- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Oil futures settled lower

Oil futures settled lower

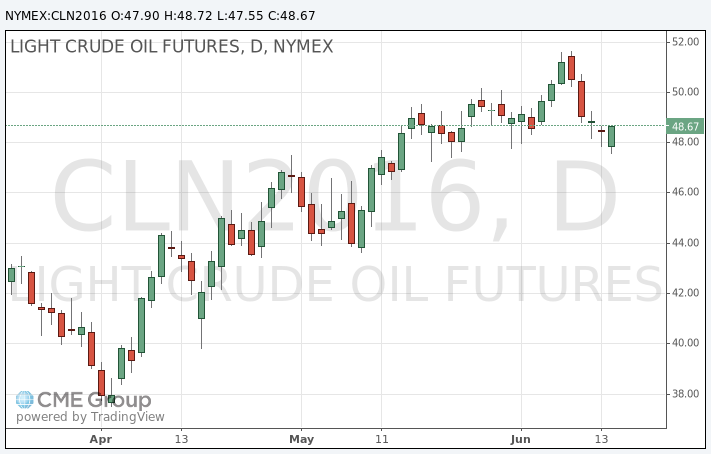

Oil futures settled lower Wednesday, pressured by concerns over global energy demand following disappointing U.S. economic data and ahead of the U.K. referendum scheduled for next week.

A modest weekly decline in U.S. crude supplies and the Federal Reserve's decision to stand pat on interest rates failed to offer much support for prices.

July West Texas Intermediate crude fell 48 cents, or 1%, to settle at $48.01 a barrel on the New York Mercantile Exchange, marking a fifth session decline in a row. The August contract for Brent lost 86 cents, or 1.7%, at $48.97 a barrel.

WTI oil futures had fallen below $48, but pared losses and saw a brief tick higher after the U.S. Energy Information Administration reported that U.S. crude supplies fell by 900,000 barrels for the week ended June 10. That contradicted the 1.2 million-barrel increase reported by the American Petroleum Institute late Tuesday, but still came in short of the 1.4 million-barrel decline expected by analysts polled by S&P Global Platts.

"The headline crude-oil number was less bullish than expected, but not as bearish as the API number-so basically a wash," Tyler Richey.

About a half-hour before WTI prices settled, the Fed announced that it would leave interest rates unchanged and it adopted a dovish stance on the outlook for monetary policy.

"The revisions to the 'dot plot' within the FOMC release that showed 6 members now only expect one rate hike in 2016," up from just one member at the last meeting, said Richey. That "was a dovish development and we are seeing the dollar correct lower as a result."

'Uncertainties about the health of the U.S. economy is the reason for the dollar weakness. That isn't necessarily a bullish thing for oil from a demand standpoint.'

"Traditionally, a weaker dollar would be supportive of oil prices, but…uncertainties about the health of the U.S. economy is the reason for the dollar weakness. That isn't necessarily a bullish thing for oil from a demand standpoint," he said.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.