- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- ZEW: strong increase in economic sentiment

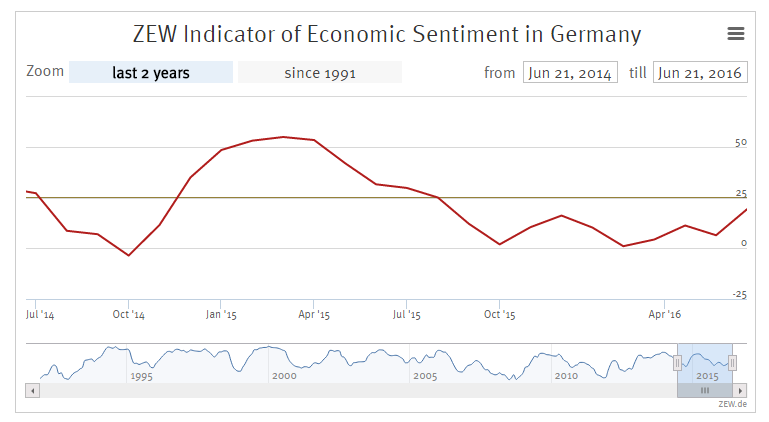

ZEW: strong increase in economic sentiment

The ZEW Indicator of Economic Sentiment for Germany has increased in June 2016. The index has improved by 12.8 points compared to the previous month, now standing at 19.2 points (long-term average: 24.4 points)."The improvement of economic sentiment indicates that the financial market experts have confidence in the resilience of the German economy. However, general economic conditions remain challenging. Apart from the weak global economic dynamics, it is mainly the EU referendum in Great Britain which causes uncertainty," says Professor Achim Wambach, President of ZEW.

The assessment of the current situation in Germany has slightly improved. Growing by 1.4 points, the index now stands at 54.5 points.

Financial market experts' sentiment concerning the economic development of the Eurozone has improved. ZEW's Indicator of Economic Sentiment for the Eurozone has increased by 3.4 points to a reading of 20.2 points. Falling by 0.8 points in June 2016, the indicator for the current situation in the euro area has dropped to a value of minus 10.0 points.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.