- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Foreign exchange market. Asian session: the yen gained

Foreign exchange market. Asian session: the yen gained

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:00 Australia MI Inflation Gauge, m/m February 0.4% -0.2%

00:00 New Zealand ANZ Business Confidence January 23 7.1

00:30 Australia Company Gross Profits QoQ Quarter IV 1.4% Revised From 1.3% -1.8% -2.8%

00:30 Australia Private Sector Credit, m/m January 0.5% Revised From 0.6% 0.5% 0.5%

00:30 Australia Private Sector Credit, y/y January 6.6% 6.5%

05:00 Japan Housing Starts, y/y January -1.3% 0.0% 0.2%

05:00 Japan Construction Orders, y/y January 14.8% -13.8%

07:00 Germany Retail sales, real adjusted January -0.2% 0.2% 0.7%

07:00 Germany Retail sales, real unadjusted, y/y January 1.5% 1.5% 0.7%

The euro traded range-bound ahead of inflation data due later today. A median forecast suggests the consumer price index was unchanged in February compared to the same period last year after growth of 0.3% in January. The annualized core CPI is likely to have slowed down to 0.9% from 1%. If data meet expectations the ECB will be persuaded to announce new stimulus measures.

The yen rose amid declines in Asian stock markets. Strong domestic data supported the currency too. Japanese industrial production rose by 3.7% in January after a 1.7% drop in December. Analysts had expected a more modest growth of 3.3%. This is the first positive change in three months.

The New Zealand dollar fell amid ANZ business confidence data. The corresponding index fell to 7.1 in January from 23 reported previously. Analysts had expected the index to advance to 25.5. The latest reading is the weakest since October 2015. The report showed that companies' own activity expectations declined to 26 from 34, slipping below the historical average. Meanwhile profit expectations fell to 12 from 18. Employment intentions fell to 12 from 20. Investment intentions stood largely unchanged at 14.

EUR/USD: the pair rose to $1.1065 in Asian trade

USD/JPY: the pair traded around Y113.00

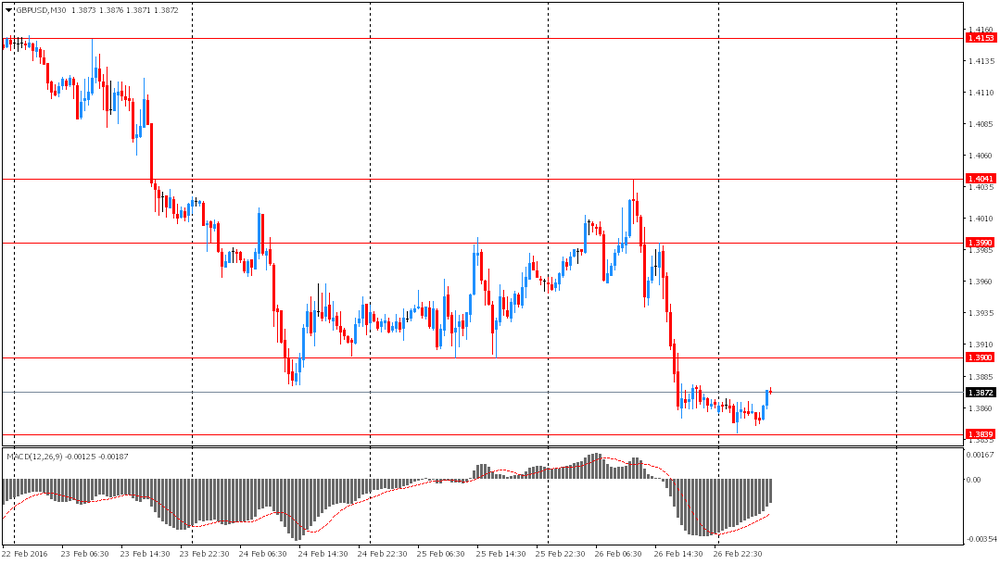

GBP/USD: the pair fluctuated within $1.3950-10

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:00 Switzerland KOF Leading Indicator February 100.3 98.8

09:30 United Kingdom Consumer credit, mln January 1169 1300

09:30 United Kingdom Mortgage Approvals January 70.84 73.6

09:30 United Kingdom Net Lending to Individuals, bln January 4.4

10:00 Eurozone Harmonized CPI, Y/Y (Preliminary) February 0.3% 0.0%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Preliminary) February 1% 0.9%

13:30 Canada Current Account, bln Quarter IV -16.2 -15.6

13:30 Canada Industrial Product Price Index, m/m January -0.2%

13:30 Canada Industrial Product Price Index, y/y January 1.1%

14:45 U.S. Chicago Purchasing Managers' Index February 55.6 53

15:00 U.S. Pending Home Sales (MoM) January 0.1% 0.5%

22:30 Australia AIG Manufacturing Index February 51.5

23:30 Japan Unemployment Rate January 3.3% 3.3%

23:30 Japan Household spending Y/Y January -4.4% -2.7%

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.