- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Asian session review: the Australian dollar has strengthened

Asian session review: the Australian dollar has strengthened

Dollar little changed against the euro. US markets are closed today because of Independence Day holiday.

Friday, euro strengthened against the dollar amid eurozone labor market report. Eurostat announced that at the end of May the unemployment rate in the eurozone was 10.1%, a decline of 0.1% compared to the previous month and confirming experts' forecasts. The latter value was the lowest since July 2011. Recall that in May 2015 unemployment was 11.0%. Among the 28 EU countries, the unemployment rate fell from 8.7% to 8.6% in May (low from March 2009). In the corresponding month in 2015, the unemployment rate was at 9.6%.

Growth of the euro has also been confirmed with statements by the representatives of the ECB Praet. He said the economy has shown signs of strengthening, and this suggests that monetary policy works, "the ECB is set to continue to play a crucial role in this process, however, the ECB's policy can not be the only remedy for the current economic problems, need more actors." - Praet said. In addition, the politician said that among the uncertainties threatening the euro-zone economy, we can distinguish the British withdrawal from the European Union and the weakness of world economic growth.

This week, on Tuesday, the focus of investors will be on retail sales in the euro zone, and on Thursday the market's attention will be focused on data on industrial production in Germany. Analysts predict a slight increase in both indicators.

In addition, on Thursday European Central Bank minutes are published, from the meeting in early June. Investors will be interested in how ECB was preparing for Brexit

.

During the Asian session, the Australian dollar rose towards the 1 July high, after rating agency Moody 's Investors Service said that political uncertainty will be short-lived and have limited consequences for the coveted triple-A credit rating.

Inflation expectations increased by 0.6% in June, after declining 0.2% in May. It was the biggest gain since December 2013. In annual terms, this indicator also increased from 1.0% to 1.5% although tomorrow the RBA is expected to leave interest rates unchanged at 1.75%.

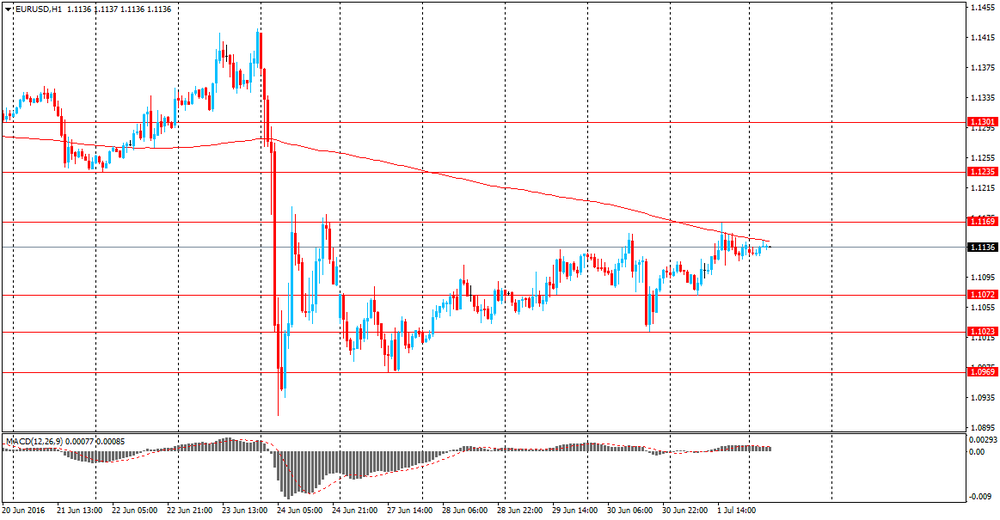

EUR / USD: during the Asian session, the pair was trading in the $ 1.1125-35.

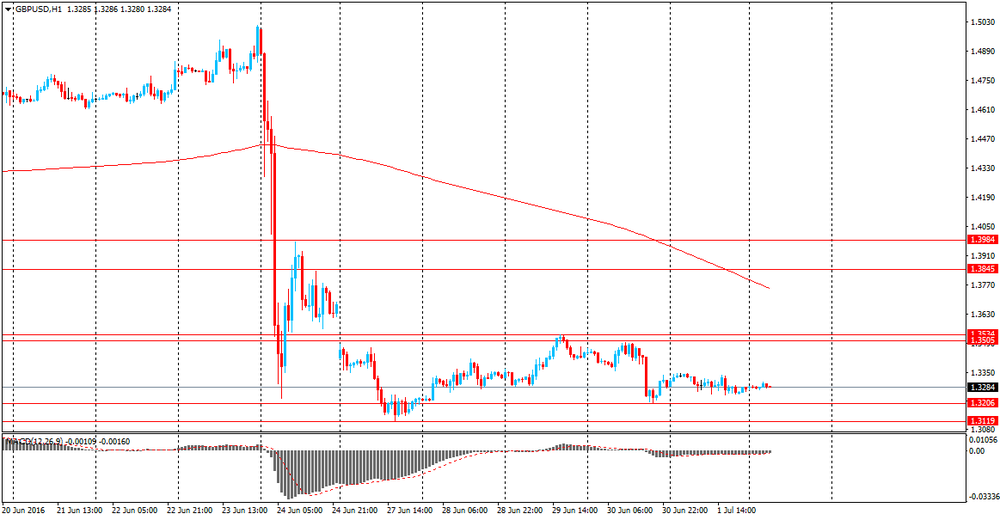

GBP / USD: during the Asian session, the pair is trading in the range of $ 1.1.3270-85.

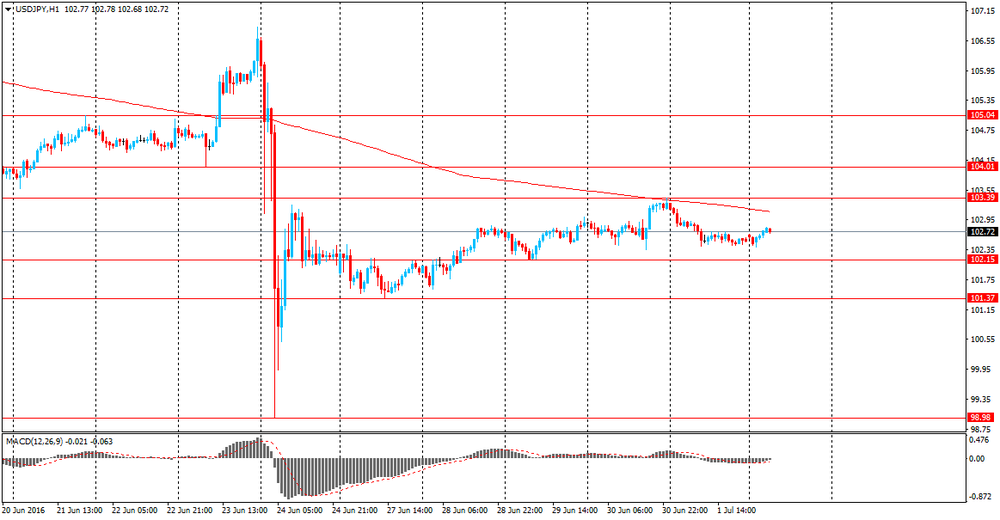

USD / JPY: during the Asian session, the pair was trading in range Y102.40-65.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.