- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Asian session review: yen continues to decline

Asian session review: yen continues to decline

During the Asian session, the yen continues to fall after yesterday's press conference were Japanese Prime Minister Shinzo Abe said the Japanese government is preparing to take measures to stimulate the economy. Abe said that today intends to instruct the Minister of economic recovery of Japan Nobuteru Ishihara to prepare comprehensive economic measures to remedy the situation.

USD / JPY, gained momentum after the news about the meeting and Bernanke Abe, who said that one The Government of Japan will lower GDP forecast. Prime Minister Shinzo Abe plans to lower GDP growth forecast for the fiscal year ending March 2017 to 0.9% from 1.7%. The new forecast will be published on Wednesday and will be adjusted for inflation. The previous forecast was published in January. Abe Administration is likely to present a forecast assuming GDP growth next year at 1.2%.

Ministry of Economy, Trade and Industry said today that the index of activity in Japan of services decreased by 0.7% in May, in line with analysts' forecasts. The previous value was revised downward from 1.4% to 0.7%. This indicator reflects the state of Japan's domestic service sector, including information and communications, electricity, gas heating and water supply, services, transport, wholesale and retail trade, finance and insurance, and social security. According to the Japanese economy on exports, this figure may account for the lower volatility of the yen. The decline also negatively impact on the Japanese currency.

The euro rose against the US dollar, following the strengthening of the pound, which was supported by evidence that Theresa May will be the next Prime Minister of Great Britain. The euro is likely to follow the pound, which is the main topic of discussion of traders before the meeting of the Bank of England, devoted to monetary policy, which will take place on Thursday. The probability of lowering interest rates by the Bank of England to a new record low and a possible political stability are the two opposing market forces for the pound and the euro.

After the referendum, the head of the Bank of England Carney said that to support the economy will probably require an easing of monetary policy during the summer. Thus, Carney signaled that the Central Bank may lower interest rates. He added that the Bank of England has a number of other tools to protect the economy and banking system, which may indicate a resumption of the bond purchase program.

After the unexpected results of the referendum, analysts expect a prolonged period of uncertainty and volatility. However, many predict a recession, increasing inflation. Most likely, the Central Bank may consider a rate cut to 0.25% an adequate measure.

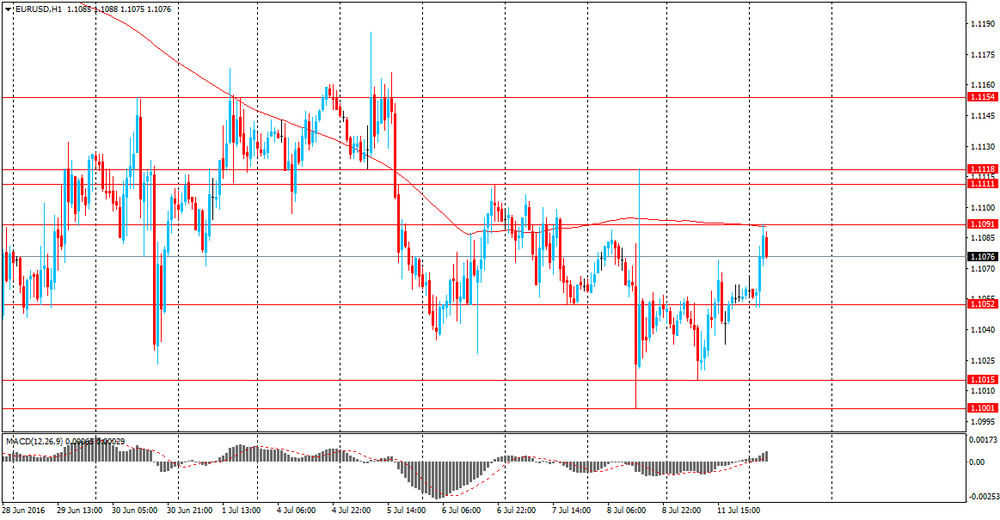

EUR / USD: during the Asian session, the pair was trading in the $ 1.1050-85 range.

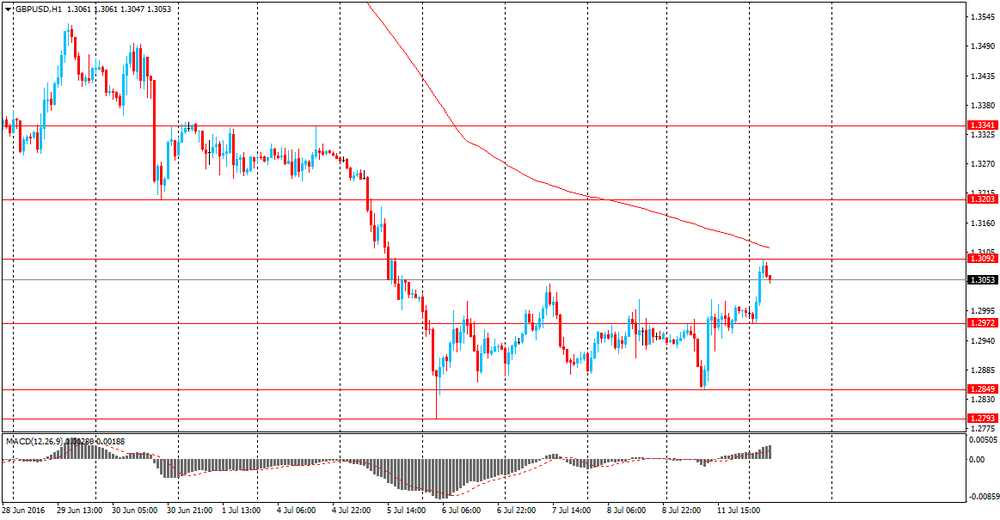

GBP / USD: during the Asian session, the pair is trading in the $ 1.2970-1.3080 range

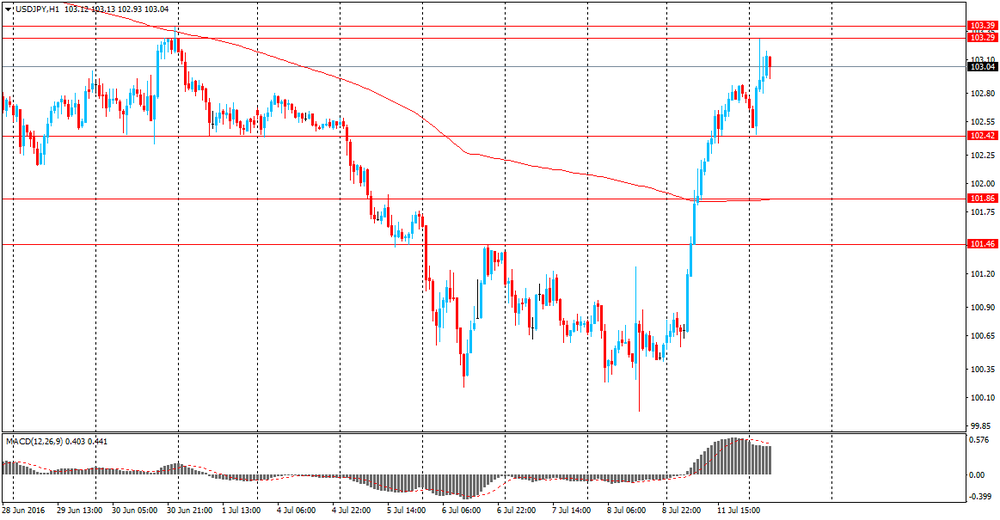

USD / JPY: during the Asian session, the pair was trading in range Y102.45-103.30.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.