gains. rate retreated from session highs on $1.6040 to $1.5940.

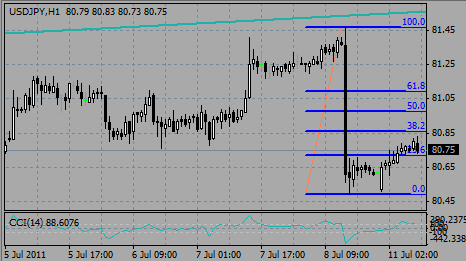

USD/JPY rose strongly from Y80.50 to Y80.80.

There is no major data for today.

The U.S. trade deficit widened in May to $44.1 billion from a revised $43.7 billion gap in the prior month, according to the median before tomorrow’s Commerce Department data.

The Federal Open Market Committee is scheduled to release tomorrow the minutes from its June 21-22 meeting.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.