- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- European session:

European session:

08:00 EU(17) Current account (July) adjusted, bln -12.9

09:00 EU(17) Trade balance (July) adjusted, bln -2.5

The euro fell, halting a two-day gain versus the dollar and yen, on concern issues of collateral required by some nations to take part in another Greek bailout will hinder agreement at a meeting of European officials today.

European Central Bank President Jean-Claude Trichet pressed euro-area governments to take decisive action at today’s meeting to halt the crisis and show “unity of purpose.” His comments, made late yesterday, came as the challenges in stem the debt crisis was highlighted by disputes over collateral for Greek loans and German objections to altering European treaties.

The euro jumped the most in a month yesterday after the ECB said it will coordinate with the Federal Reserve and other central banks to conduct three separate dollar liquidity operations to ensure lenders have enough of the currency through the end of the year.

The Dollar Index, which measures the greenback against the currencies of six major U.S. trading partners, trimmed a weekly decline as concern the world’s largest economies are slowing fuels demand for the safest assets.

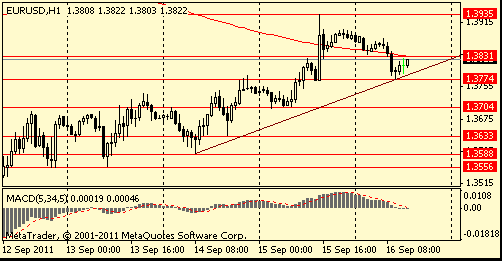

EUR/USD: the pair decreased below $1.3800.

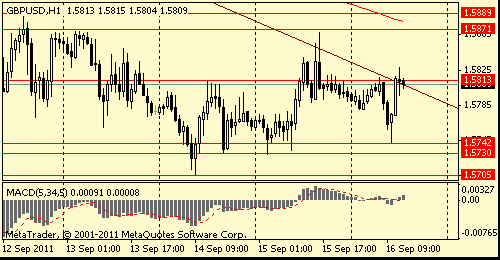

GBP/USD: the pair showed low in $1.5740 area then restored above $1.5800. Later decrease renewed.

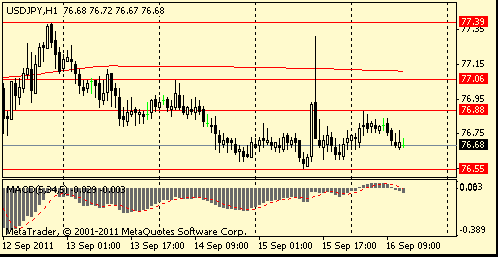

USD/JPY: the pair holds Y76.65-Y76.90.

In second half of the day focus will be on following data:

13:00 GMT Jul Tsy TICS.

13.55 GMT Sep prelim Rtrs-UMich consumer sentiment. Est56.5

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.