- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Foreign exchange market. European session: the euro traded lower against the U.S. dollar on new Greek deadline

Foreign exchange market. European session: the euro traded lower against the U.S. dollar on new Greek deadline

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

05:00 Japan Eco Watchers Survey: Current June 53.3 53.2 51.0

05:00 Japan Eco Watchers Survey: Outlook June 54.5 53.5

07:00 United Kingdom Halifax house price index June 0.3% Revised From -0.1% 1.7%

07:00 United Kingdom Halifax house price index 3m Y/Y June 8.6% 9.6%

09:00 Eurozone Eurogroup Meetings

11:00 U.S. MBA Mortgage Applications July -4.7% 4.6%

11:30 United Kingdom Annual Budget Release

The U.S. dollar traded mixed against the most major currencies ahead of the release of the Fed's last meeting minutes.

The euro traded lower against the U.S. dollar on new Greek deadline. European Council President Donald Tusk said on Tuesday that just five days left for Greece to reach a deal with its creditors to save it from bankruptcy.

"Until now I avoided talking about deadlines, but tonight I have to say it loud and clear - the final deadline ends this week. All of us are responsible for the crisis, and all of us have a responsibility to resolve it," he said.

European Commission President Jean-Claude Juncker said on Tuesday that authorities are prepared for all outcomes of the negotiations with Greece about its debt crisis, including a scenario of the Greek exit from the Eurozone.

He added that the commission has another plans in case if Athens needs humanitarian aid and his favourite plan how to keep Greece in the Eurozone.

European Central Bank Governing Council Member Christian Noyer said on Wednesday that Greek banks would not receive any emergency lending if the Greek government fails to reach a deal with its creditors.

The Greek government sent a formal application for a new bailout programme from the European Stability Mechanism.

The Bank of France released its business sentiment index for France on Wednesday. The index fell to 98 in June from 99 in May.

The central bank expects the French economy to expand 0.2% in the second quarter of 2015.

The British pound traded lower against the U.S. dollar after the release of the annual budget by UK's Finance Minister George Osborne. The government plans to achieve a surplus in the 2019/20 financial year, one year later than previously planned.

The Office for Budget Responsibility projects the U.K. economy to grow 2.4% in 2015, 2.3% in 2016, and 2.4% in 2017.

Halifax released its house prices data for the U.K. on Wednesday. House prices in the U.K. increased 1.7% in June, after a 0.3% rise in May. May's figure was revised up from a 0.1% decline.

On a yearly basis, house prices climbed 9.6% in three months to June, after a 8.6% increase in three months to May. It was the fastest pace since September 2014.

"Economic growth, higher employment, increasing real earnings growth and very low mortgage rates are all supporting housing demand," Halifax's housing economist Martin Ellis said.

The Canadian dollar traded mixed against the U.S. dollar ahead of Canadian housing market data. The Canadian building permits are expected to decline 5.0% in May, after a 11.6% rise in April.

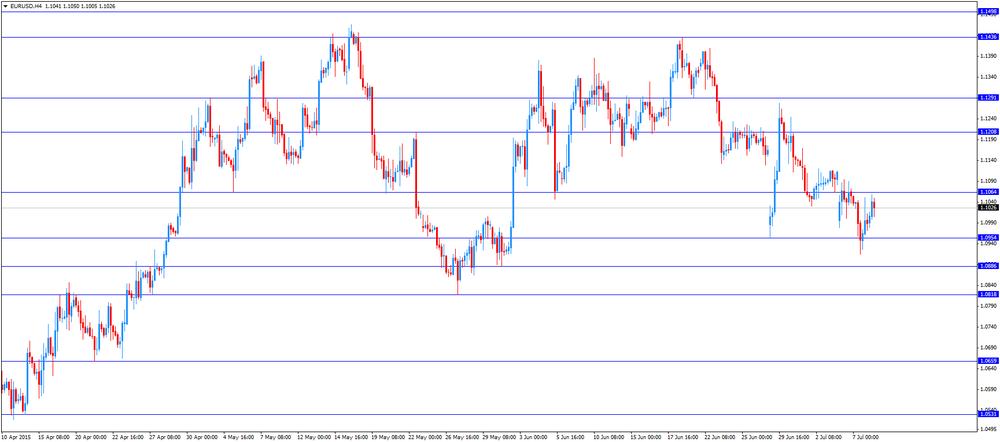

EUR/USD: the currency pair traded mixed

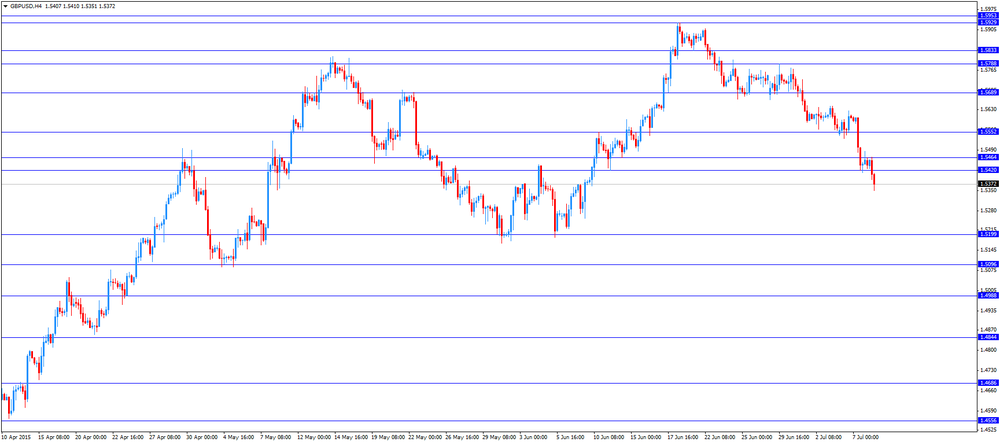

GBP/USD: the currency pair declined to $1.5351

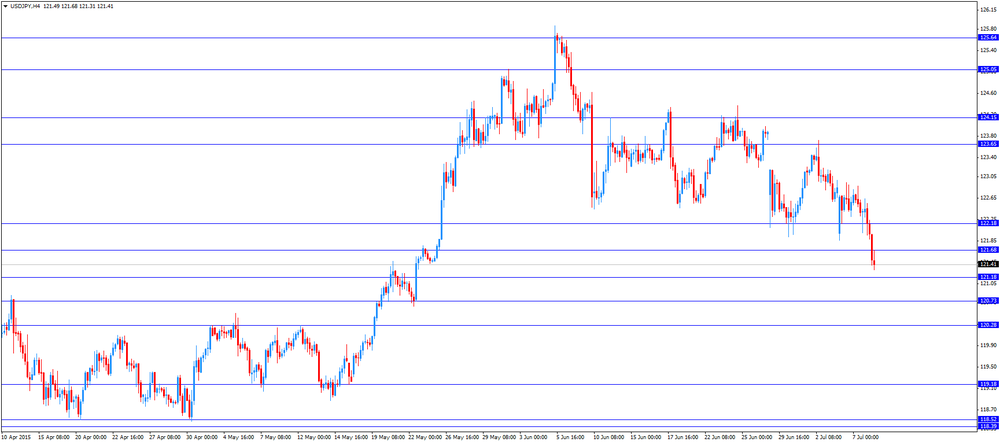

USD/JPY: the currency pair decreased to Y121.31

The most important news that are expected (GMT0):

12:30 Canada Building Permits (MoM) May 11.6% -5.0%

18:00 U.S. FOMC Member Williams Speaks

18:00 U.S. FOMC meeting minutes

23:50 Japan Core Machinery Orders, y/y May 3.0% 16.3%

23:50 Japan Core Machinery Orders May 3.8% -5%

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.