- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

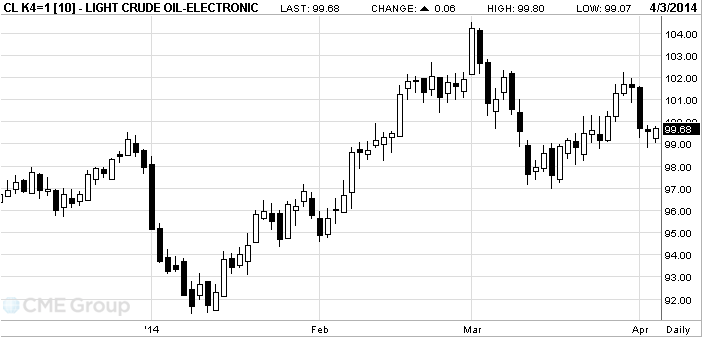

- Oil rose

Oil rose

Brent

crude rose from the lowest level in almost five months amid concern that talks

between the Libyan government and rebels won’t restore oil exports. West Texas

Intermediate’s discount to Brent widened.

The

European benchmark gained as much as 0.6 percent. The rebels’ Executive Office

for Barqa, representing the region of Cyrenaica, denied a report that the group

will cede one of the four ports that have been under its control since July to

the government in a few days. WTI traded below $100 as U.S. jobless claims rose

more than forecast last week.

“Libya

is right on Europe’s doorstep and it has more impact on Brent,” said Michael

Lynch, president of Strategic Energy & Economic Research in Winchester,

Massachusetts. “There are concerns about Libya’s ports and oil exports.”

Brent

for May settlement gained 23 cents to $105.02 a barrel at 10:46 a.m. New York

time on the London-based ICE Futures Europe exchange. Volume was 35 percent

above the 100-day average. Prices fell to $104.79 yesterday, the lowest

settlement since Nov. 7. The North Sea grade is used to price more than half

the world’s oil, including exports from Libya.

WTI for

May delivery declined 23 cents to $99.39 a barrel on the New York Mercantile

Exchange. The volume of all futures traded was 24 percent below the 100-day

average.

WTI was

at a discount of $5.63 to the European benchmark crude. The spread shrank to

$5.17 yesterday, the narrowest level since October.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.