- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- European session:The euro dropped

European session:The euro dropped

The 17-nation currency slid against most of its 16 major peers before European Union and International Monetary Fund officials speak today with Greek Finance Minister Evangelos Venizelos to judge whether his government is eligible for its next aid payment.

The U.S. currency rose as Asian stocks fell, spurring demand for the safest assets.

The Australian dollar dropped against the greenback before the Reserve Bank is due to release tomorrow the minutes of this month’s policy meeting.

The dollar rallied before the Federal Open Market Committee gathers tomorrow for a two-day meeting.

The committee may decide to replace some of the short-term Treasury securities in the Federal Reserve’s $1.65 trillion portfolio with long-term debt in a bid to lower rates on everything from mortgages to car loans, according to economists at Wells Fargo & Co., Barclays Capital Inc. and Goldman Sachs Group Inc. Some analysts dub the maneuver “Operation Twist” because it would bend long-term yields lower.

Australia’s dollar snapped two days of gains versus the greenback on concern the RBA will signal interest-rate cuts in its September meeting minutes to be released tomorrow, curbing demand for the South Pacific nation’s currency.

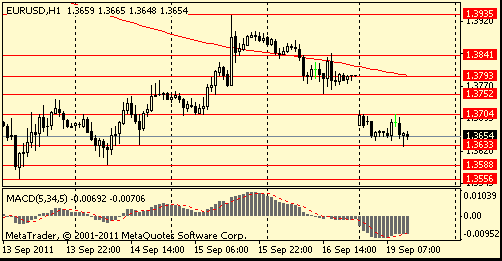

EUR/USD: holds $1.3630-$ 1.3700.

GBP/USD: the pair restored from morning low in area $1.5750. But returned back to $1.5700 area later.

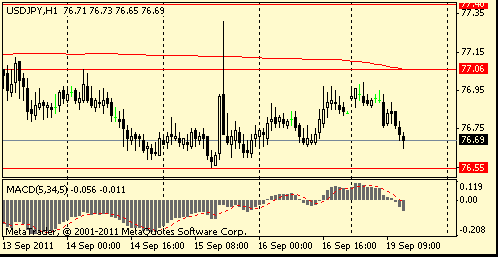

USD/JPY: the pair decreased in Y76.60 area.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.