- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Gold price little changed for the day

Gold price little changed for the day

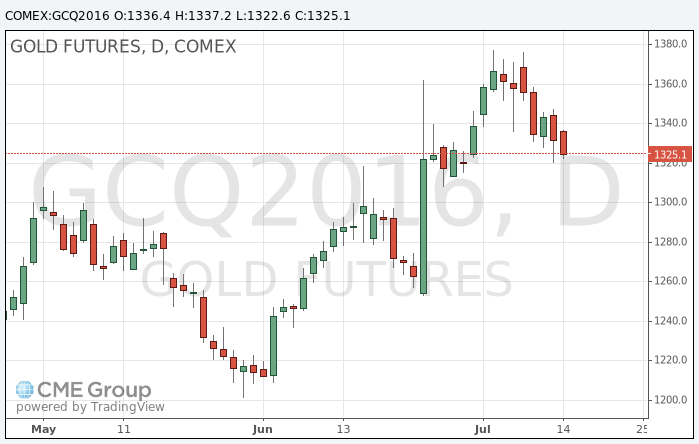

Gold becomes moderatly cheaper in the course of today's trading, and preparing to finish in the red the first week of the last seven against the backdrop of improving risk appetite and strengthening of the dollar.

Asian stock markets rose to an eight-month high after encouraging data from China, while European shares fell after the attack in the south of France, which killed 84 people.

After six weeks of growth, the longest rally since March 2014, gold have fallen by 2.5 percent since the beginning of this week after strong data on new jobs in non-agricultural sector of the US and reduced risks about Brexit.

"Investors are taking profits, and now $ 1,300 is a new level of support for gold prices, - said a senior strategist at ING Bank Hamza Khan -. Wider political events such as elections in the US, followed by the French and German elections next year, will be enough to support gold, even if other assets will rise in value in a low interest rate and the search for yield. "

The dollar is preparing to finish the week gaining more than 5 percent against the yen.

Three Fed officials on Thursday said that should not rush to increase US interest rates, in spite of signs that the US economy has reached almost full employment.

The assets of the world's largest gold exchange-traded fund SPDR Gold Trust fell 0.25 percent to 962.85 tonnes on Thursday.

Traders in Asian fixed sold gold reserves after the increase in prices last week to a maximum of more than two years, and jewelers in India continue to offer huge discounts.

The cost of the August gold futures on the COMEX fell to $ 1322.6 per ounce.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.