- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Oil prices rose

Oil prices rose

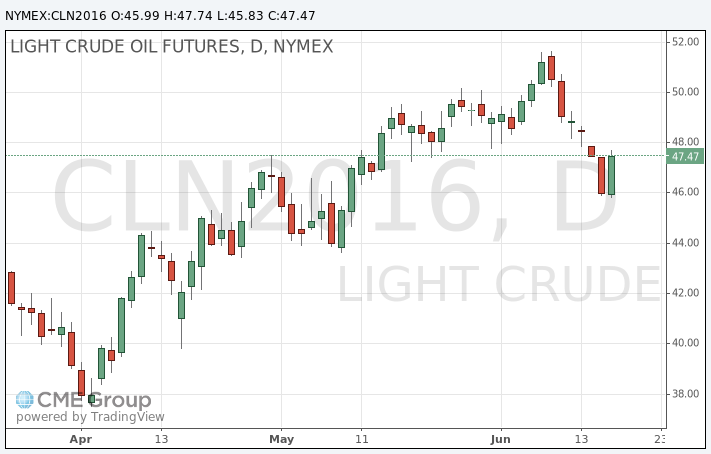

Oil prices rose on Friday for the first time in a week as the dollar fell and investors in global markets cautiously bought some riskier assets as anxiety eased about Britain's possible exit from the European Union.

Crude futures were still on track for a weekly loss after daily declines Monday through Thursday.

Brent crude futures' front-month contract were up $1.28, or 2.7 percent, at $48.47 a barrel .

The front-month in U.S. crude's West Texas Intermediate (WTI) futures rose $1.18, or 2.5 percent, to $47.39.

For the week, Brent was down 4 percent and WTI about 3 percent.

Investors will be on the lookout for a weekly reading on the U.S. oil rig count due from oil services firm Baker Hughes at 1700 GMT.

Last week, the rig count rose for a second week in a row, the first time since August, as oil drilling activity increased with crude trading over $50 a barrel.

On Thursday, Brent and WTI lost about 4 percent each as investors fretted that the global economy could be thrown into turmoil if the UK votes next week to ditch its EU membership.

On Friday, Britain mourned the death of UK member of parliament Jo Cox, a day after the vocal advocate for Britain remaining in the union was murdered. Her death threw next week's referendum on EU membership into limbo.

The dollar fell about a quarter percent, retreating from its 2-week high on Thursday that had weighed on demand for greenback-denominated oil from the holders of the euro and other currencies.

Some analysts cautioned that with UK's future EU still unknown until a vote next Thursday, oil could come under pressure again.

"It's mainly Brexit at the moment, at least until next Thursday, before people start to look at the more fundamental oil/commodity drivers again," ABN Amro's senior energy economist Hans van Cleef said.

Julian Jessop, chief economist and head of commodities research at Capital Economics, told Reuters Global Oil Forum that a Brexit situation could lead to a sharp oil selloff sending Brent to as low as $40.

In industry news, global oil majors Chevron and Royal Dutch Shell were putting up small refineries for auction as they looked to trim lower-margin assets amid rising crude prices.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.