- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Foreign exchange market. Asian session: The euro fell

Foreign exchange market. Asian session: The euro fell

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

04:30 Australia RBA Meeting's Minutes

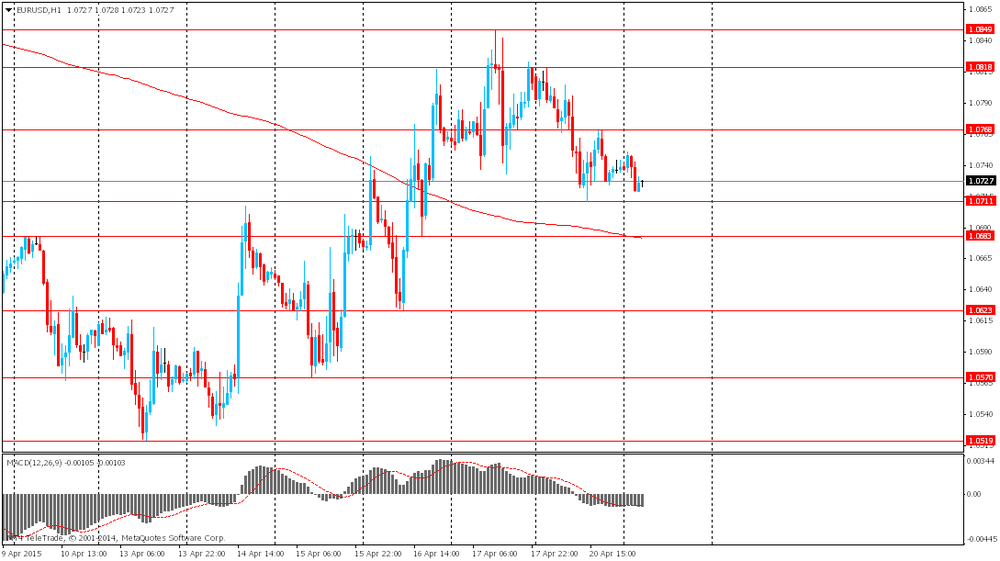

The euro fell at $1.0738, toward the lower end of a $1.0712 to $1.0825 range seen yesterday, weighed down by German bund yields touching fresh lows and Greek woes dominating the headlines. Ahead of key data in the form of German ZEW due for release later in the European session (0900 GMT).

The aussie fell at $0.7725, toward the low end of the $0.7707 to $0.7843 seen yesterday, as aussie strength attributed to China's rate stimulus was more than negated on news that China's Property developer, Kasia Group, had defaulted on its overseas debt. Broad-based

US dollar strength was also seen following upbeat US corporate earnings results and RBA Stevens' speech where he mentioned rates could be cut again if needed and the aussie was very likely to fall further over time.

EUR / USD: during the Asian session the pair fell to $ 1.0720

GBP / USD: during the Asian session the pair fell to $ 1.4880

USD / JPY: during the Asian session the pair rose to Y119.50

Another data lite day for the UK with attention on Germany ZEW at 0900GMT. Wednesday brings BOE Minutes and Thursday UK retail sales. Until then main market focus remains on Greece debt woes and linked comment. UK General Election remains a background factor with betting now favouring a minority Labour led government.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.