- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- US focus: US downgrade fuels distrust of US dollar

US focus: US downgrade fuels distrust of US dollar

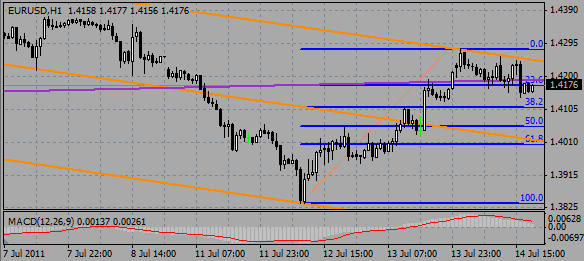

Today the U.S. dollar significantly dropped as late Wednesday Moody's and Chinese ratings agency Dagong both put the US AAA credit rating on negative watch.

“The fear of the U.S. downgrade has led to a swift move to the safe haven currency,” said Sebastien Galy, a foreign-exchange analyst at Societe Generale in London.

Euro strengthened versus US dollar amid the weakness of the latter. Despite Greece's credit rating was cut three levels by Fitch Ratings from B+ to CCC, any downgrade in the eurozone has increasingly less impact than debt problems in the US.

It should be noted that yesterday Federal Reserve chairman Ben Bernanke, raised the possibility of a third bout of quantitative easing – or “QE3”, that the central bank is ready to provide additional economic stimulus if needed.

Japan’s currency, shedding in the beginning of the session against dollar amid speculation the nation will intervene in markets to limit its gains, retreated but declining again.

The Swiss franc reached to record highs against the dollar, euro and the pound amid concerns about credit ratings of U.S and Greece. Today Fitch Ratings has affirmed Switzerland's ratings at 'AAA'. Its outlook remains stable.

New Zealand’s dollar strengthened to a record after a government report showed the economy grew faster than expected. The New Zealand economy has released today its house price index for the month of June which increased 1.3%, compared with a previous drop by 1.8% in May. This fact signaled the nation is recovering from a deadly earthquake in February.

Despite yesterday the yellow metal rallied to a new high around $1,600 per troy ounce and silver approached $40 per troy ounce and today continued theirs rally on fiscal and economic problems in the US, currently the precious metals are slightly above yesterday’s closing price.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.