- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Before the bell: Stocks set to continue rebound

Before the bell: Stocks set to continue rebound

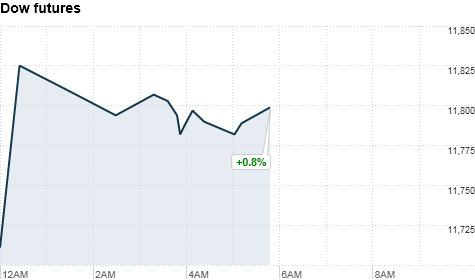

The U.S. stock futures solidly higher ahead of Friday's opening bell.

U.S. stocks closed broadly higher Thursday, rebounding after two days of sharp declines as investors reacted to heightened worries about a nuclear crisis in Japan.

The Japanese yen had been driven sharply higher in recent days due to global uncertainty and the prospect of more cash flowing into Japan.

But the yen eased after finance ministers from the Group of 7 major economic powers announced a coordinated intervention to prevent the Japanese currency from rising further. The announcement pushed the Nikkei up 2.7%.

With no U.S. economic data or corporate results on the agenda Friday, investors will likely remain focused on the ongoing disaster in Japan.

After a massive earthquake and tsunami devastated the northern part of Japan last Friday, workers at the Fukushima Daiichi nuclear power plant have been struggling to cool damaged reactors.

World markets: European stocks rose in afternoon trading. Britain's FT-100 added 0.5%, the DAX in Germany notched up 0.3% and France's CAC-40 gained 0.7%.

Asian markets ended the session higher. The Shanghai Composite rose 0.3%, the Hang Seng in Hong Kong added less than 0.1%.

Companies: Shares of General Electric (GE, Fortune 500) were up 1.2% in premarket trading after CEO John Dineen told reporters Thursday that the company expects its health care business revenue in India to grow 25% in 2011.

Freeport McMoran Copper and Gold (FCX, Fortune 500) gained 1.9% in premarket trade. Shares have risen 8.8% over the past five days as commodity prices soar.

Nike (NKE, Fortune 500) shares fell 7.7% in premarket trading after the company reported disappointing earnings late Thursday. Nike said higher commodity prices hurt profit margins and the company will raise prices on many of its products as a result.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.