- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Asian session: Yen collapced after BoJ intervention

Asian session: Yen collapced after BoJ intervention

Data released:

05:00 Japan BoJ meeting announcement 0.00-0.10% 0.00-0.10%

The yen weakened against all its major counterparts after Japan sold its currency in the foreign- exchange market for the first time since March to stem gains that threaten the nation’s economic recovery.

The yen slumped more than 3% against the dollar, the biggest intraday drop since March, after the Bank of Japan followed its Swiss counterpart in easing monetary policy.

Japanese Finance Minister Yoshihiko Noda said today’s intervention was one-side.

“Intervention will be more effective if it comes with monetary easing,” said Kazuo Kitazawa at Credit Suisse Group AG. “I can’t say intervention is successful until the yen depreciates beyond 80 against the dollar.”

The Bank of Japan expanded its asset-purchase fund to 15 trillion yen ($189 billion) from 10 trillion yen, according to a statement. Policy makers also kept the benchmark interest rate near zero. They ended their meeting a day earlier than scheduled on request of the government.

The franc fell for a second day after the Swiss National Bank cut interest rates to zero yesterday.

The Swiss National Bank yesterday lowered its target from 0.25%.

The franc has gained 9.2% over the past month. The yen has risen 0.9% and the dollar has fallen 0.9%, the indexes show.

Meanwhile, gains in the dollar were tempered before U.S. reports today and tomorrow that economists said will show initial jobless claims rose and the unemployment rate stayed above 9%.

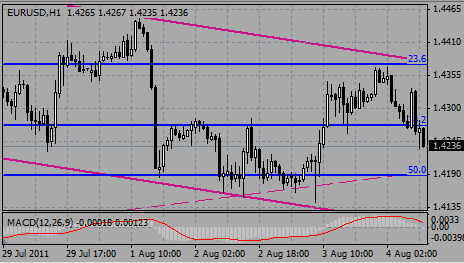

EUR/USD rose to $1.4344 after it earlier tested lows on $1.4140. Later rate recovered decline and weakened to $1.4245/50.

USD/JPY eased from Y77.40 to Y76.80 before BOJ intervention lifted it to Y80.00. Currenty rate retreats.

Germany's Factory Orders are scheduled at 10:00 GMT.

The BoE and ECB rate decisions will be the main focus for today with announcement comes at 11:00 GMT and 11:45 GMT respectively.

Later the main attention will be on ECB's head Trichet's traditional press-conference at 12:30 GMT.

US Jobless claims report also due to come at 12:30 GMT.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.