- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Foreign exchange market. Asian session: the euro weakened

Foreign exchange market. Asian session: the euro weakened

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:00 Australia HIA New Home Sales, m/m October -4.0% -3.0%

00:30 Australia Trade Balance October -2.40 Revised From -2.32 -2.665 -3.30

01:45 China Markit/Caixin Services PMI November 52.0 53.1 51.2

The euro declined against the U.S. dollar ahead of an ECB meeting later today. Many investors expect the bank to decide to expand its quantitative easing program. Speaking earlier at a European Banking Congress in Frankfurt ECB President Maria Draghi said that at the next meeting the central bank will assess the degree of stability of factors, which hold back inflation. He added if the 2% inflation target was at risk the central bank would use all tools available to support it.

The New Zealand dollar rose after Fonterra, New Zealand-based biggest dairy company in the world, said it would make payments to shareholders on December 10. The company noted that the latest GlobalDairyTrade auction highlighted growing milk powder prices. Fonterra's representatives said they wished to believe that dairy prices were on their way up, but concerns remained. These comments have supported the NZD today.

The Australian dollar declined at the beginning of the session amid weak trade balance data. The country's trade deficit came in at A$3.3 billion in October. The deficit has widened compared to -A$2.4 billion reported previously. Economists had expected a deficit of -A$2.67 billion. Imports were unchanged in October, while exports fell by 3%. Nevertheless the AUD rebounded later in the session.

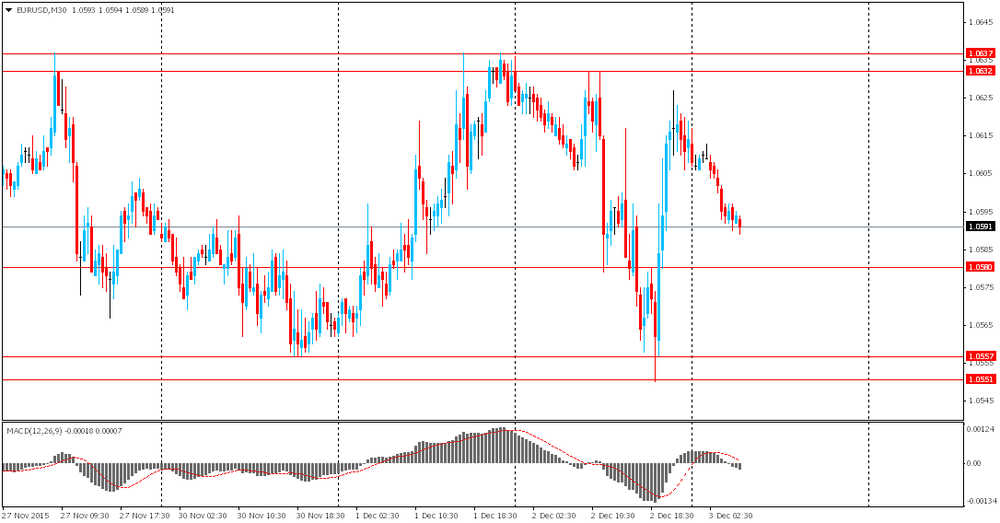

EUR/USD: the pair fell to $1.0585 in Asian trade

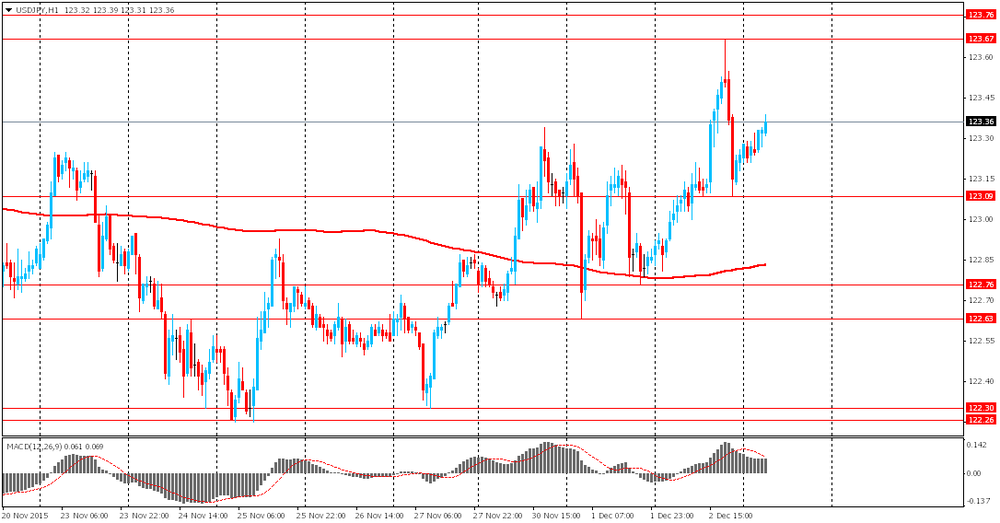

USD/JPY: the pair rose to Y123.45

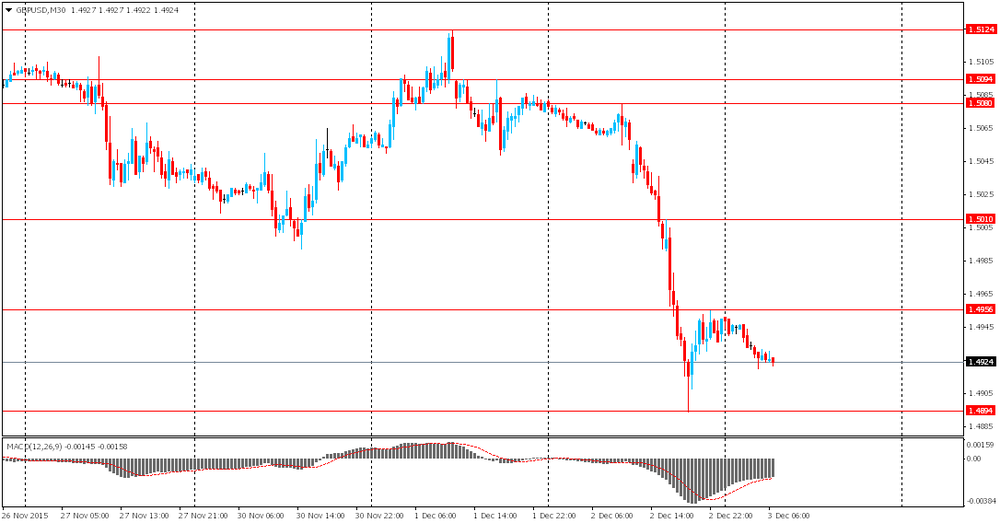

GBP/USD: the pair fell to $1.4920

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:50 France Services PMI (Finally) November 52.7 51.3

08:55 Germany Services PMI (Finally) November 54.5 55.6

09:00 Eurozone Services PMI (Finally) November 54.1 54.6

09:30 United Kingdom Purchasing Manager Index Services November 54.9 55

10:00 Eurozone Retail Sales (MoM) October -0.1% 0.2%

10:00 Eurozone Retail Sales (YoY) October 2.9% 2.7%

12:45 Eurozone ECB Interest Rate Decision 0.05% 0.05%

13:30 Eurozone ECB Press Conference

13:30 U.S. Continuing Jobless Claims November 2207 2187

13:30 U.S. Initial Jobless Claims November 260 268

14:45 U.S. Services PMI (Finally) November 54.8 56.5

15:00 U.S. ISM Non-Manufacturing November 59.1 58

15:00 U.S. Factory Orders October -1.0% 1.4%

15:00 U.S. Fed Chairman Janet Yellen Speaks

18:10 U.S. FED Vice Chairman Stanley Fischer Speaks

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.