- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Positioning For A Grind Downwards In Eur/Usd - BNPP

Positioning For A Grind Downwards In Eur/Usd - BNPP

efxnews with the latest BNP Paribas trade recommendation:

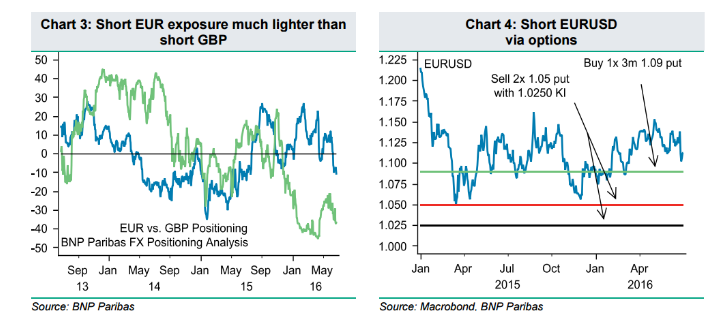

The still-elevated level of GBP volatility renders downside GBP structures very expensive after last Thursday's UK referendum. Financial markets appear to view the UK's vote to exit the EU as creating political stress within the eurozone. Positioning in the EUR has deviated from exposure to the JPY (+43) and CHF (+17) but is only moderately short at -16 compared to -45 for the GBP. Uncertainty and financial market stress are likely to remain high. In this environment, the EUR short exposure may catch up with the GBP's short exposure.

We favour positioning for a grind downwards in EURUSD, rather than a sharp move, as we see two key factors preventing a sharp decline in the EUR:

1. European Central Bank policy (asset purchase programme) will limit the widening of peripheral spreads through its purchases. Hence borrowing costs should not return to levels which would compromise fiscal sustainability. Peripheral spreads (Spain and Italy) versus Germany did initially widen by around 30bp but have since narrowed back.

2. The EUR should draw support from its circa 3% of GDP current account surplus, which has expanded considerably since 2012. Furthermore, to the extent that global investor confidence is currently at a low level, eurozone investor outflows (recycling of the current account surplus) through portfolio outflows may slow.

Finally, we note that BNP Paribas FX Positioning Analysis signals that short EUR exposure is much lighter than short GBP positioning (Chart 3). Short EUR positioning stands at -16 (on a scale of +/- 50), while short GBP positioning has reached -45. Therefore, there is considerable scope for investors to add to short EUR positions to position for further European stress.

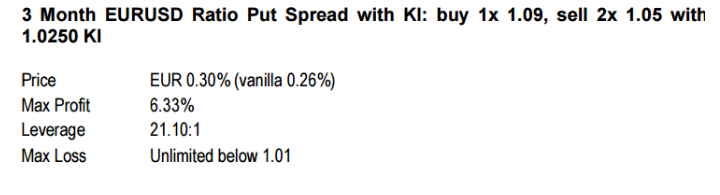

We favour the following trade recommendation which positions for a grind downwards in EURUSD but does not reach new lows below the 1.0524 of December 2015.

Adding a knock-in at 1.0250 is cheap as risk-reversals strongly favour EUR puts. The structure is flat vega at inception and has 6bp of positive rolldown over the first month. We would hedge the structure if the knock-in is activated.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.