- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Credit Suisse downgraded AUD, NZD forecasts. Targets

Credit Suisse downgraded AUD, NZD forecasts. Targets

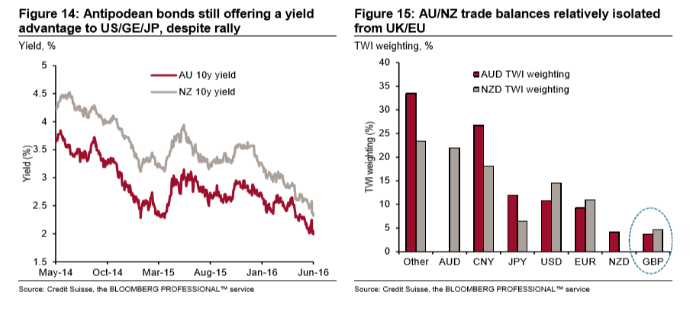

"Our antipodean view in the wake of the Brexit vote is predicated on two observations:

In the short-term context of high volatility, elevated risk aversion and high correlations, currencies like the AUD and NZD tend to trade in line with broader risk sentiment without much differentiation. Given that we expect the current climate of politically-induced market dislocations to continue for some time, AUD and NZD are likely to underperform 'safe-haven' currencies such as JPY, CHF, and USD.

Balanced against this is the ongoing political instability in the UK and Europe, as well as potential "Trumpxit" risk from the US, which can drive longer-term portfolio capital flows to Australia and New Zealand. As they are highly rated sovereigns with stable political environments and still carry some risk free yield, they have considerable potential to become viewed as 'safe-haven' currencies in their own right.

Thus, we express this sentiment by downgrading our 3m AUDUSD forecast from 0.74 to 0.72, and our 3m NZDUSD forecast from 0.7250 to 0.7060 (continuing to target 3m AUDNZD 1.02), while leaving our 12m forecasts unchanged at 0.70 and 0.66, respectively".

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.