- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Asian session: the euro dropped

Asian session: the euro dropped

The yen rose against most of its major counterparts as EU’s worsening debt crisis and speculation that a report today will show U.S. durable goods orders fell last month, bolstered demand for the safest assets.

The euro headed for its biggest monthly decline against the yen in more than a year after the Financial Times reported yesterday that some euro-area countries want private creditors to take bigger writedowns on their Greek bond holdings. The euro held a three-day advance against the dollar.

Greek Prime Minister George Papandreou won parliamentary backing late yesterday for a property tax to meet deficit- reduction targets required to avoid default. Germany still privately anticipates that the Mediterranean nation will default on its debt as early as this year, Bild reported Chancellor Angela Merkel. France’s statistics office confirmed today that gross domestic product was unchanged in the second quarter from the preceding period. That’s in line with the initial estimate reported last month.

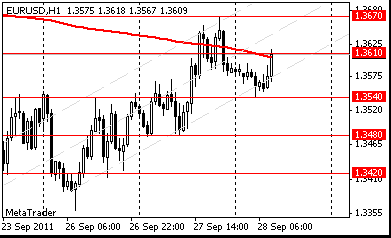

EUR/USD: on asian session the pair gain dropped.

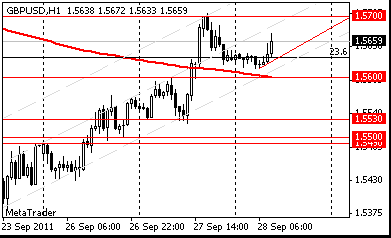

GBP/USD: on asian session the pair hold at narrow range.

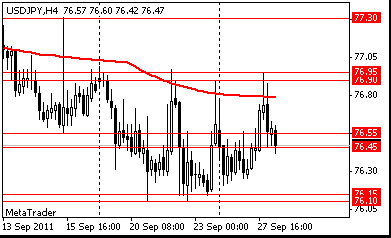

USD/JPY: on asian session the pair gain.

Focus today Troika to return to Athens to continue inspection/review. Finnish parliament vote on the amendment to the EFSF framework

agreement at 1100GMT. Later U.S. Durable Goods Orders August and U.S. EIA Crude Oil Stocks change.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.