- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Fade Any Near-Term Stabilisation Effort - Morgan Stanley

Fade Any Near-Term Stabilisation Effort - Morgan Stanley

"The vote to leave the EU has already and unsurprisingly prompted a significant market reaction, with the USD and JPY strengthening significantly, and GBP and EM currencies weakening substantially. While the risk of a policy response at multiple levels to stabilise markets is high, and has already led to a modest reversal of early losses, we believe the medium-term implications for growth, cross-border capital flows and risk taking more broadly mean that we are likely to see further USD and JPY strength and GBP, EM and commodity market weakness. As such, we would recommend fading any near-term stabilisation efforts.

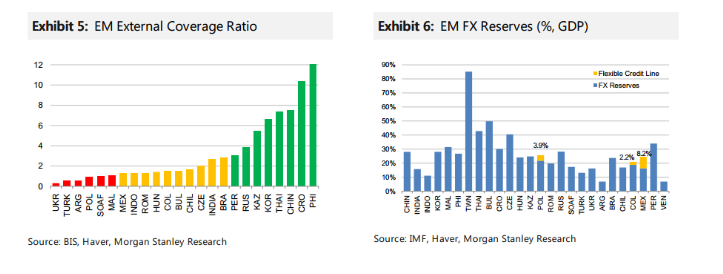

Pressure points: We see a number of pressure points that are likely to lead to further volatility in currency markets, with more USD and JPY strength and weakness in EM currencies.

First, the initial move lower in GBP, EUR, and other major and EM currencies has of course resulted in significant USD strength. This will likely create a self-reinforcing effect, with pressure likely to now emerge on CNY. Our RMB model suggests that the USD/CNY fixing will be 400pips higher, and this would create a second-round impact on regional peers such as KRW, TWD, THB and SGD.

Second, the market is quite likely to worry about the reverberations of this decision on the rest of Europe, with the risk that other countries may attempt to pursue a similar course of action. This could result in a tightening of financial conditions, retrenchment in the European banking sector, and a growth slowdown should concerns over a Euro breakup start to get priced back into the market. This would naturally spill over into global growth concerns.

Third, global monetary firepower to cope with another global economic downturn is relatively limited. Not only will this raise the odds of markets turning risk-negative, but it also allows for a more significant differentiation between those markets where we see scope for a monetary response and those where we do not. Economies where policy rates are still relatively elevated and there are no concerns about the currency reaction to easing are likely to see their currencies weaken. This is largely in the low-yielding Asia block, versus JPY and to some extent EUR".

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.