- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Gold surged to the highest in almost two years

Gold surged to the highest in almost two years

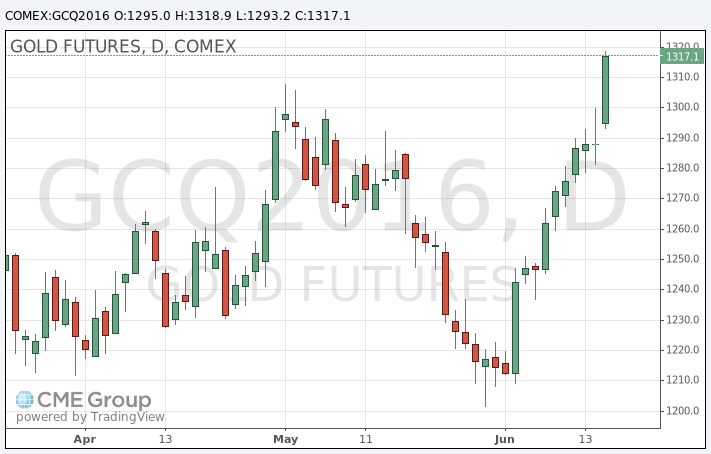

Gold surged to the highest in almost two years as the outlook for low U.S. interest rates and concern that the U.K. will leave the European Union boosted demand for a haven. Base metals declined amid concerns the global economy is losing steam.

Bullion advanced for a seventh day after the Federal Reserve reined in its projection for rate increases over the next two years. Fed Chair Janet Yellen said Wednesday that the U.K.'s June 23 referendum on whether to leave the EU was a factor in holding rates steady.

With recent polls showing U.K. voters favor leaving the bloc, investors are exiting equities and piling into precious metals. Gold holdings in exchange-traded funds are at the highest since October 2013 and silver-backed funds are at a record. Prices of both metals have surged more than 23 percent this year.

The economy seems at risk because of the threat of "Brexit, a China slowdown and doubts from the Fed that the U.S. economy may be performing sub-optimally," Bart Melek, the head of commodity strategy at TD Securities in Toronto, said in a telephone interview.

The number of Fed officials who see just a single rate hike this year rose to six, from one in March. The odds of a rate increase by December have dropped to 29 percent from 76 percent at the start of this month, Fed funds futures show. Low borrowing costs boost the appeal of owning precious metals, which don't pay interest.

Gold will rally if Britons choose to exit the EU, reaching $1,350 within a week of the vote, according to a survey of traders and analysts. Should a majority choose to remain in the bloc, bullion might slide to $1,250, it showed.

Gold futures for August delivery rose to $1,318.90 an ounce on the Comex in New York, after touching the highest since August 2014. The metal headed for a seventh day of gains, the longest stretch since March 2015.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.