- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Asian session review: the dollar rose against the yen

Asian session review: the dollar rose against the yen

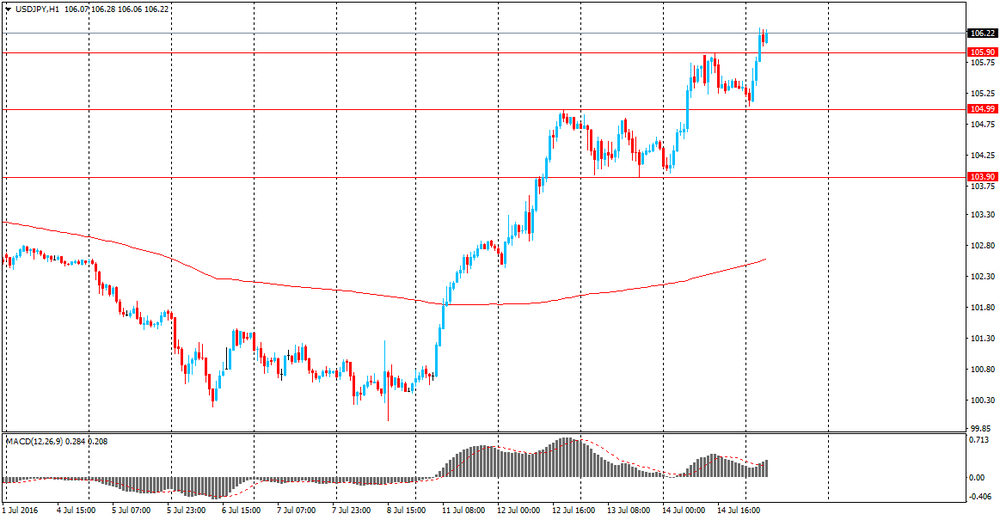

Since the beginning of the trading session, the US dollar rose against the yen reaching Y106,23, the highest since June 24 after strong data on China's GDP, which increased risk appetite.

China's gross domestic product in the second quarter increased by 6.7% compared to the same period of the previous year. However, the figure was slightly above economists' expectations of 6.6%. Seasonally adjusted, GDP in the second quarter rose by 1.8% after rising 1.1% in the first quarter.

The growth of China's economy in the second quarter remained stable, indicating the positive impact of stimulus measures implemented by the Chinese government

China's central bank lowered interest rates six times since November 2014 in an attempt to support economic growth.

Also, the National Bureau of Statistics of China released data on industrial production and retail sales, according to which industrial production in China from January to June increased by 6.2% compared to the same period of the previous year of 6.0%. The indicator was higher than economists' forecast of 5.9%.

Retail sales in China increased by 10.6% in June, higher than the previous value, and analysts' expectations of 10% year on year.

Investment in China's urban sector in the first half of the current year increased by 9%, which is lower than the previous value of 9.6% and 9.4% of analysts' expectations. Reduced investments in the urban sector indicates a weakening of the pace of overall economic growth of China. As the economy of China has a major impact on the global economy, this indicator has a specific meaning for the Forex market.

The report by the National Bureau of Statistics of China said that in the first half the volume of investment in agriculture increased by 21.1%. Investments in industry increased by 4.4%. The inflow of investments in the services sector grew by 11.7%.

In China, in recent years there there has been a slowdown in the growth of investment in fixed assets. So, in 2011 the volume of investments increased by 31.8% and by the end of 2015 - only 10%.

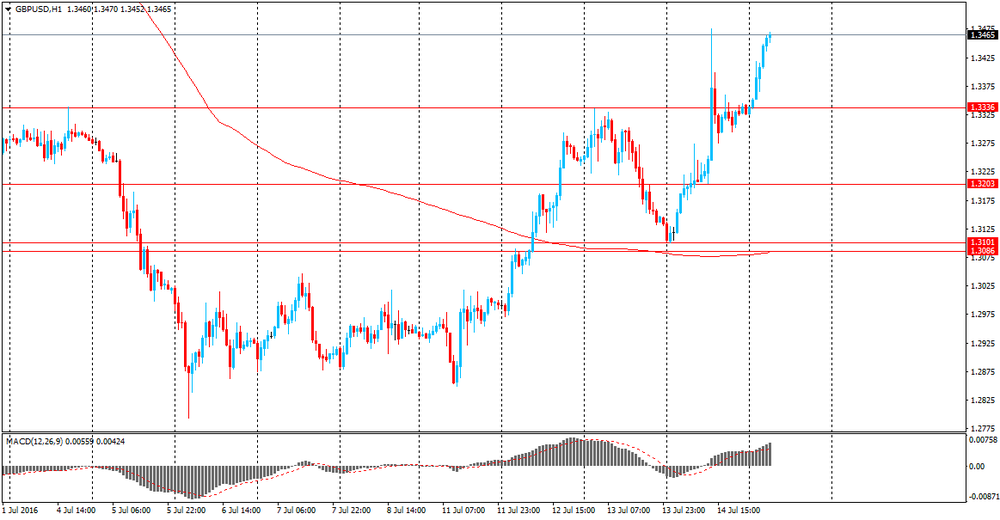

Pound, during the session received support from the Bank of England meeting results. Despite the experts' forecasts, the Central Bank decided to leave the interest rate unchanged at 0.5%. The minutes of the meeting noted that the number of votes cast in favor of keeping the key was 8, and the number of votes cast in favor of raising the key rate, 1. Also in the report it was said that most members of the Committee are expected easing in August. "The committee members previously discussed the different possible packages of measures, but the degree of additional incentives will depend on the August forecasts, need a detailed analysis of all the policy options.". "Economic activity is likely to weaken after the referendum. Recently revealed a sharp drop in household confidence indicators and the business community, however, some companies have postponed investment and personnel decisions.".

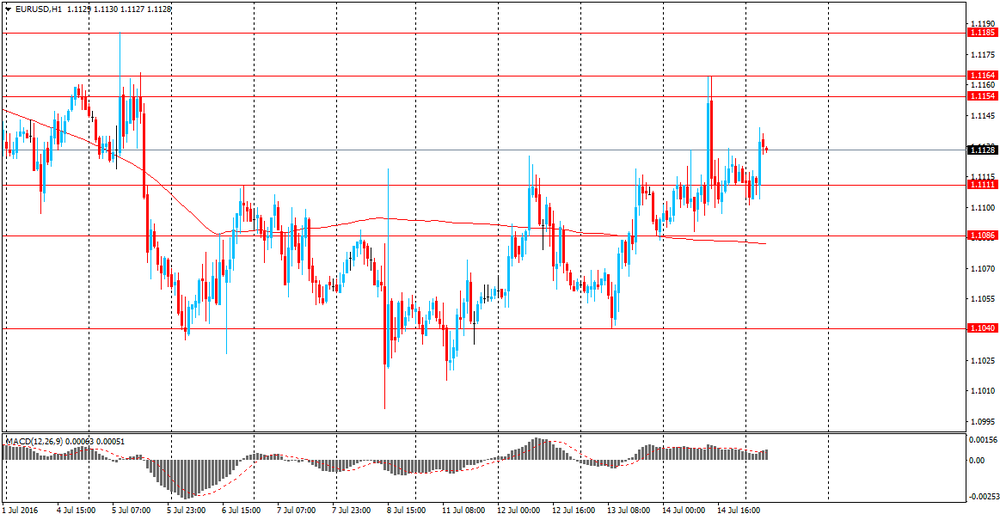

EUR / USD: during the Asian session, the pair was trading in the $ 1.1100-25 range.

GBP / USD: during the Asian session, the pair is trading in the $ 1.3325-1.3420 range,

USD / JPY: during the Asian session, the pair rose to Y106.31

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.