- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- US focus: Euro weakens amid speculation on extension of short-selling ban in Europe

US focus: Euro weakens amid speculation on extension of short-selling ban in Europe

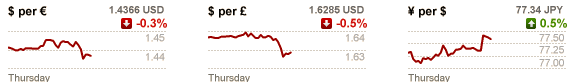

The euro weakened against the dollar and pared gains versus the yen on concern regulators will need to extend a ban on short-selling in European equity markets to prevent the region’s sovereign-debt crisis from worsening.

Better-than expected durable-goods orders and home-price data from the U.S. curbed speculation Fed Chairman Ben S. Bernanke will announce a third round of bond purchases that boost the supply of dollars, known as quantitative easing, when he speaks tomorrow at a symposium at Jackson Hole, Wyoming.

“Expectations for QE3 have been pared down because the recent economic data isn’t conclusive” enough to warrant urgent action, said Sim Moh Siong, a foreign-exchange strategist at Bank of Singapore Ltd. The dollar’s strength “is consistent” with those expectations, he said.

U.S. house prices rose 0.9% in June from the month before, the biggest increase since September 2005, a report showed yesterday. Durable-goods orders jumped 4% in July from a year earlier, following a revised 1.3% contraction the previous month.

The pound fell to the lowest level in more than two weeks against the euro as a report showed U.K. consumer confidence dropped in July, fueling concern the economic recovery will falter.

Sterling reached its lowest against the dollar since Aug. 17. Nationwide Building Society said its index of sentiment declined 2 points to 49 from June, the lowest reading since April. A gauge of consumers’ expectations for the economy in the next six months slipped 3 points to 67, the customer-owned lender said in an e-mailed report today. The pound declined as stock-market gains across Europe sapped demand for the nation’s bonds as a haven from the euro area’s debt crisis.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.