- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Oil fell

Oil fell

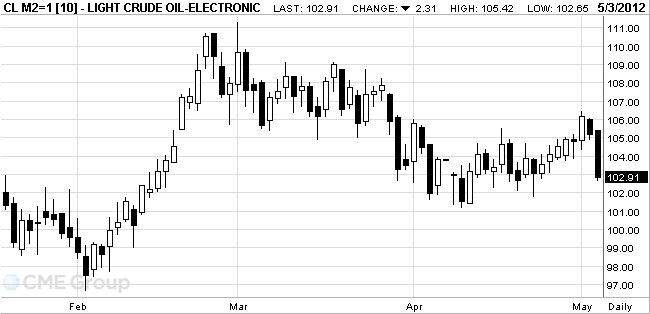

Oil tumbled the most in almost a month as European Central Bank President Mario Draghi said the euro area’s economic outlook has become “more uncertain.”

Prices dropped as much as 2.4 percent as Draghi said the region’s economic forecast is subject to downside risks, though the ECB still expects a gradual recovery this year. The central bank held its benchmark interest rate at a record low of 1 percent. Austerity measures aimed at stemming the debt crisis have pushed economies from the Netherlands to Spain back into recession. The ECB may be unwilling to add to stimulus as it presses governments to enact reforms and take responsibility for the crisis.

Oil’s loss accelerated after data showed U.S. service industries expanded at a slower pace than projected in April.

The Institute for Supply Management’s non-manufacturing index for the U.S. fell to a four-month low of 53.5 in April from 56 in March, the Tempe, Arizona-based group’s data showed today. The median forecast of 74 economists called for a decrease to 55.3. Readings above 50 signal expansion.

Crude for June delivery touched $102.65 in the biggest intraday drop since April 4 on the New York Mercantile Exchange. Prices have fallen 7.4 percent in the past year.

Brent oil for June settlement fell $1.73, or 1.5 percent, to $116.47 a barrel on the London-based ICE Futures Europe exchange.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.