- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Foreign exchange market. European session: the British pound traded higher against the U.S. dollar on the U.K. labour market data

Foreign exchange market. European session: the British pound traded higher against the U.S. dollar on the U.K. labour market data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Westpac Consumer Confidence June 8.5% -1.0%

08:30 United Kingdom Average earnings ex bonuses, 3 m/y April 2.2% Revised From 2.0% 2.1% 2.3%

08:30 United Kingdom Average Earnings, 3m/y April 2.0% Revised From 2.1% 1.7% 2.0%

08:30 United Kingdom ILO Unemployment Rate April 5.1% 5.1% 5%

08:30 United Kingdom Claimant count May 6.4 Revised From -2.4 -0.1 -0.4

09:00 Eurozone Trade balance unadjusted April 28.6 26 27.5

The U.S. dollar traded mixed to lower against the most major currencies ahead of the release of the Fed's interest rate decision. Analysts expect the Fed to keep its interest rate unchanged.

The U.S. PPI is expected to increase 0.3% in May, after a 0.2% rise in April.

The U.S. producer price inflation excluding food and energy is expected to rise 0.1% in May, after a 0.1% gain in April.

The U.S. industrial production is expected to decline 0.2% in May, after a 0.7% rise in April.

The euro traded mixed against the U.S. dollar. Eurostat released its trade data for the Eurozone on Wednesday. Eurozone's unadjusted trade surplus declined to €27.5 billion in April from €28.6 billion in March, beating expectations for a fall to €26 billion. Exports fell at an unadjusted annual rate of 1.0% in April, while imports dropped 5.0%.

The British pound traded higher against the U.S. dollar on the U.K. labour market data. The Office for National Statistics (ONS) released its labour market data on Wednesday. The U.K. unemployment rate declined to 5.0% in the February to April quarter from 5.1% in the January to March quarter. It was the lowest level since October 2005.

Analysts had expected the unemployment rate to remain unchanged.

Average weekly earnings, excluding bonuses, climbed by 2.3% in the February to April quarter, exceeding expectations for a 2.1% rise, after a 2.2% gain in the January to March quarter. The previous quarter's figure was revised up from a 2.1% rise.

Average weekly earnings, including bonuses, rose by 2.0% in the February to April quarter, exceeding expectations for a 1.7% gain, after a 2.0% increase in the January to March quarter.

The Bank of England monitors closely the wages growth it considers when to start hiking its interest rate.

The Canadian dollar traded higher against the U.S. dollar ahead of the release of the manufacturing shipments data from Canada. Canadian manufacturing shipments are expected to rise 0.6% in April, after a 0.9% fall in March.

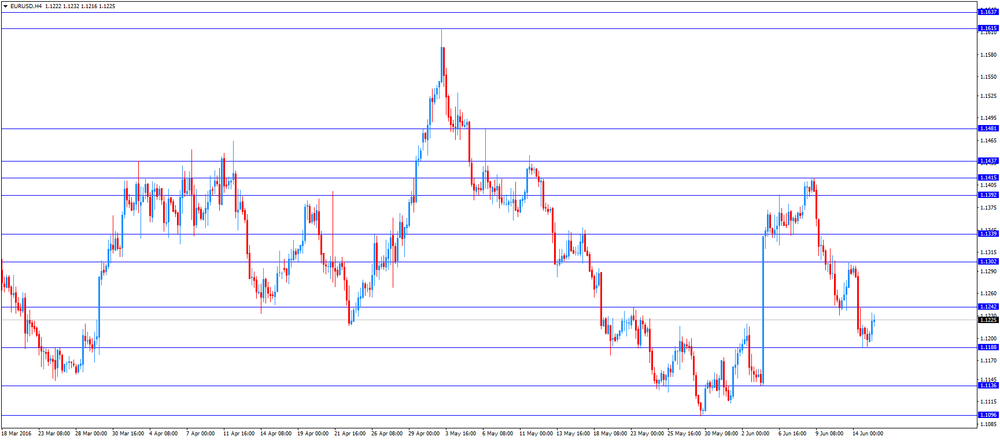

EUR/USD: the currency pair traded mixed

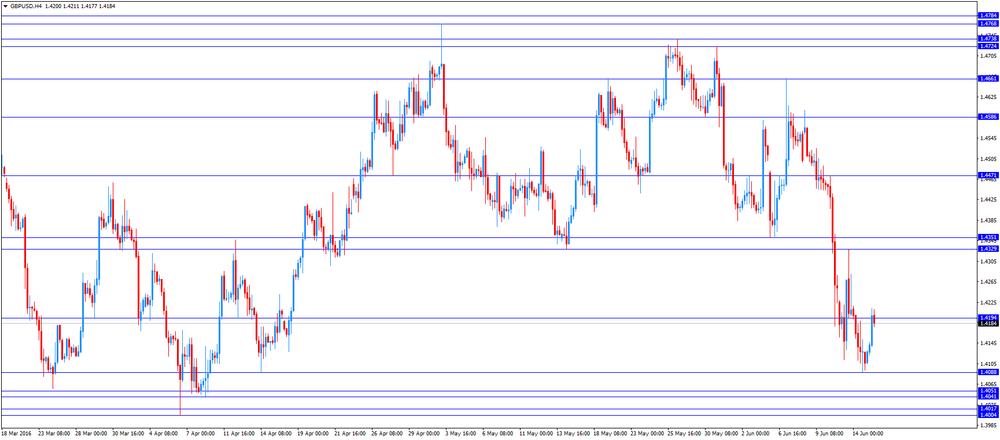

GBP/USD: the currency pair rose to $1.4213

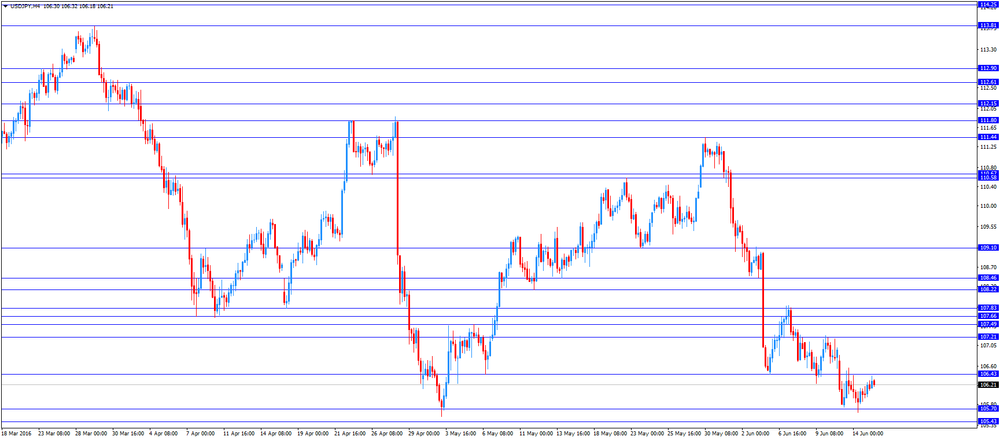

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 Canada Manufacturing Shipments (MoM) April -0.9% 0.6%

12:30 U.S. PPI, m/m May 0.2% 0.3%

12:30 U.S. PPI, y/y May 0% -0.1%

12:30 U.S. PPI excluding food and energy, m/m May 0.1% 0.1%

12:30 U.S. PPI excluding food and energy, Y/Y May 0.9% 1%

13:15 U.S. Capacity Utilization May 75.4% 75.2%

13:15 U.S. Industrial Production (MoM) May 0.7% -0.2%

13:15 U.S. Industrial Production YoY May -1.1%

14:00 Eurozone ECB's Jens Weidmann Speaks

14:30 U.S. Crude Oil Inventories June -3.226 -2.27

18:00 U.S. Fed Interest Rate Decision 0.5% 0.5%

18:00 U.S. FOMC Economic Projections

18:00 U.S. FOMC Statement

18:30 U.S. Federal Reserve Press Conference

22:45 New Zealand GDP q/q Quarter I 0.9% 0.5%

22:45 New Zealand GDP y/y Quarter I 2.3% 2.6%

23:55 Canada BOC Gov Stephen Poloz Speaks

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.