- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Foreign exchange market. Asian session: the yen rose

Foreign exchange market. Asian session: the yen rose

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

04:00 Japan BoJ Interest Rate Decision 0% 0% 0%

04:00 Japan Bank of Japan Monetary Base Target 275 275

04:00 Japan BoJ Monetary Policy Statement

04:30 Japan All Industry Activity Index, m/m September -0.2% 0.2% -0.2%

06:30 Japan BOJ Press Conference

07:00 Switzerland Trade Balance October 3.05 3.4 4.16

The U.S. dollar stepped down from a seven-month high against other major currencies amid profit taking. Earlier the greenback rose significantly against the euro and the yen after the minutes of the Fed's meeting showed some policy makers were concerned that a signal of a probability of higher rates in December would be exaggerated. However most policy makers believe that the U.S. economy will improve by December meeting and will be able to withstand a rate hike.

The yen rose against the greenback on positive data. For the first time in six months Japanese trade balance has recovered from a deficit in October. Exports exceeded imports by ¥111.5 billion. Japanese exports declined by 2.1% in October despite a weaker yen. However imports fell by 13.4%. Exports to China fell by 3.6% marking the third month of declines in a row. The Bank of Japan's decision to leave its monetary policy unchanged also supported the yen.

EUR/USD: the pair rose to $1.0715 in Asian trade

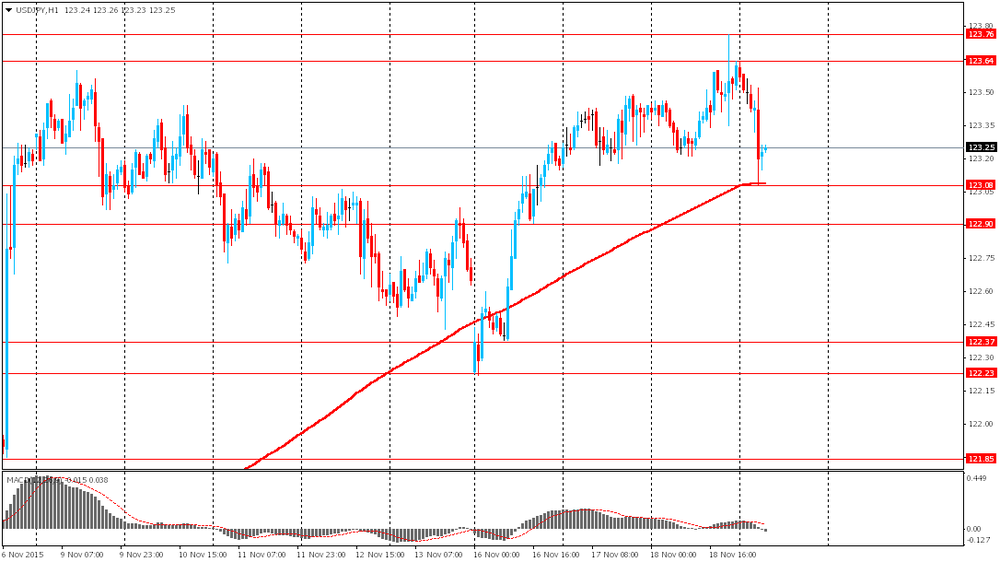

USD/JPY: the pair fell to Y123.10

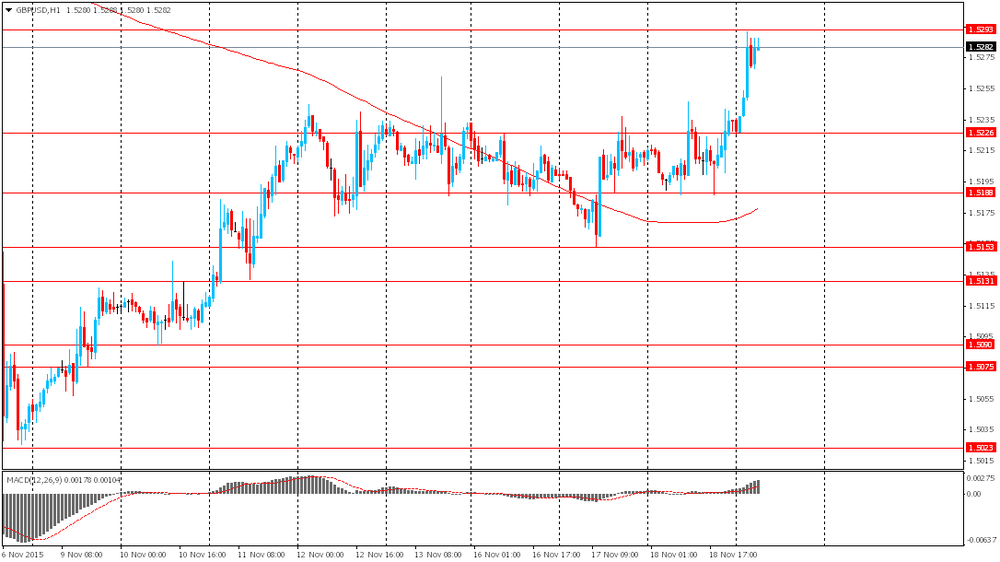

GBP/USD: the pair rose to $1.5295

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:00 Eurozone ECB's Jens Weidmann Speaks

09:00 Eurozone Current account, unadjusted, bln September 13.7

09:30 United Kingdom Retail Sales (MoM) October 1.9% -0.5%

09:30 United Kingdom Retail Sales (YoY) October 6.5% 4.2%

12:30 Eurozone ECB Monetary Policy Meeting Accounts

13:30 Canada Wholesale Sales, m/m September -0.1% 0.3%

13:30 U.S. Continuing Jobless Claims November 2174 2170

13:30 U.S. Initial Jobless Claims November 276 271

15:00 U.S. Leading Indicators October -0.2% 0.5%

15:00 U.S. Philadelphia Fed Manufacturing Survey November -4.5 -1

17:30 U.S. FOMC Member Dennis Lockhart Speaks

21:45 U.S. FED Vice Chairman Stanley Fischer Speaks

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.