- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- EU session review: Swiss franc rises on safe-haven demand

EU session review: Swiss franc rises on safe-haven demand

Data released:

08:00 Italy Consumer confidence (July) 103.7 104.0 105.8

Investors buy the safe-haven currencies like the Swiss franc and yen today as global sovereign debt concerns were heightened by a further downgrade of Greece and the continuing political disputes in the US over the country’s debt ceiling.

Moody’s, the rating agency, on Monday downgraded Greek sovereign debt by three notches, saying that following last week’s €159bn bail-out by the European Union and International Monetary Fund, the country’s second major rescue pay-out, the risk of default was now almost a certainty.

“The announced programme implies that the probability of a distressed exchange, and hence a default, on Greek government bonds is virtually 100 per cent,” Moody’s said. But the rating agency was broadly positive about the bail-out, adding that Greece could now stabilise and eventually reduce its overall debt burden.

The situation in the US also dominated investors’ concerns, as meetings between President Obama and senior Republicans to discuss lifting the country’s debt ceiling to avoid default ended in stalemate.

Although the dollar was broadly weaker it still managed gains against the pound as UK data disappointed. Research institute Markit revealed that UK household finances were at the weakest level since its survey started in 2009.

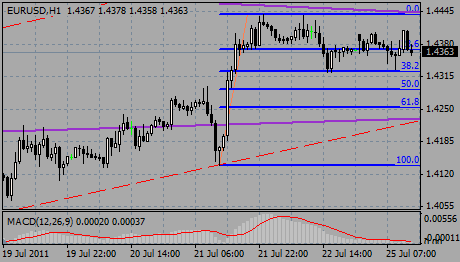

EUR/USD failed to break above $1.4400 and retreated to the lows around $1.4357. Rate still remains under pressure.

GBP/USD holds within the $1.6260/$1.6310 range.

USD/JPY continues to recover after it teated bids ahead of Y78.00. Rate currently holds around Y78.34.

There is no major US data for today.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.