- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- European session: the euro rose

European session: the euro rose

10:00 Eurozone Industrial production, (MoM) January -0.4% Revised From -0.7% +0.6% -0.2%

10:00 Eurozone Industrial Production (YoY) January +1.2% Revised From +0.5% +1.9% +2.1%

The euro has risen sharply against the U.S. dollar despite weak data on industrial production in the euro area . Official data showed Eurostat, in the euro zone industrial production fell unexpectedly in January , largely due to reduced production of energy.

Industrial output fell 0.2 percent on a monthly basis in January , showing the second consecutive fall. Economists had expected production to grow by 0.6 percent after falling by a revised 0.4 percent in December .

Production of energy decreased by 2.5 percent, and the production of durable consumer goods fell by 0.6 percent . Intermediate goods decreased by 0.1 percent. Partially offset this decline is that the release of capital goods rose by 0.9 percent, while production of consumer non-durable goods increased by 0.4 percent.

On an annual basis, industrial production growth accelerated to 2.1 percent from 1.2 percent in December . Economists forecast that output will grow by 1.9 per cent .

In light of this release analysts ING Bnak NV commented : " The main reason for poor outcome again was to reduce energy production by 2.5% , but intermediate goods and consumer durables also pointed to the decline in production ... While the benchmark is not met expectations , weak energy component probably overshadowed a slight improvement in the overall indicator. However, to strengthen the eurozone recovery process still requires export growth . "

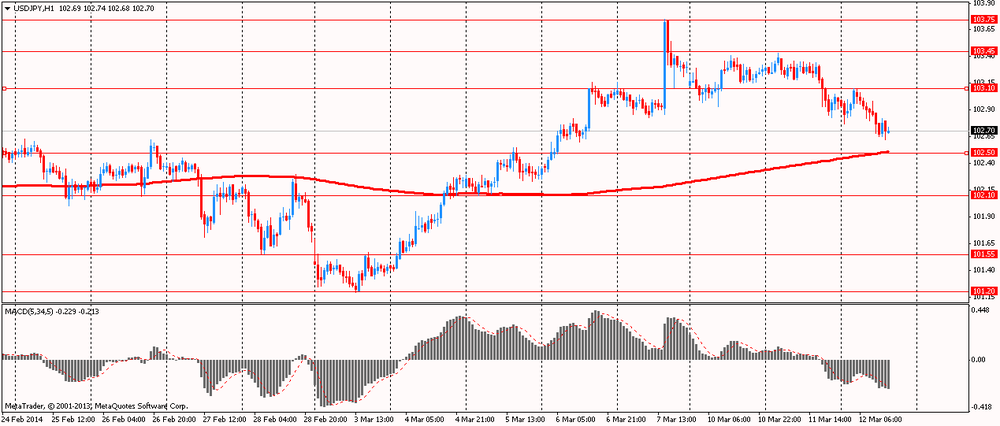

The yen rose against most currencies on concerns about the state of China's economy. This increases the demand for safe-haven assets , which is the yen . In February, China's exports fell by the largest value since the beginning of the financial crisis . Index decreased yoy by 18.1 % , while the experts had expected growth of 7.5%. However, the real picture is quite difficult to evaluate because of the rather long New Year celebrations on the lunar calendar . Holidays in China traditionally distort statistics . Meanwhile, imports grew by 10.1% , resulting in a trade deficit reached highs for 2 years at $ 23 billion

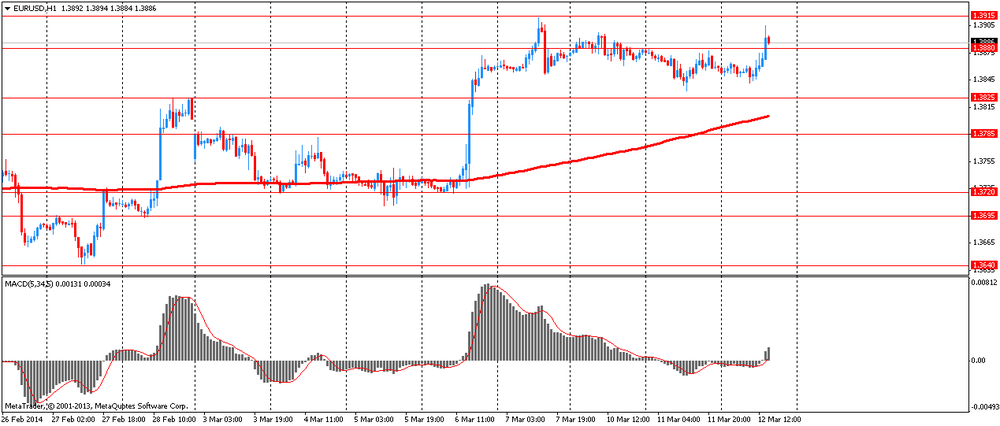

EUR / USD: during the European session, the pair rose to $ 1.3905

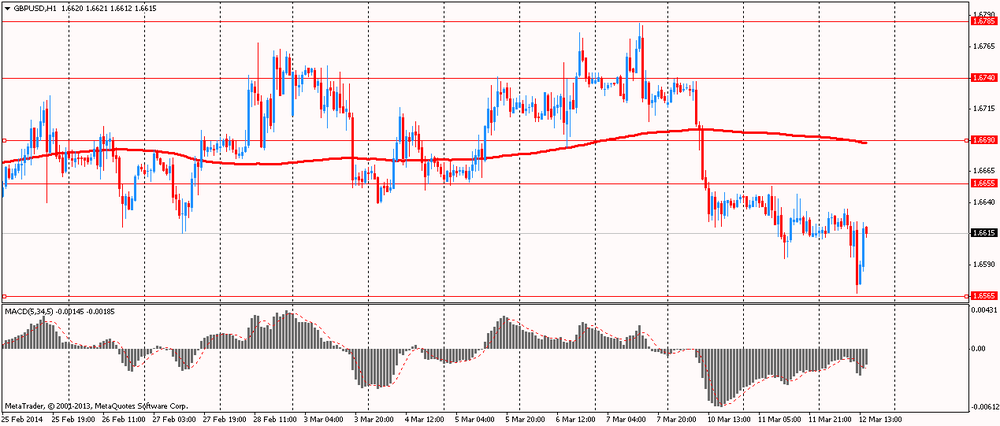

GBP / USD: during the European session, the pair fell to $ 1.6567 and retreated

USD / JPY: during the European session, the pair fell to Y102.62

At 17:01 GMT the United States places the 10 - year bonds . At 18:00 GMT the United States will be released monthly budget execution report . At 20:00 GMT we will know the RBNZ decision on the basic interest rate will be a press conference by the RBNZ will be done RBNZ accompanying statement , the protocol will monetary policy RBNZ . At 23:50 GMT , Japan will publish the change in orders for machinery and equipment in January .

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.