- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- WSE: Session Results

WSE: Session Results

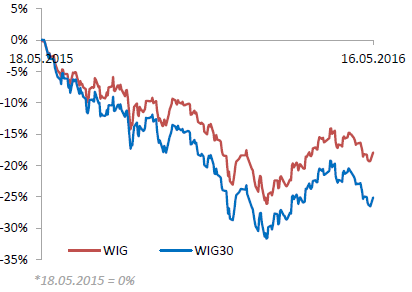

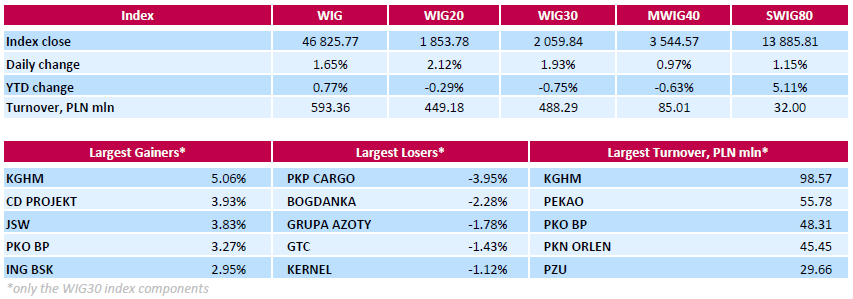

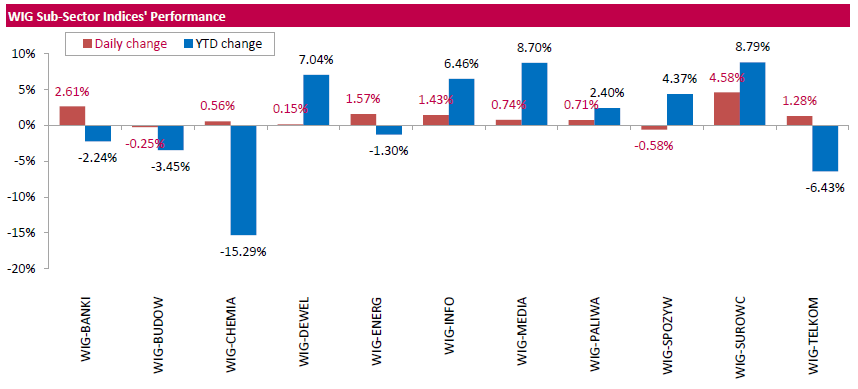

Polish equity market closed higher on Monday. The broad market measure, the WIG Index, surged by 1.65%. Except for food sector (-0.58%) and construction (-0.25%), every sector in the WIG Index rose, with materials (+4.58%) outperforming.

The large-cap stocks' measure, the WIG30 Index, rose by 1.93%. There were only five decliners among the index components. Railway freight transport operator PKP CARGO (WSE: PKP) was the worst-performing name, tumbling by 3.95% after the company reported Q1 net loss of PLN 66 mln, deeper than the expected loss of PLN 44 mln. Other laggards were thermal coal miner BOGDANKA (WSE: LWB), chemical producer GRUPA AZOTY (WSE: ATT), property developer GTC (WSE: GTC) and agricultural producer KERNEL (WSE: KER), losing between 1.12% and 2.28%. At the same time, copper producer KGHM (WSE: KGH) became the strongest advancer with a 5.06% gain. On Friday, the company reported its net profit reached PLN 161 mln in Q1, above the analysts' forecasts of PLN 101 mln. KGHM also stated it was delaying the next phase of expansion at its key overseas mine in Chile as stubbornly low metals prices more than halved its net profit in Q1. Oher major outperformers were videogame developer CD PROJEKT (WSE: CDR), coking coal producer JSW (WSE: JSW) and banking name PKO BP (WSE: PKO), climbing by 3.93%, 3.83% and 3.27% respectively.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.