- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Goldman Sachs cuts Eur and Gbp forecasts

Goldman Sachs cuts Eur and Gbp forecasts

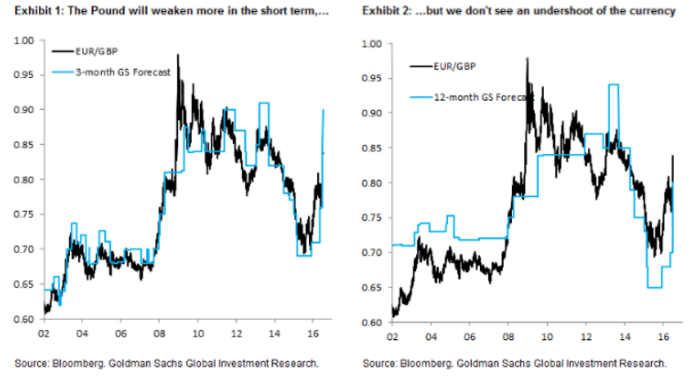

"Following the Brexit surprise, we revised our Sterling forecasts weaker, but - amid lots of doomsday scenarios for the Pound - resisted the temptation to forecast a free-fall. Now that markets have settled somewhat, we are switching to forecast a second leg of weakness for the Pound, as the Bank of England's policy response drives the currency weaker.

...The market is not discounting the easing effect of asset purchases, the persistence of easier monetary conditions in the UK, and the US-UK monetary policy divergence that we expect nearly as much as it should.

Next week, we expect the BoE to provide a further indication of the scope of the conventional and unconventional monetary policy measures we expect. This will be the catalyst for a further downward move in Sterling.

...Turning to the Euro, the negative growth spill-overs that our economists expect is a cumulative 0.5 percent over two years (compared with 2.75 percent for the UK). This slowdown implies downside risks to our already low inflation projections and puts additional pressure on the ECB to step up the pace of monetary accommodation.

Our economists expect an extension of the asset purchase programme through 2018 and a shift away from the ECB's capital key. The latter change could reduce market worries over Bund scarcity and, in our view, could lead to more EUR/$ weakness.

Our new EUR/GBP forecast is 0.90, 0.86 and 0.80 in 3-, 6- and 12-months (from 0.85, 0.82 and 0.78 previously), i.e. builds in more Sterling weakness in the near term. We also revise our EUR/$ forecast to 1.08, 1.04 and 1.00 in 3-, 6- and 12-months (from 1.12, 1.10 and 1.05 previously).

These changes imply a new path for GBP/$ of 1.20, 1.21 and 1.25 in 3-, 6- and 12-months, i.e. substantially more front-loaded downside than in our forecast in the immediate aftermath of the Brexit vote (1.32, 1.34 and 1.35)".

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.