- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Foreign exchange market. European session: the U.S. dollar traded against the most major currencies after the release of the weaker-than-expected U.S. durable goods orders data

Foreign exchange market. European session: the U.S. dollar traded against the most major currencies after the release of the weaker-than-expected U.S. durable goods orders data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

07:00 Switzerland UBS Consumption Indicator September 1.64 Revised From 1.63 1.65

09:00 Eurozone Private Loans, Y/Y September 1.0% 1.1% 1.1%

09:00 Eurozone M3 money supply, adjusted y/y September 4.9% Revised From 4.8% 5% 4.9%

09:30 United Kingdom GDP, q/q (Preliminary) Quarter III 0.7% 0.6% 0.5%

09:30 United Kingdom GDP, y/y (Preliminary) Quarter III 2.4% 2.4% 2.3%

12:30 U.S. Durable Goods Orders September -3.0% Revised From -2.3% -1.2% -1.2%

12:30 U.S. Durable Goods Orders ex Transportation September -0.9% Revised From 0.0% 0% -0.4%

12:30 U.S. Durable goods orders ex defense -2.1% Revised From -1% -2%

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y August 5.0% 5.1% 5.1%

The U.S. dollar traded against the most major currencies after the release of the weaker-than-expected U.S. durable goods orders data. The U.S. Commerce Department released durable goods orders data on Tuesday. The U.S. durable goods orders decreased 1.2% in September, in line with expectations, after a 3.0% drop in August. August's figure was revised down from a 2.3% fall.

The decline was partly driven by a weak demand for transportation equipment, which slid by 2.9% in September.

The U.S. durable goods orders excluding transportation fell 0.4% in September, missing expectations for a flat reading, after a 0.9% decrease in August. August's figure was revised down from a flat reading.

The S&P/Case-Shiller home price index increased 5.1% in August, in line with expectations, after a 5.0% gain in July.

The euro traded mixed against the U.S. dollar after the mixed economic data from the Eurozone. The European Central Bank (ECB) released its M3 money supply figures on Tuesday. M3 money supply rose 4.9% in September from last year, missing expectations for a 5.0% gain, after a 4.9 % increase in August. August's figure was revised up from a 4.8% rise.

Loans to the private sector in the Eurozone climbed 1.1% in September from the last year, in line with expectations, after a 1.0% gain in August.

The British pound traded mixed against the U.S. dollar after the release of the weaker-than-expected economic data from the U.K. The Office for National Statistics released its U.K. GDP data on Tuesday. The preliminary U.K. gross domestic product (GDP) climbed 0.5% in the third quarter, missing expectations for a 0.6% gain, after a 0.7% rise in the second quarter. It was the slowest pace since the fourth quarter of 2012.

The slow pace of the growth was driven by weak output in the construction and manufacturing sectors. Construction fell 2.2% in the third quarter, production declined 0.3%, while services rose 0.7%.

"The economy overall is still expanding steadily. However, the sectoral pattern is mixed," the ONS chief economist Joe Grice said.

On a yearly basis, the preliminary U.K. GDP increased 2.3% in the third quarter, missing forecasts of a 2.4% rise, after a 2.4% gain in the second quarter.

The Swiss franc traded mixed against the U.S. dollar. UBS released its consumption index for Switzerland on Tuesday. The UBS consumption index increased to 1.65 in September from 1.64 in August. August's figure was revised up from 1.63.

The increase was partly driven by a rise in automobiles sales.

"Lower prices for foreign-produced consumer goods in Swiss francs, such as automobiles, may be the likely reason," the bank said.

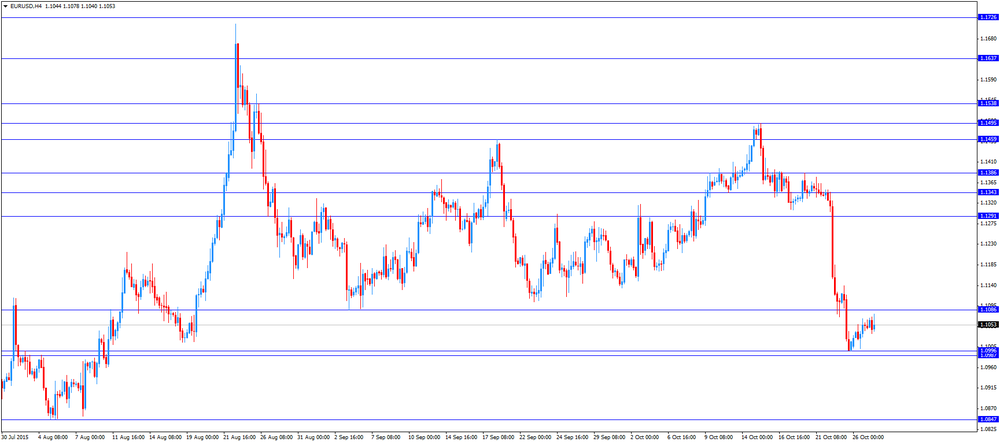

EUR/USD: the currency pair traded mixed

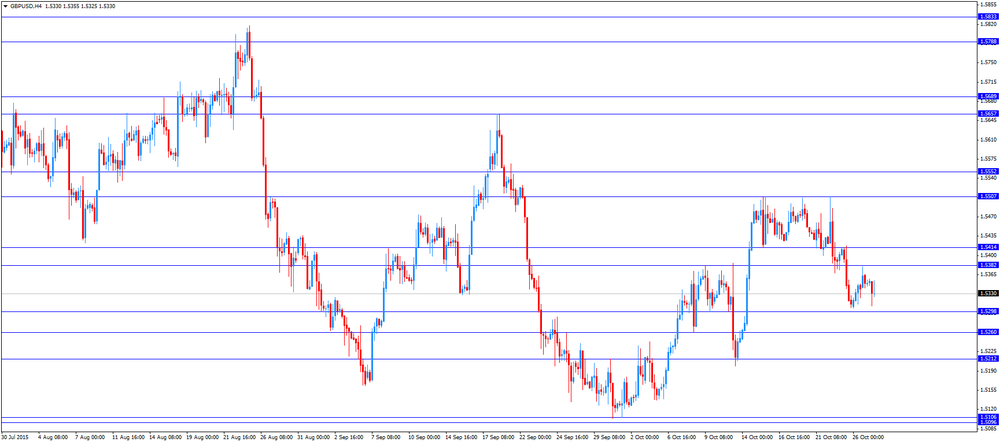

GBP/USD: the currency pair traded mixed

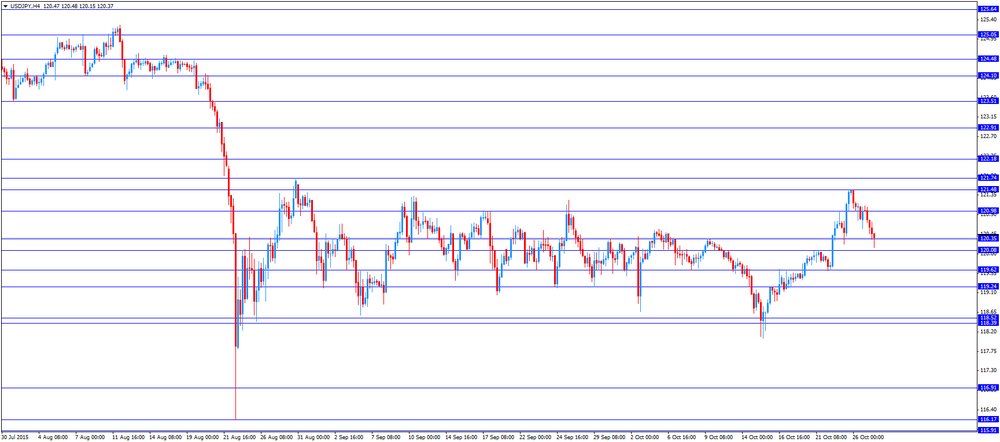

USD/JPY: the currency pair declined to Y120.33

The most important news that are expected (GMT0):

13:45 U.S. Services PMI (Preliminary) October 55.1 55.1

14:00 U.S. Richmond Fed Manufacturing Index October -5

14:00 U.S. Consumer confidence October 103 103

16:20 Canada Gov Council Member Lane Speaks

23:50 Japan Retail sales, y/y September 0.8% 0.4%

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.