- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Asian session review: we know what happens after tight ranges

Asian session review: we know what happens after tight ranges

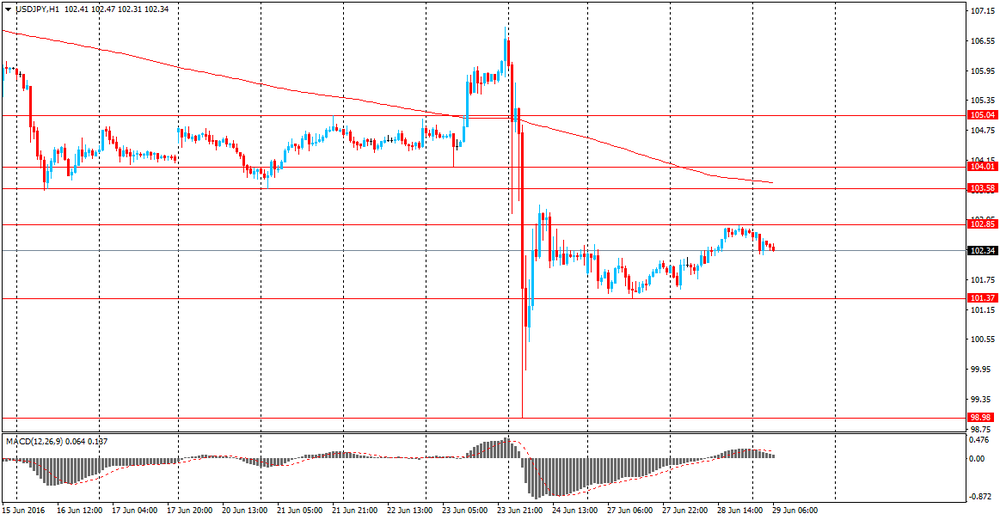

The yen has stabilized, halting its recent strong gains. Today, Japanese Prime Minister Shinzo Abe urged the Bank of Japan to provide sufficient funds to satisfy market liquidity. He also instructed the Minister of Finance Aso to pay the utmost attention to movements in the currency and the financial markets.

Abe said that the uncertainty and risks in the financial markets persist and the government is ready to mobilize all available means of policies to support the Japanese economy.

Bank of Japan governor, Kuroda, in turn, said that Japanese banks do not have problems with funding in foreign currency and the Bank of Japan will be able to add funds to the market if necessary.

The volume of retail sales in Japan remained unchanged at the level of 0.0% in May. In annual terms, this figure fell to -1.9% from the previous value of -0.9%. Analysts expected a decline to -1.6%.

Retail sales in large stores in Japan also declined, reaching 2.2% in May after falling 0.7% in April

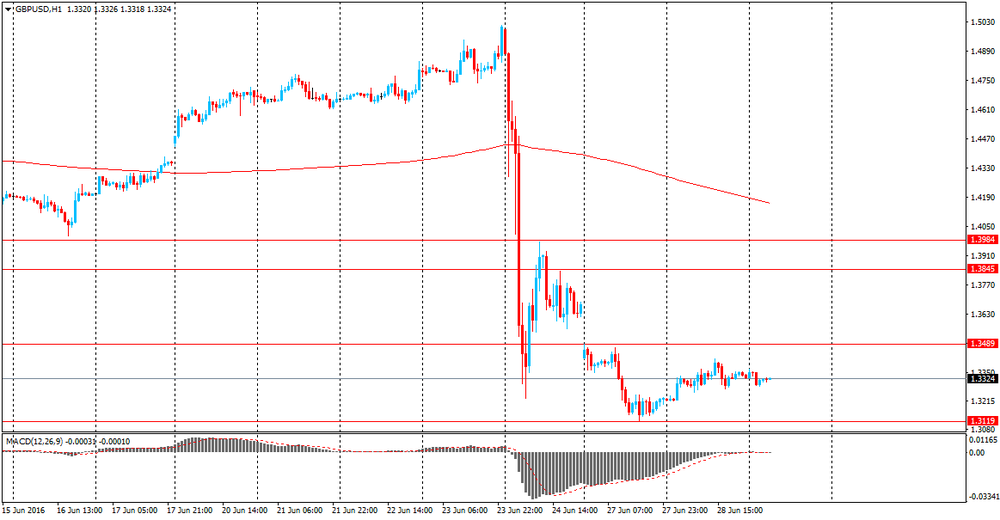

Pound traded near the low of June 24 as the market is concerned about the possible consequences of Brexit. Recall, the pound touched its lowest level since mid-1985 - $ 1.3119, having fallen by 11.5% compared to the closing level on June 23.

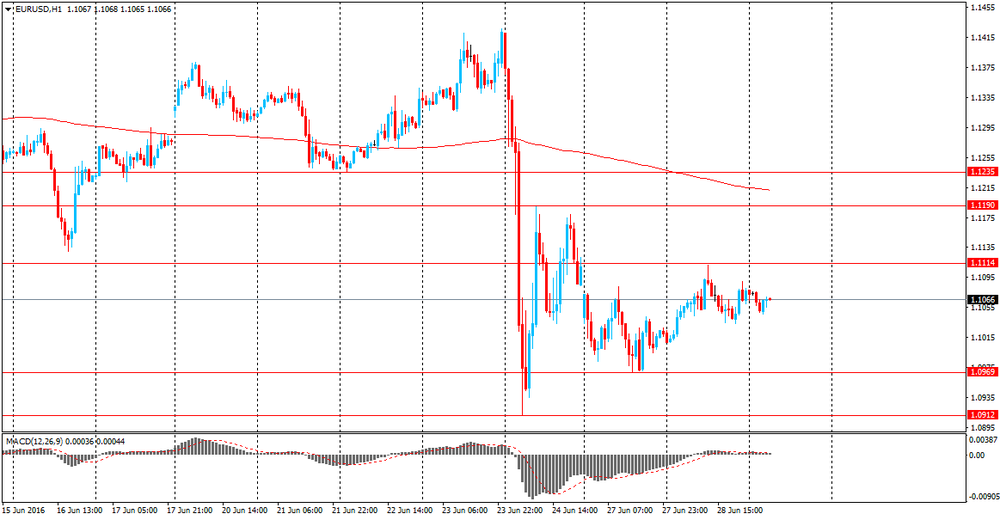

The euro has stabilized in a tight range, preparing the next sharp move. Yesterday ECB President Draghi in an interview with Bloomberg said that the UK decision to leave the EU could lead to a reduction in euro zone GDP growth of 0.5%. GDP growth will decline, at least for three years. Draghi also said that it is time to pay attention to the potential Brexit impact on the banking and could have a negative impact on the currency markets.

The Australian dollar generally traded around yesterday's high. Since the beginning of the session, the AUD/USD fell slightly against the background of negative data on new home sales in Australia. As it became known, new home sales in Australia declined in May to -4.4%, after declining in April at -4.7%.

Despite a slight improvement, sales of new homes continued to decline since the beginning of this year. Sales of detached houses fell by -6.7% and sales of apartment buildings rose by + 4.9%.

EUR / USD: during the Asian session, the pair traded in the $ 1.1045-60 range.

GBP / USD: traded in of $ 1.3285-1.3305 range.

USD / JPY: traded in Y101.15-25 range.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.