- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Asian session: The euro fell

Asian session: The euro fell

00:00 Japan Bank holiday

00:30 Australia Retail sales (MoM) September +0.4% +0.5% +0.8%

00:30 Australia Retail Sales Y/Y September +2.3% +2.9%

00:30 Australia House Price Index (QoQ) Quarter III +2.4% +2.3% +1.9%

00:30 Australia House Price Index (YoY) Quarter III +5.1% +7.6% +7.6%

00:30 Australia ANZ Job Advertisements (MoM) October +0.2% -0.1%

The euro fell to its lowest level in more than six weeks before European Central Bank Executive Board member Joerg Asmussen speaks in the run-up to a policy meeting amid signs further stimulus may be needed in the region.

Europe’s common currency extended its biggest weekly drop since July 2012 before the Mario Draghi-led ECB meets on Nov. 7, when economists predict it will keep interest rates at 0.5 percent. Bank of America Corp., UBS AG and Royal Bank of Scotland Group Plc forecast the ECB will cut rates at this week’s meeting, according to a Bloomberg News survey of 68 economists, with the rest predicting no change. The ECB last lowered its benchmark rate in May to a record 0.5 percent.

The dollar added to gains from last week against most major peers after Federal Reserve Bank of Dallas President Richard Fisher said the central bank should resume normal monetary policy as soon as possible. “I am not a proponent of ever-increasing government spending,” Fisher, who will hold a vote on monetary policy next year, said in the partial text of a speech in Sydney today. “I mention this simply to illustrate a point: Unlike in most recoveries, government has played a countercyclical, suppressive role. The inability of our government to get its act together has countered the procyclical policy of the Federal Reserve.”

The Aussie climbed after data today showed retail sales grew at the fastest pace in seven months, adding to prospects the Reserve Bank won’t cut interest rates tomorrow. Retail sales rose 0.8 percent in September, compared with the median forecast for a 0.4 percent advance in a Bloomberg survey.

EUR / USD: during the Asian session the pair fell to $ 1.3440

GBP / USD: during the Asian session, the pair fell to $ 1.5900

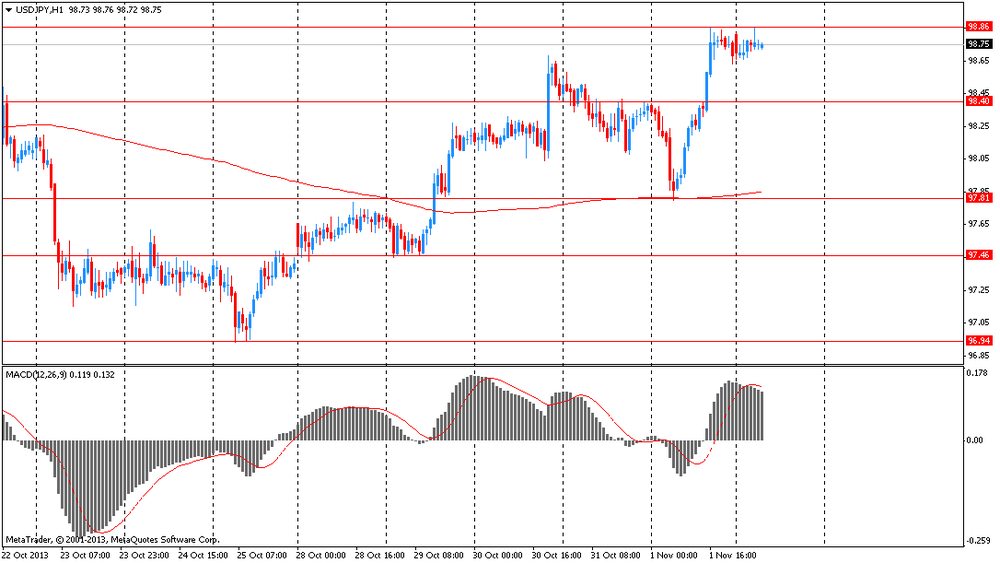

USD / JPY: during the Asian session the pair traded in the range of Y98.65-85

Eurozone mfg PMI data for release this morning and could influence via the cross, with UK construction PMI providing the main domestic interest during the morning. Focus this weeks turns to Thursday's ECB rate decision, following the recent release of soft EZ inflation data, with US NFP following on Friday.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.