- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- European session: investors awaited at US employment data

European session: investors awaited at US employment data

Data:

08:30 UK PPI (Output) (September) unadjusted 0.3%

08:30 UK PPI (Output) (September) unadjusted Y/Y 6.3%

08:30 UK PPI Output ex FDT (September) adjusted 0.3%

08:30 UK PPI Output ex FDT (September) unadjusted Y/Y 3.8%

08:30 UK PPI (Input) (September) adjusted 1.7%

08:30 UK PPI (Input) (September) unadjusted Y/Y 17.5%

10:00 Germany Industrial production (August) seasonally adjusted -1.0% -1.0%

10:00 Germany Industrial production (August) not seasonally adjusted, workday adjusted Y/Y 7.7%

The euro headed for a weekly gain versus the dollar on speculation financial support for European banks will help stem the region’s debt crisis.

The euro rose after the European Central Bank said yesterday it will reintroduce yearlong loans and resume purchases of covered bonds to encourage lending.

The pound rose on optimism the Bank of England’s decision to reactivate its bond-purchase program will help revive the U.K.’s faltering economy.

Losses in the dollar and yen were tempered before U.S. reports today forecast to show a gain in unemployment in September was not enough to bring down the jobless rate.

Employment climbed by 55,000 workers after no change in August, according to the median forecast of economists. The jobless rate was 9.1 percent for a third month, according to the forecasts.

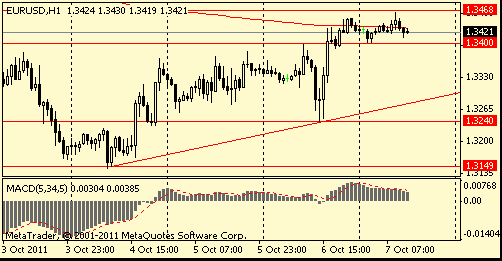

EUR/USD: the pair holds in $1.3400-$ 1,3460 range.

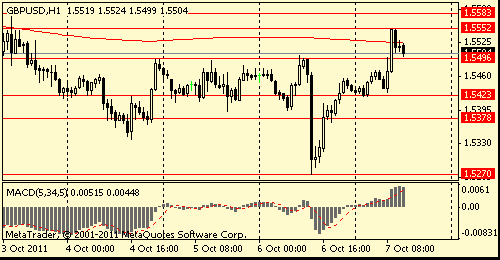

GBP/USD: the pair dore above $1.5500.

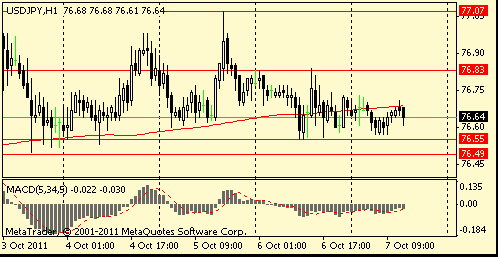

USD/JPY: the pair holds in Y76.55-Y76,75 range.

The main focus is on US data at 1230GMT when nonfarm payrolls are forecast to rise 80,000 in September after the flat August reading, but the unemployment rate is expected to rise to 9.2%. An absence of the Verizon strikers should be a key factor in the payrolls rebound. Hourly earnings are seen up 0.2% after see-sawing sharply in the last four months. The average workweek is expected to hold steady at 34.2 September. Wholesale Inventories follow at 1400GMT.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.