- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- European session: the pound rose

European session: the pound rose

08:00 United Kingdom Halifax house price index October +0.3% +0.4% +0.7%

08:00 nited Kingdom Halifax house price index 3m Y/Y October +6.2% +7.0% +6.9%

08:48 France Services PMI (Finally) October 50.2 50.2 50.9

08:53 Germany Services PMI (Finally) October 52.3 52.3 52.9

08:58 Eurozone Services PMI (Finally) October 50.9 50.9 51.6

09:30 United Kingdom Industrial Production (MoM) September -1.1% +0.7% +0.9%

09:30 United Kingdom Industrial Production (YoY) September -1.5% +1.8% +2.2%

09:30 United Kingdom Manufacturing Production (MoM) September -1.2% +1.2% +1.2%

09:30 United Kingdom Manufacturing Production (YoY) September -0.2% +0.8% +0.8%

10:00 Eurozone Retail Sales (MoM) September +0.5% Revised From +0.7% -0.3% -0.6%

10:00 Eurozone Retail Sales (YoY) September -0.2% Revised From -0.3% +0.6% +0.3%

11:00 Germany Factory Orders s.a. (MoM) September -0.3% +0.6% +3.3%

11:00 Germany Factory Orders n.s.a. (YoY) September +3.1% +5.6% +7.9%

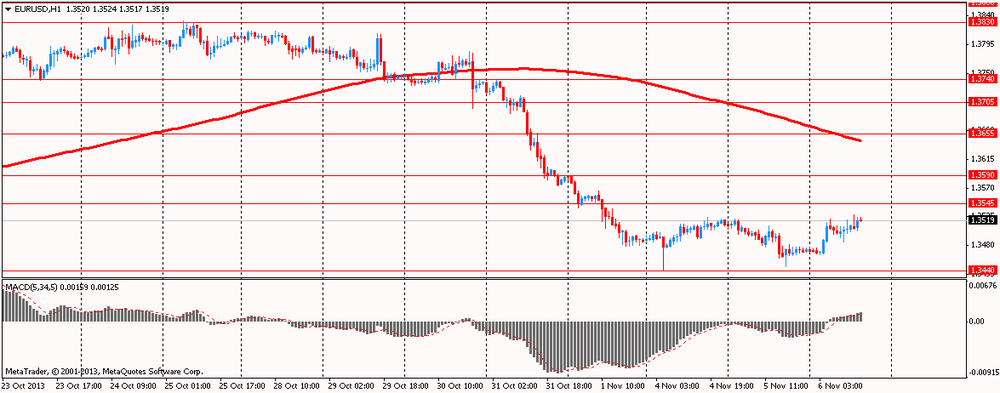

The euro traded in a range against the dollar amid mixed statistics on retail sales in the euro zone and industrial orders in Germany.

Retail sales in the euro zone fell in September as consumer spending remained weak against the backdrop of high unemployment and slow wage growth . Retail sales rose in July and August, and their fall in September serves as a reminder that , despite the rise in consumer confidence , consumer demand in the euro area remains sluggish and inflation pressures - is extremely low. The European Union 's statistics agency announced on Wednesday that sales in September compared with August fell by 0.6 % , although up 0.3 % compared to the same period in 2012 . The data was worse than expected.

Orders in the industrial sector in Germany in September rebounded sharply thanks to strong foreign demand for capital goods , as well as in a large volume of orders for big-ticket items . Orders in the manufacturing sector rebounded in September by 3.3 % compared with the previous month , far exceeding forecasts of economists, who expected an increase of 0.6 %. In the previous two months, the volume of orders decreased.

Strong performance of orders in September provided a jump in foreign demand : foreign orders jumped by 6.8 % compared with the previous month , offsetting a 1.0% decline in domestic demand. Compared to the same period of the previous year, the total volume of orders adjusted for the number of working days increased by 7.9%. Unadjusted orders jumped 11.0%.

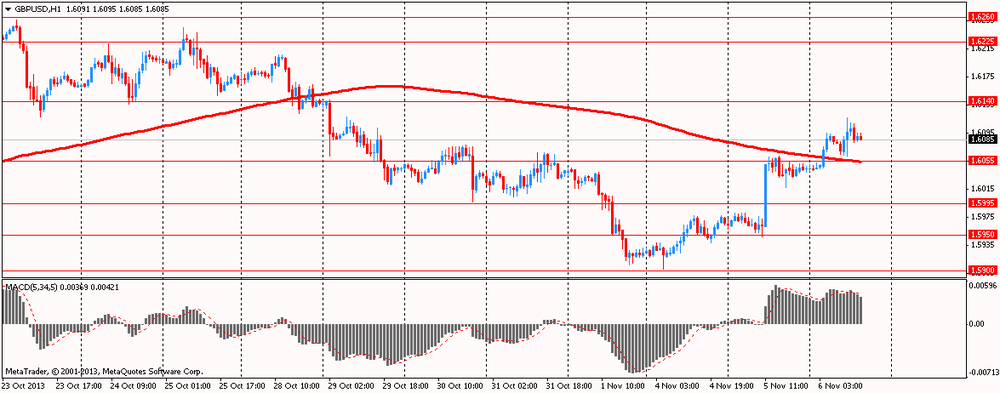

The pound rose against the dollar , supported by data on industrial production in Britain.

British industrial production rose in September after two consecutive declines , according to the latest figures from the Office for National Statistics . Recovery was stronger than economists expected.

Total production increased by 2.2 percent year on year in September , after falling 1.5 percent in August and 1.1 percent decline in July. The consensus forecast of economists was at the level of growth of 1.8 percent .

Manufacturing output grew by 0.8 per cent per annum in September. This happened after falling 0.2 percent in August and 0.4 percent drop in July. The result corresponds to the forecast of economists.

On a monthly basis , total production increased by 0.9 percent compared with a forecast of 0.7 percent growth. Manufacturing output increased by 1.2 percent in September compared with the previous month , in line with economists' forecasts .

EUR / USD: during the European session, the pair is trading in the range of $ 1.3486 - $ 1.3528

GBP / USD: during the European session, the pair rose to $ 1.6117

USD / JPY: during the European session, the pair fell to Y98.46

Canada at 13:30 GMT will publish the change in volume of building permits issued in September , at 15:00 GMT - the index of the PMI Ivey ( seasonally adjusted ) from the Ivey PMI index for October. At 15:00 GMT Britain will release data on the change in GDP from NIESR for October. At 18:00 GMT the United States places the 10 - year bonds .

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.