- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Foreign exchange market. Asian session: the yen fell

Foreign exchange market. Asian session: the yen fell

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:05 United Kingdom Gfk Consumer Confidence January 2 1 4

00:30 Australia Producer price index, q / q Quarter IV 0.9% 0.6% 0.3%

00:30 Australia Producer price index, y/y Quarter IV 1.7% 1.9%

00:30 Australia Private Sector Credit, m/m December 0.4% 0.6% 0.5%

00:30 Australia Private Sector Credit, y/y December 6.6% 6.6%

04:00 Japan BoJ Interest Rate Decision 0% -0.1%

04:00 Japan Bank of Japan Monetary Base Target 275 275

04:00 Japan BoJ Monetary Policy Statement

05:00 Japan Housing Starts, y/y December 1.7% 0.5% -1.3%

05:00 Japan Construction Orders, y/y December 5.7% 14.8%

06:30 France GDP, q/q (Preliminary) Quarter IV 0.3% 0.2% 0.2%

06:30 France GDP, Y/Y (Preliminary) Quarter IV 1.1% 1.5%

06:30 Japan BOJ Press Conference

The euro declined ahead of today's inflation data. Economists expect the consumer price index to have risen by 0.4% y/y in January from 0.2% in December. If data meet expectations this would mean that inflation may start to pick up pace in 2016.

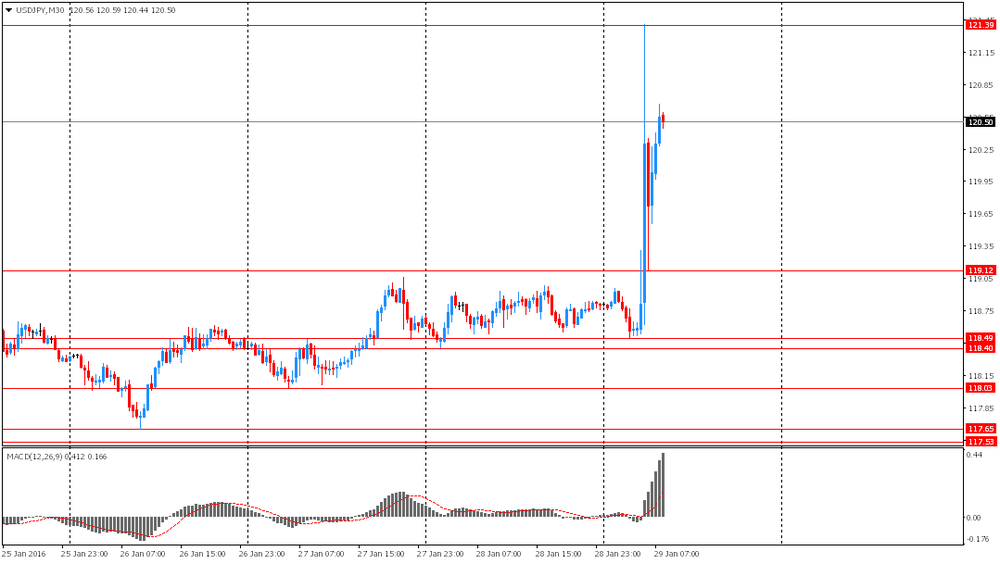

The yen declined against the U.S. dollar and the euro after the Bank of Japan introduced negative interest rates. Board members voted 5 to 4 to adopt negative 0.1% interest for excess reserves financial institutions keep at the central bank. The bank said this step was taken in order to stimulate inflation growth. According to the statement, the BOJ would keep the rate negative for "as long as it is necessary for maintaining that target in a stable manner."

The Australian dollar rose amid rising oil prices. Recent weak data on the U.S. economy weighed on the greenback and contributed to gains in the AUD.

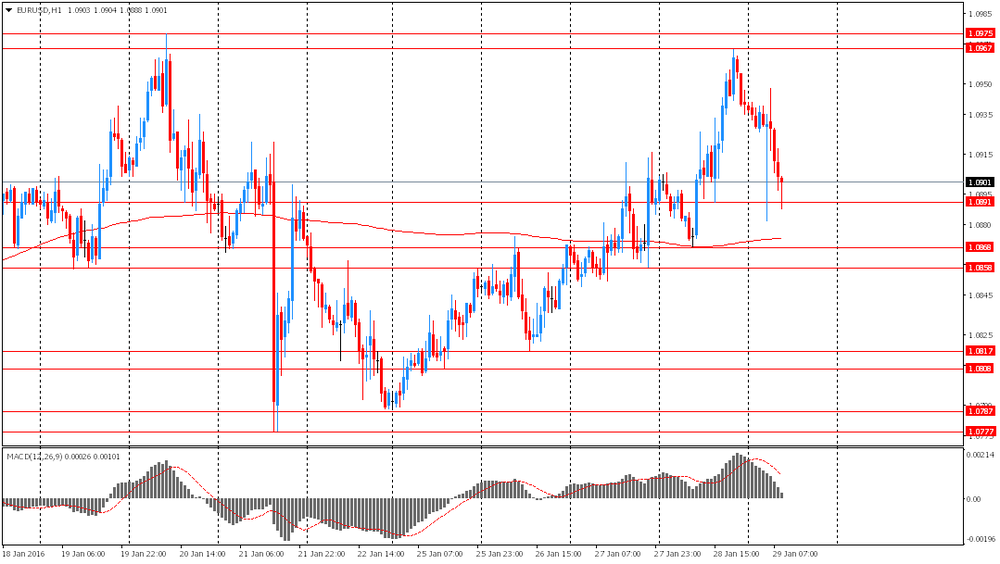

EUR/USD: the pair fell to $1.0890 in Asian trade

USD/JPY: the pair rose to Y121.40

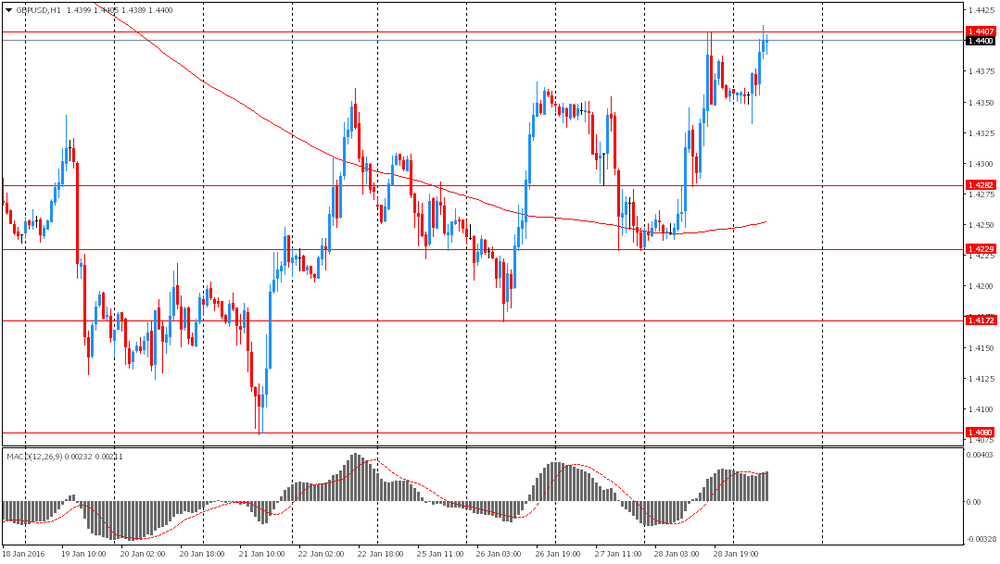

GBP/USD: the pair rose to $1.4405

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:00 Germany Retail sales, real adjusted December 0.2% 0.5%

07:00 Germany Retail sales, real unadjusted, y/y December 2.3% 2%

08:00 Switzerland KOF Leading Indicator January 96.6 96

09:00 Eurozone Private Loans, Y/Y December 1.4% 1.5%

09:00 Eurozone M3 money supply, adjusted y/y December 5.1% 5.2%

10:00 Eurozone Harmonized CPI, Y/Y (Preliminary) January 0.2% 0.4%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Preliminary) January 0.9% 0.9%

13:30 Canada Industrial Product Price Index, m/m December -0.2% -0.3%

13:30 Canada Industrial Product Price Index, y/y December -0.2%

13:30 Canada GDP (m/m) November 0.0% 0.3%

13:30 U.S. PCE price index ex food, energy, q/q (Preliminary) Quarter IV 1.4% 1.2%

13:30 U.S. PCE price index, q/q (Preliminary) Quarter IV 1.3% 0.7%

13:30 U.S. GDP, q/q (Preliminary) Quarter IV 2.0% 0.8%

14:45 U.S. Chicago Purchasing Managers' Index January 42.9 45

15:00 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) January 92.6 93

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.