- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- European session: the pound fell

European session: the pound fell

08:30 United Kingdom Bank of England Minutes

08:30 United Kingdom BBA Mortgage Approvals September 38.2 39.4 43

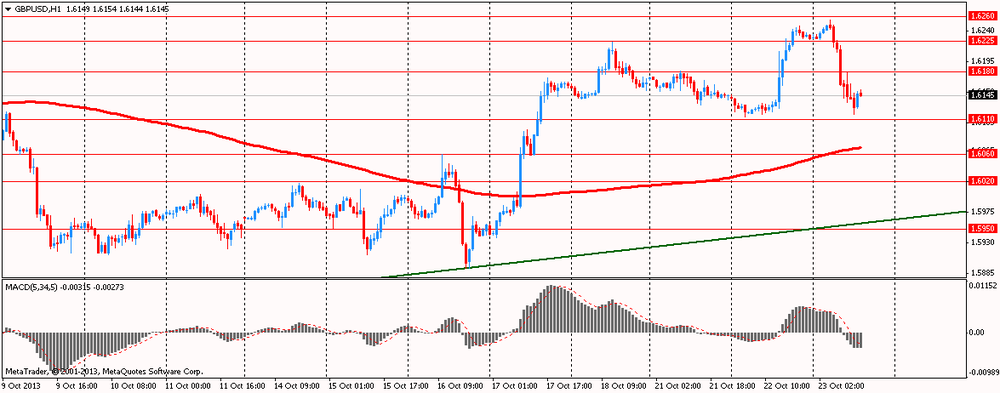

The British pound is reduced after the release of the protocol of the Bank of England, which reflected the unanimous sentiment of the Committee members to keep loose monetary policy with just a hint of the fact that the steady improvement of the economy of Britain can serve as a sufficient argument for further revision of the forecasts for the rate increase .

In respect of new policies transparent communication , which the lawyer is the new head of the Bank of England M. Carney , the report states: "At the moment it seems likely that in the 2nd half of 2013 unemployment will be lower and the rate of production - faster than expected in the August inflation report ".

However, says further , " On the basis of the latest statistics on the labor market is still too early to make any confident verdicts on the extent of the growth of productivity."

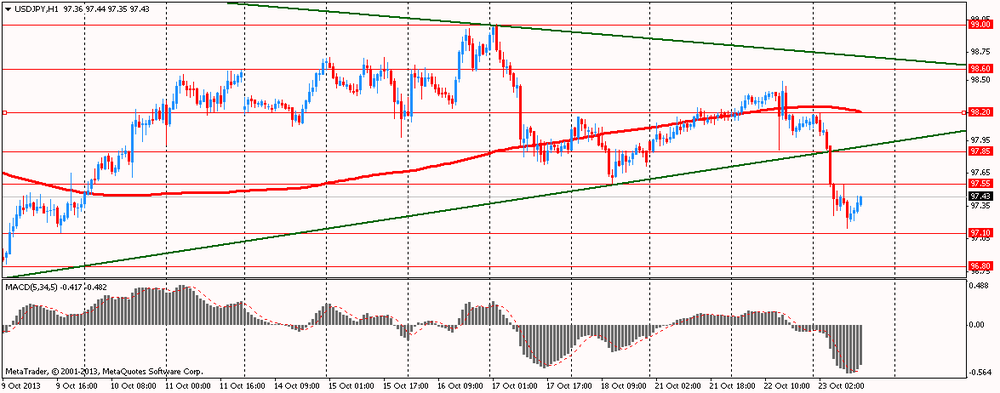

The yen rose to its highest level in two weeks against the dollar , as the volume of bad loans in China soared to a peak in July , stimulating demand for safer assets . The yen rose against all 16 major currencies.

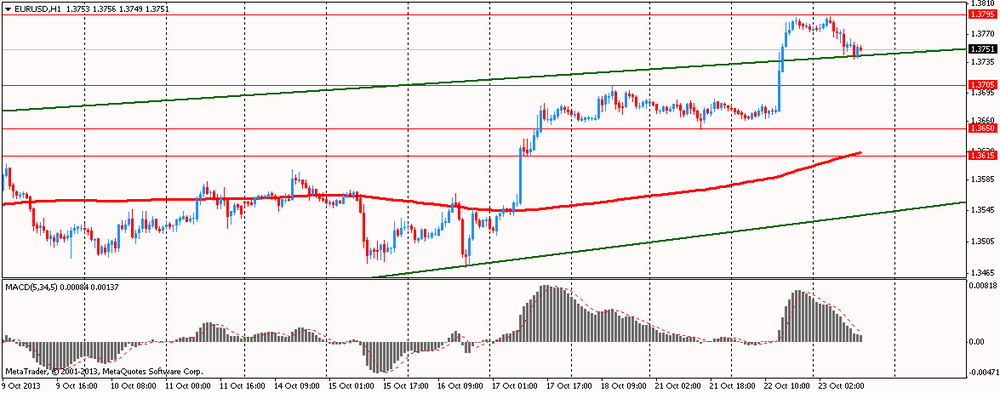

Euro fell against the U.S. dollar amid evidence that the debts of the governments of the euro area in the 2nd quarter continued to grow. This indicates that , despite the return to the Monetary Union growth, one of the most difficult problems have not been solved.

According to data released on Wednesday the EU statistics agency Eurostat, eurozone public debt in relation to the aggregate euro area GDP in the 2nd quarter increased to 93.4 % versus 92.3 % in the 1st quarter and to 89.9 % in the same period the previous year.

According to the rules of the European Union , governments must keep their debt at a level not exceeding 60 % of GDP.

EUR / USD: during the European session, the pair fell to $ 1.3739

GBP / USD: during the European session, the pair fell to $ 1.6118

USD / JPY: during the European session, the pair fell to Y97.15

At 12:30 GMT the United States will import price index for September. At 14:00 GMT we will know the decision of the Bank of Canada Interest Rate and the accompanying statement will be made of the Bank of Canada. At 14:00 GMT Eurozone will release an indicator of consumer confidence for October. At 14:30 GMT will publish a report on the Bank of Canada's monetary policy. At 14:30 GMT the United States , there are data on stocks of crude oil from the Ministry of Energy . At 15:15 GMT will be a press conference by the Bank of Canada . At 21:45 GMT New Zealand will release the trade balance (for 12 months , from the beginning of the year ) and the trade balance for September.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.