- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Oil rose

Oil rose

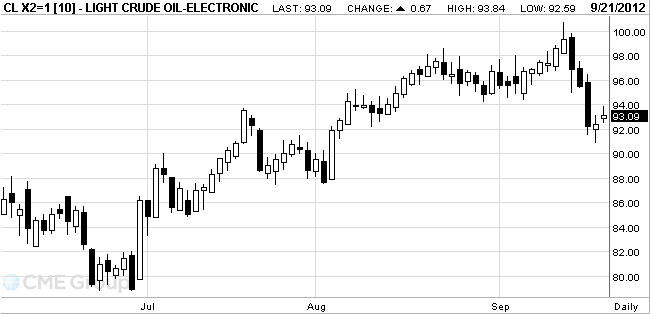

World oil prices continue to rise during the trading session on Friday amid cheaper U.S. dollar, as well as investors' hopes that the world's central bank stimulus measures will support the development of the world economy and, consequently, the demand for oil.

The depreciation of the dollar makes crude more attractive for holders of other currencies. In addition, bidders are still hoping for a positive effect of the measures the world's central banks to support the development of national economies.

In addition, oil prices are rising because of the deterioration of the political situation in Libya and fears for the stability of the production in the North Sea.

Libya, a member of OPEC, and the third largest oil producer among African countries, rapidly increase production after the overthrow of Muammar Gaddafi last year, but an attack on the U.S. Embassy last week raised doubts about the ability of the new government to keep the situation under control.

In Europe was postponed scheduled for October shipment of two more batches of North Sea Forties grade due to the reduction of its production. Delay export this class in September and October - the most significant since May, when they were delayed 11 of 19 games, according to Reuters, based on sources in the trade circles. North Sea Forties - the most important of the four varieties, forming basket Brent.

On the eve of OPEC reported that members of the organization, which accounts for about 40% of world oil supplies, planning to cut for a while rough exports by 0.7% - to 23.66 million barrels per day at the beginning of the maintenance operations of oil capacity. Exports of crude oil from the Middle East for four weeks fell by 1.1% - to 17.27 million barrels a day.

However, the head of the IEA Maria van der Hoeven, the market will have no shortage of raw material through the supply from Saudi Arabia, Canada and the USA. "We will closely monitor the market and see that it has a lot of raw material," - said van der Hoeven at an energy conference in Madrid

At the same time, the decline in oil for the current week was approximately 6%. Negative dynamics was caused by rumors of a possible opening of the strategic reserves of the United States, the statistical data of the Ministry of Energy of the country saw an increase of stocks of raw materials wholesale stores U.S., and the news from Saudi Arabia, which offer to increase supplies of raw materials.

Experts do not expect a significant increase in oil prices in the medium term, given a sufficient supply of the market and the problems of the world economy. Published on Thursday data from the euro zone, China and the USA have shown a weak industrial activity in these regions.

Crude oil for November delivery increased to $93.84 a barrel on the New York Mercantile Exchange.

Brent oil for November settlement climbed 99 cents, or 0.9 percent, to $111.02 a barrel on the London-based ICE Futures Europe exchange.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.