- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Asian session: Dollar heads the weekly decline

Asian session: Dollar heads the weekly decline

The dollar headed for its biggest weekly drop against the yen in three months after Standard & Poor’s became the second ratings company this week to say it may cut the U.S.’s top credit grade.

The euro strengthened as Italian lawmakers prepared for a confidence vote on an austerity package and before the release of stress tests on European banks.

The European Banking Authority will release the results of the stress tests for 91 banks as part of an effort to reassure investors the region’s banks have sufficient capital.

The greenback headed for a second weekly loss against the Swiss franc as S&P said there’s at least a 50% chance it will cut the AAA rating within 90 days if it concludes Congress and President Barack Obama’s administration haven’t achieved a credible solution to the rising government debt burden.

Moody’s Investors Service put the U.S. Aaa credit rating on review for a downgrade on July 13, citing concern officials won’t raise the nation’s $14.3 trillion debt limit in time to prevent a missed payment.

“Uncertainty about the credit rating and debt-ceiling talk will continue weighing on the dollar,” said Toshiya Yamauchi, a senior currency analyst at Ueda Harlow Ltd.. “The market has a negative view for the dollar.”

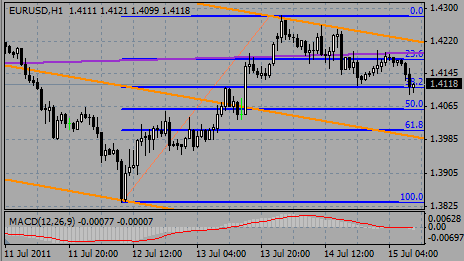

EUR/USD printed highs on $1.4190 before retreated to $1.4110.

GBP/USD retreated from $1.6170 to $1.6120.

USD/JPY rose from Y78.90 to Y79.20.

Today's focus in Europe will be on EU Trade balance.

In US investors will digest US CPI for June at 12:30 GMT. The same time NY Fed Empire State manufacturing index comes.

At 13:15 GMT US Industrial production will be released.

At 13:55 preliminary Michigan sentiment index is due to come.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.