- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- European session: the euro fell moderately

European session: the euro fell moderately

The euro is trading with a moderate decrease against the U.S. dollar Friday after adjusting for growth of employment data . Investors assess the prospects for further minimize incentives in the U.S. before the performances of a number of heads of the Federal Reserve this week. So , on Monday would be the head of the Federal Reserve Bank ( FRB ) of Atlanta Dennis Lockhart , Tuesday - Charles Plosser of the Philadelphia Fed and Richard Fisher of the Dallas Fed - both in 2014 are entitled to vote on matters of monetary policy on the Committee on the Fed's operations on the open market . And on Thursday deliver a report the U.S. central bank chairman Ben Bernanke , his speech will be devoted to the general difficulties of central banks , and it is not clear whether it will affect the folding theme incentives. The next Fed meeting will be held January 28-29 .

Recall that the U.S. dollar declined against most major currencies on Friday after the U.S. in December, was created only 74,000 jobs , that is, was recorded the weakest growth since early 2011 . The unemployment rate , meanwhile, fell to 6.7 % compared with 7.0% in the previous month - the lowest level since October 2008 . But the decline seemed to occur mainly because more people left the work force. Economists had expected an increase of jobs in non-agricultural area at 193,000 while maintaining unemployment at 7.0 % in December.

The Australian dollar reached a one-month high against the dollar after the volume of mortgage lending in Australia increased in November. Total number of mortgages in Australia rose a seasonally adjusted 1.1 percent in November compared with the previous month, the Australian Bureau of Statistics reported on Monday, and was 52 912.

The main indicator coincided with economists' forecasts , after rising 1.0 percent in October.

Total number of loans for the construction of new homes rose by 2.3 percent to 5686 .

Credits for the purchase of new homes fell 4.3 percent to 2856, while loans to purchase housing on the secondary market rose by 1.4 percent to 44,370 .

The volume of loans rose to 1.7 percent , remaining unchanged from the previous month and totaled 26.934 billion Australian dollars .

Investment lending rose by 1.5 percent for the month and amounted to 10.383 billion Australian dollars , slowing from growth of 8.5 percent in October.

EUR / USD: during the European session, the pair fell to $ 1.3643

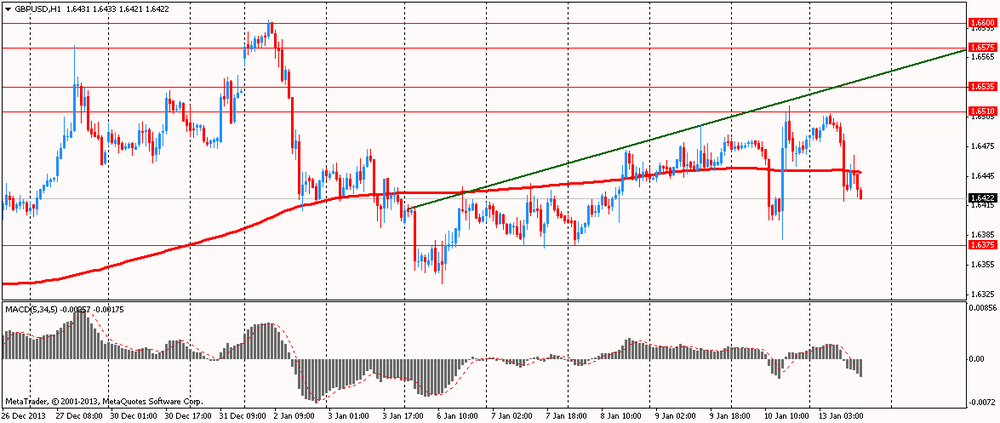

GBP / USD: during the European session, the pair fell to $ 1.6420

USD / JPY: during the European session, the pair rose to Y103.57

At 15:30 GMT , Canada will release indicator of expectations in the field of credit and financial institutions , according to the Bank of Canada , the light of the expected growth of trade (Review sentiment in the business environment of the Bank of Canada ) for the 4th quarter . At 19:00 GMT the United States will be released monthly budget execution report for December. At 21:00 GMT New Zealand is to publish house price index from REINZ, changing housing sales from REINZ for December sentiment indicator from the NZIER business environment for the 4th quarter . At 23:50 GMT , Japan will release the overall current account balance , total adjusted current account surplus in November.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.