- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Asian session review: Yen little changed

Asian session review: Yen little changed

The dollar took a breather, but remained near a 3 month high against a basket of currencies affected by the vote in the UK to leave the European Union.

Despite the stabilization of exchange rates, the uncertainty as to how the UK will affect the output of the global economy remains extremely high. 2nd quarter flows will increase volatility and investors cand close their positions before the long weekend in the US. Month end is a volatile period that can offer trading oportunities.

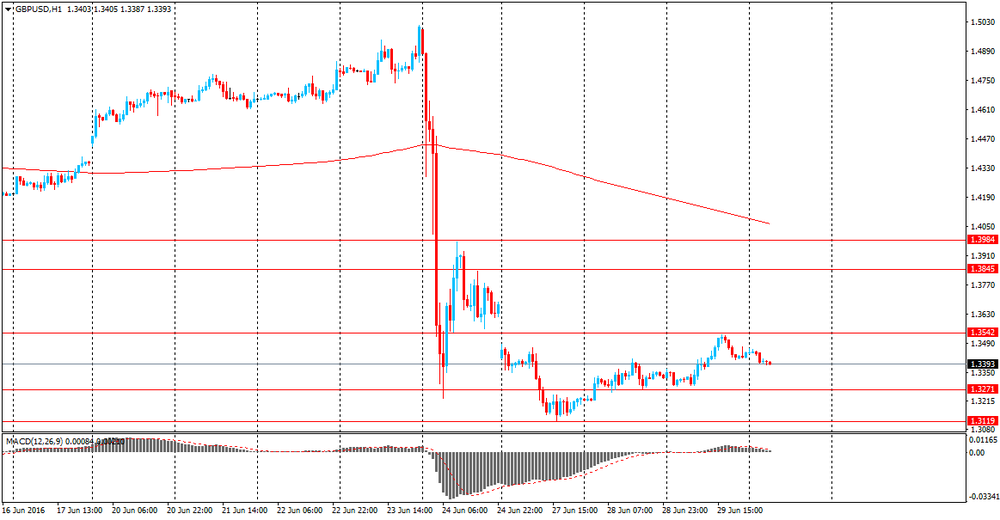

The pound traded near the 28 June high rebounded from a 31-year low reached on Monday, the lowest level since 1985. Recall the two-day decline of the pound on Friday and Monday was the largest in recent history.

EU leaders discussed the consequences of brexit at the summit in Brussels. On Tuesday, EU leaders said that the UK should not expect any preferences from the former partners on the trade block.

The last meeting of EU leaders has become hot, although it was probably a premature farewell to the British Prime Minister David Cameron and sluggish approval of the previously approved plans in the sphere of economy. The leaders of the European Union, bearing their share of responsibility for creating an atmosphere in the EU that favored Brexit.

According to the data released today, the consumer confidence index from the GfK UK in June remained unchanged at -1. Analysts had expected a decline to -2.

Today's data on consumer confidence index was calculated through a survey conducted from June 1 to June 15

The GfK said that they are going to do a new survey, which will be published on July 8 to try to assess the impact of the UK decision to withdraw from the EU structure.

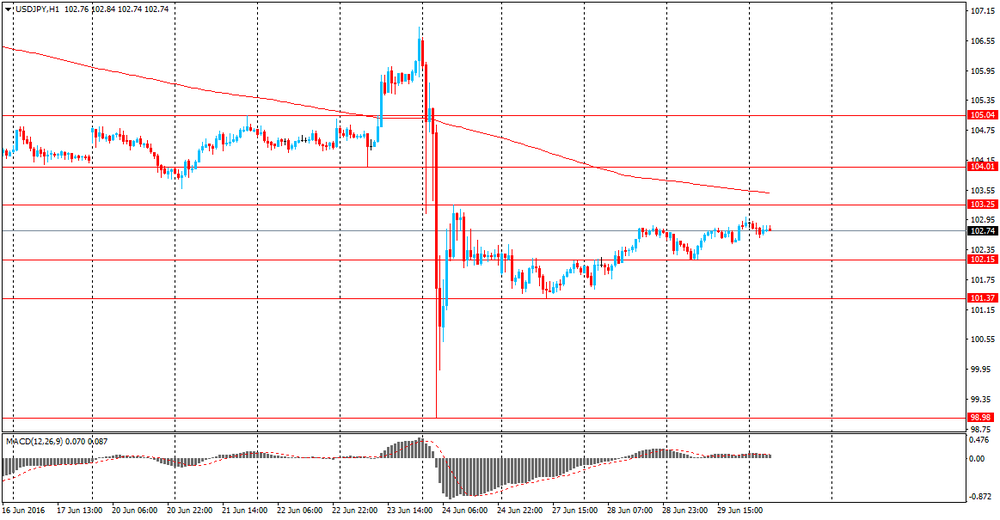

The yen was little changed from the closing session on 28 June, despite trade and industry weak preliminary data . The Japanese industrial production fell by 2.3%. Analysts had expected a decline to -0.1%. In annual terms, industrial production fell by 0.1% after a decline of -3.3% in April.

Japanese Ministry of Economy, Trade and Industry predicts growth of industrial production in the coming months. Growth of industrial production is expected in June at 1.7% and in July to 1.3%.

The Australian dollar fell to some extent, influenced by the data released today by private sector lending. Lending to the private sector in Australia increased by 0.4% in June, lower than the previous value of 0.5%. In annual terms, this figure decreased from 6.7% in May to 6.5% in June.

The report on private sector lending, published by the Reserve Bank of Australia, reflects the amount of funds borrowed by Australian private sector. It shows whether the private sector can afford large expenses that will support economic growth. This figure is considered an indicator of business conditions and economic situation in Australia as a whole.

Housing loans increased in June by 0.5% after the credit growth in May by 0.4%. On an annualized basis, +6.9%.

Personal loans decreased 0.1% in June and 1.1% in annual terms.

Business loans, though increased by + 0.3%, the rate was lower than the previous value of + 0.8%.

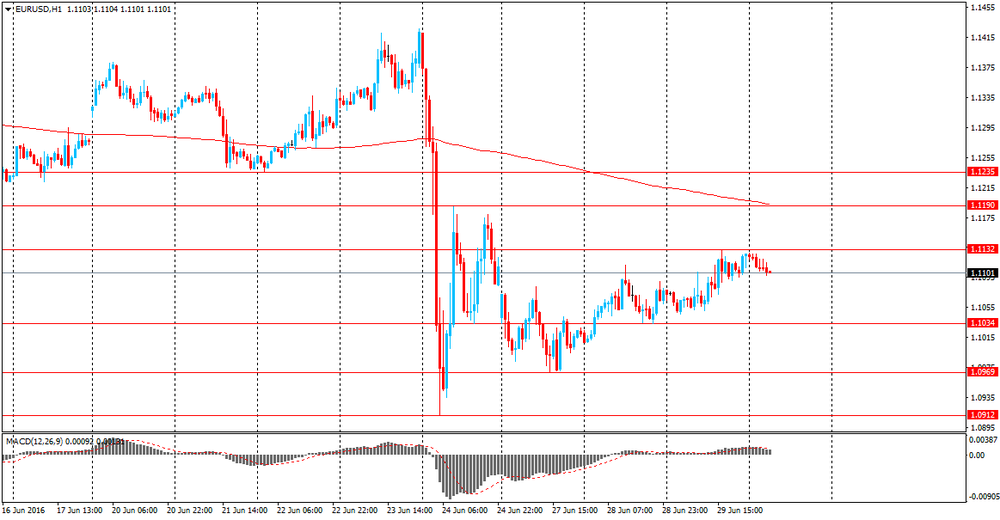

EUR / USD: during the Asian session, the pair traded in $ 1.1080-1.1100 range.

GBP / USD: traded in 1.1.3360-1.3400 range.

USD / JPY: traded in Y101.45-55 range.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.