- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- European session: the euro stabilized

European session: the euro stabilized

06:45 Switzerland Unemployment Rate January 3.2% 3.2% 3.2%

07:45 France Industrial Production, m/m December +1.2% Revised From +1.3% -0.1% -0.3%

07:45 France Industrial Production, y/y December +1.5% +0.5%

09:30 Eurozone Sentix Investor Confidence February 11.9 10.3 13.3

The euro / dollar failed to gain a foothold on the heights reached and pulled back from 11 -day high , as the pair virtually ignored the study of confidence of European investors Sentix. As revealed on Monday monthly survey research center Sentix, investor confidence in the eurozone unexpectedly improved in February . Investor sentiment index rose by 1.4 points to 13.3 points. The result was higher than the projected decline to 10.3 points. The improvement was mainly due to the increase in assessment of the current situation in February. Current situation index rose to 1.8 from 0.8 in January and was positive for the first time since August 2011 . At the same time , investors' expectations have risen only slightly in February to 25.5 from 25.3 in January.

The euro kept data on industrial production in France. Industrial production in France increased at a slower pace in December , with growth rates gave way to the forecasts of economists showed on Monday, the latest data statistical office Insee. Industrial production grew by 0.5 percent in December compared with the same month last year. Economists had expected a more rapid increase of 1 per cent . In November, production recorded a growth of 1.7 percent.

Industrial production fell by 0.3 percent compared to November , when it was recorded an increase of 1.2 percent. Expectations were reducing by 0.1 percent . During the three months ended in December , production increased by 0.3 percent compared with the previous three-month period . Industrial production grew by 0.5 per cent in quarterly terms.

In Insee also noted that production in the French manufacturing sector expanded by 0.9 percent year on year in December. On a monthly measurement of industrial production remained unchanged after rising 0.2 percent in November.

The yen strengthened against the euro and the dollar in anticipation of tomorrow's presentation of the new Federal Reserve Chairman Janet Yellen . Chapter Fed on Tuesday will deliver to Congress for the first time after its official accession to the post of head of the Federal Reserve and is expected to confirm the Fed's intention to continue to decline in the quantitative easing program unabated.

The dollar index suspended its five-day decline, even after January in the U.S. was created only 113 thousand jobs , and the unemployment rate fell to 6.6 % compared to 6.7% in December , said Friday the Ministry of Labour . Economists had expected an increase of the number of non-agricultural jobs in the 185 thousand unemployment fell to its lowest level since October 2008 .

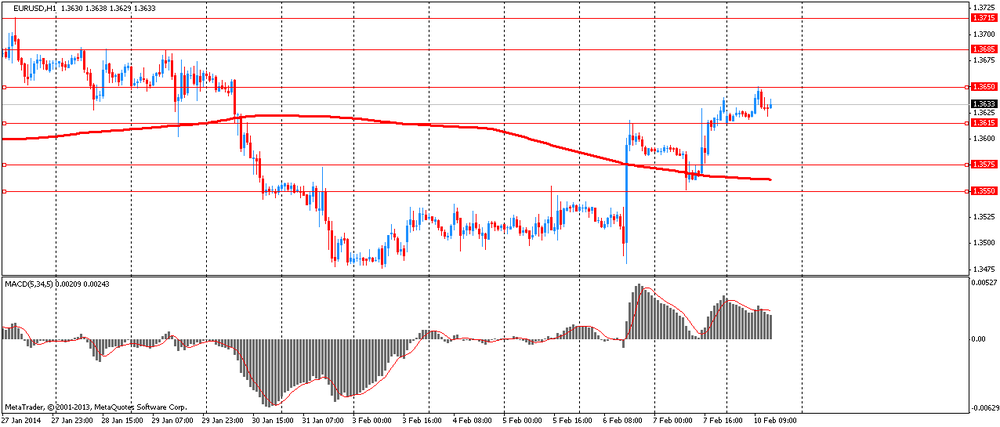

EUR / USD: during the European session, the pair rose to $ 1.3650 , then dropped to $ 1.3622

GBP / USD: during the European session, the pair fell to $ 1.6381

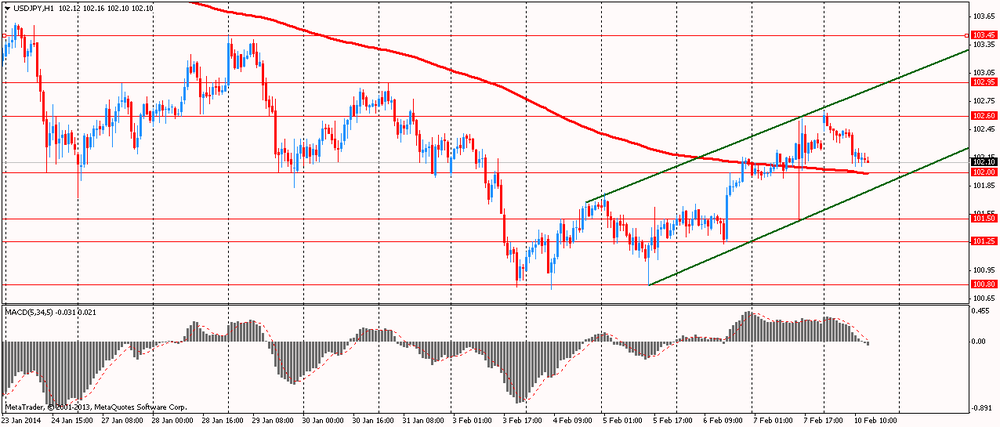

USD / JPY: during the European session, the pair dropped to Y102.06

At 13:15 GMT will be released in Canada by Housing Starts in January . At 15:00 GMT the U.S. will release the share of overdue mortgage payments for the 4th quarter . At 17:50 GMT to make a speech , Deputy Governor of the Bank of Canada John Murray .

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.