- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- European session review: the US dollar rose

European session review: the US dollar rose

The US dollar strengthened against other major currencies after the Federal Reserve indicated that interest rates may be increased in the coming months, with a certain probability in September.

In his statement yesterday at the rate the Fed noted that the economy and the labor market continue to be strengthened, reinforcing hopes for an initial rise in rates at the meeting in September. The Fed reported that it is watching the economic recovery after the recession in the first quarter and its "moderate growth" in the moment.

The Fed chief Janet Yellen said that the central bank may raise interest rates in September if the economy continues to improve the alleged rate.

On Thursday scheduled the publication of preliminary data on the growth of the US economy in the second quarter. The data is expected to show economic recovery after the recession in the first quarter caused by the severe winter conditions.

The euro retreated from session lows after the data on the index of sentiment in the economy, but then fell again. The threat of a Greek exit from the euro zone does not have a negative impact on sentiment in the corporate sector in the region in July. Companies in the past month more optimistic about their own prospects, although increased consumer concerns.

The published data on Thursday the European Commission pointed to an unexpected increase in confidence in the companies in most major economies in the eurozone.

The survey was carried out of the European Commission at the time when Greece is so much closer to the exit from the euro zone as no country before. Nonetheless, Greece July 13 failed to reach agreement with creditors that will allow the country over the next three years to obtain new loans.

Increased confidence in the companies suggests that the observed recent increase in investment and employment is likely to continue, supporting the economic recovery in the eurozone.

Sentiment in the euro-zone economy, which takes into account the mood of businesses and consumers, in July rose to 104.0 from 103.5 in the previous month, reaching the highest level since July 2011. The index is still above the long-term average level of 100.0.

Economists had expected the index decline in July to 103.3.

The European Commission confirmed that consumer confidence weakened in July, but the mood of the companies of the manufacturing sector, the service sector and the retail sector improved, while the mood of construction companies and the banking sector declined slightly.

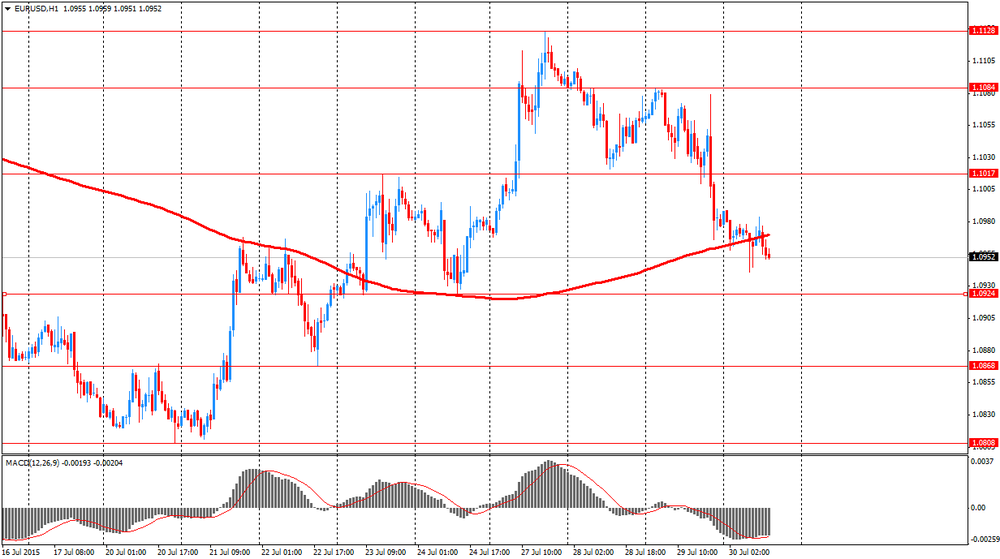

EUR / USD: during the European session the pair fell to $ 1.0941, and then rose to $ 1.0984

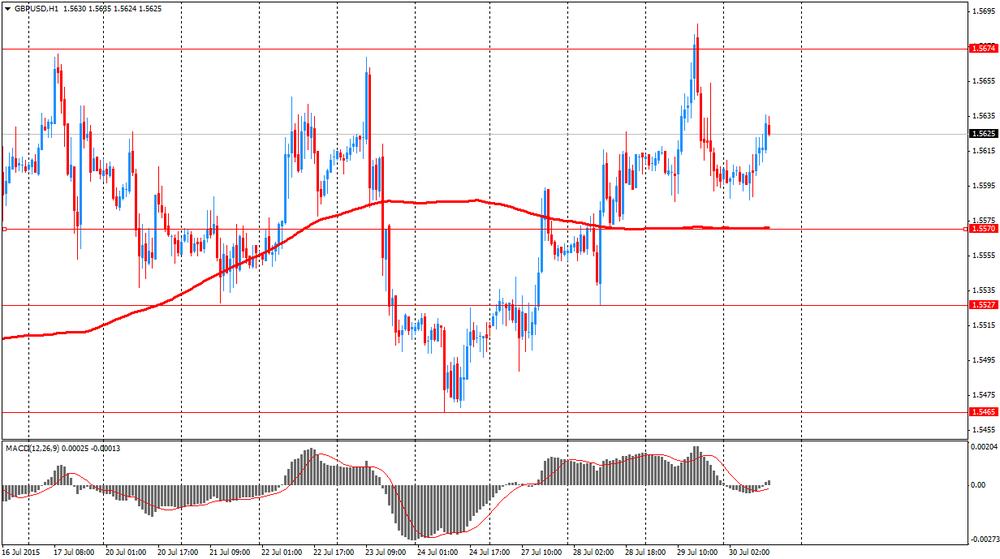

GBP / USD: during the European session, the pair rose to $ 1.5636

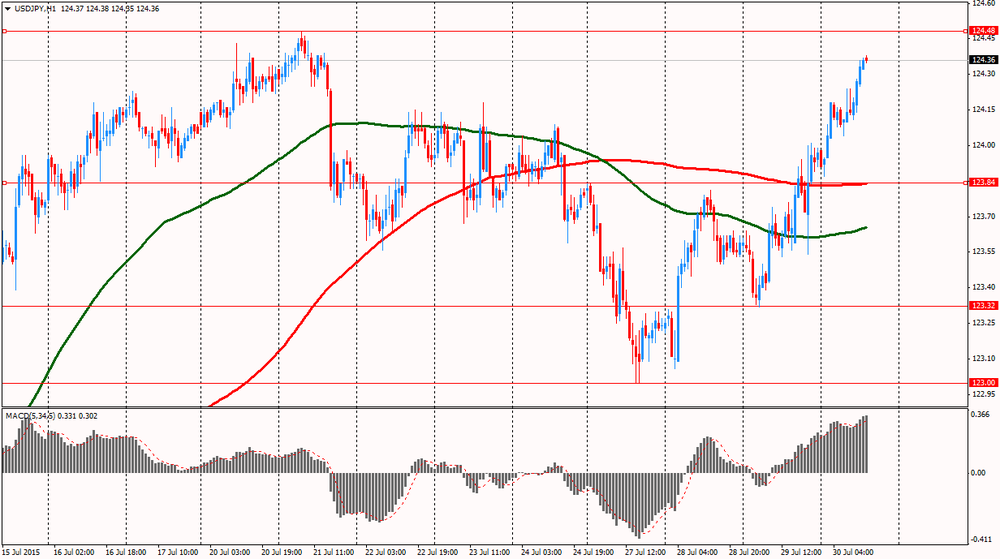

USD / JPY: during the European session, the pair rose to Y124.38

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.