- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Foreign exchange market. European session: the euro traded lower against the U.S. dollar on the results of the referendum in Greece

Foreign exchange market. European session: the euro traded lower against the U.S. dollar on the results of the referendum in Greece

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia MI Inflation Gauge, m/m June 0.3% 0.1%

01:30 Australia ANZ Job Advertisements (MoM) June 0.0% 1.3%

05:00 Japan Leading Economic Index (Preliminary) May 106.4 106.2

05:00 Japan Coincident Index (Preliminary) May 111 109.2

06:00 Germany Factory Orders s.a. (MoM) May 2.2% Revised From 1.4% -0.4% -0.2%

07:15 Switzerland Consumer Price Index (MoM) June 0.2% -0.1% 0.1%

07:15 Switzerland Consumer Price Index (YoY) June -1.2% -1.2% -1.0%

The U.S. dollar traded mixed to higher against the most major currencies ahead of U.S. economic data The ISM non-manufacturing purchasing managers' index is expected to rise to 56.2 in June from 55.7 in May.

The euro traded lower against the U.S. dollar on the results of the referendum in Greece. 61.31% of Greeks voted "No" in the Sunday's referendum, while 38.69% of Greeks voted "Yes".

Greek Finance Minister Yanis Varoufakis has resigned after the referendum.

"Soon after the announcement of the referendum results, I was made aware of a certain preference by some eurogroup participants, and assorted 'partners', for my… 'absence' from its meetings; an idea that the Prime Minister judged to be potentially helpful to him in reaching an agreement," he said in his blog on early Monday.

Head of the Eurogroup Jeroen Dijsselbloem said on Sunday that the outcome of the referendum is "regrettable".

"I take note of the outcome of the Greek referendum. This result is very regrettable for the future of Greece. For recovery of the Greek economy, difficult measures and reforms are inevitable. We will now wait for the initiatives of the Greek authorities. The Eurogroup will discuss the state of play on Tuesday 7 July," he said.

Meanwhile, the economic data from the Eurozone was better than expected. Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index increased to 18.5 in July from 17.1 in June, missing expectations for a decline to 18.7. The index rose despite the uncertainty over the Greek debt crisis.

German seasonal adjusted factory orders declined 0.2% in May, beating expectations for a 0.4% drop, after a 2.2% rise in April. April's figure was revised up from a 1.4% gain.

The decline was driven by a drop in new orders from the Eurozone. New orders from the Eurozone plunged 1.5% in May, while orders from other countries increased 1.2%.

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports from the U.K.

The Swiss franc traded lower against the U.S. dollar despite the better-than-expected consumer price inflation from Switzerland. Switzerland's consumer price index rose 0.1% in June, beating expectations for a 0.1% decrease, after a 0.2% rise in May.

On a yearly basis, Switzerland's consumer price index increased to -1.0% in June from -1.2% in May, beating forecasts of a 1.2% decline.

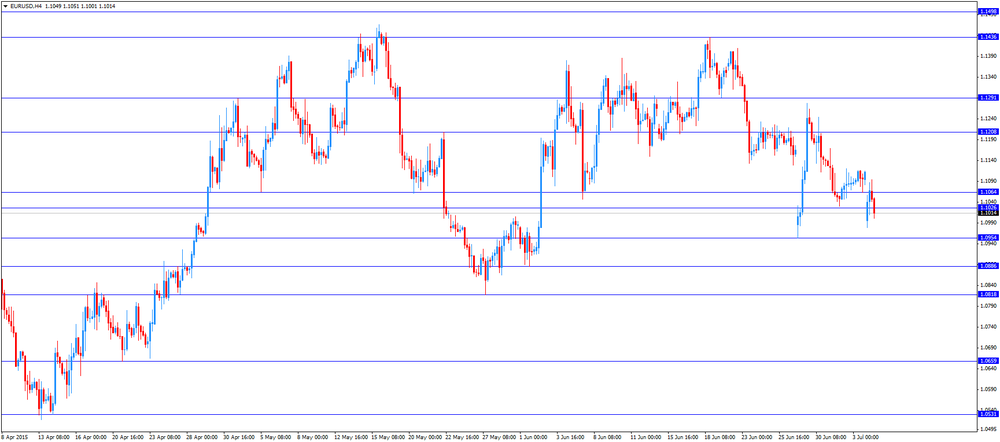

EUR/USD: the currency pair fell to $1.1001

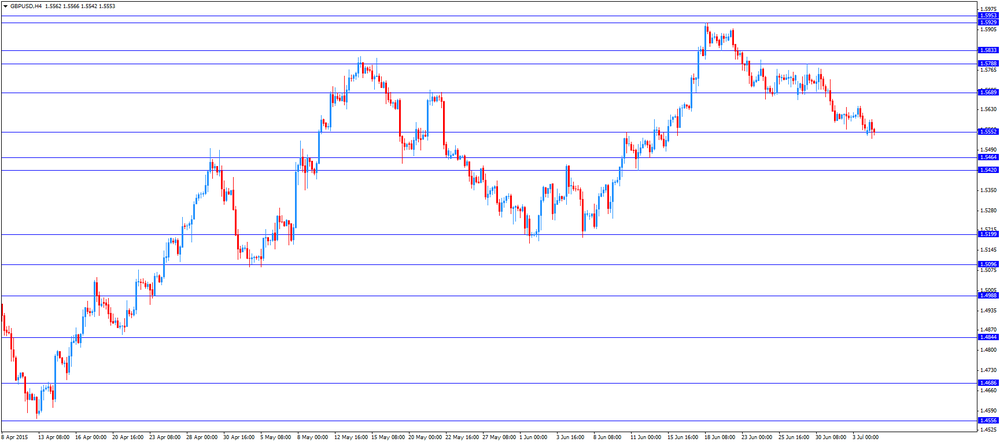

GBP/USD: the currency pair traded mixed

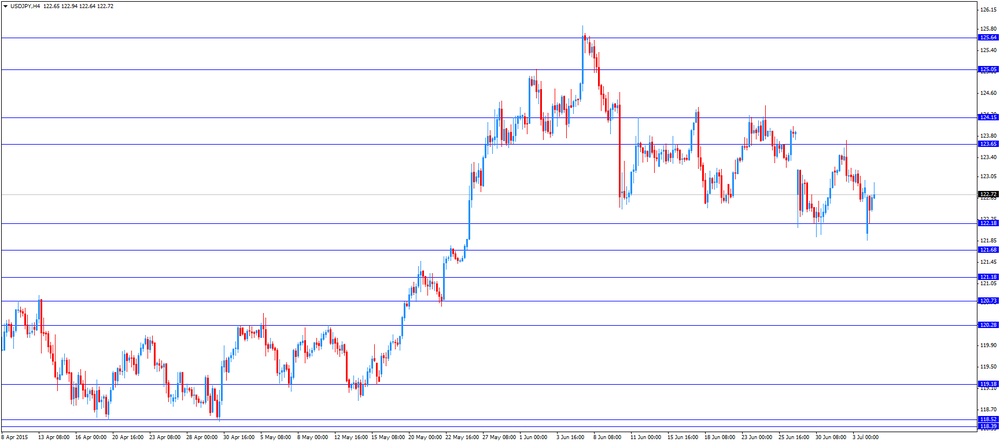

USD/JPY: the currency pair rose to Y122.94

The most important news that are expected (GMT0):

14:00 Canada Ivey Purchasing Managers Index June 62.3 55

14:00 U.S. ISM Non-Manufacturing June 55.7 56.2

14:00 U.S. Labor Market Conditions Index June 1.3

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.