- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Asian session review: the dollar weakened slightly

Asian session review: the dollar weakened slightly

The euro strengthened slightly against the US dollar after yesterday's decline on the results of the ECB meeting. As expected, the ECB has decided not to change the monetary policy: the key rate remained at a record low of 0% and the deposit rate at -0.4%. At the same time, the head of the Central Bank Draghi signaled in September a possible further easing. In September, the ECB economists will present the new forecasts for growth and inflation, allowing a more clear asses of the probability of slowing down economic recovery. As for the Brexit impact, he said that everything will depend on how long the negotiations will take place between the UK and the EU on the new conditions of interaction, as well as the results of these negotiations. "It is too early to judge the impact" - Draghi said, adding that Brexit was a problem for the European economy, given the geopolitical uncertainties. He also said to use all available instruments in the framework of the mandate in the case of reducing the probability of achieving the inflation target over the coming years, if necesary.

The market is expecting the indexes of business activity in the service sector and in manufacturing for July: at 07:00 GMT the report from France, 07:30 GMT - Germany, at 08:00 GMT - the eurozone and in the 08:30 GMT Britain. According to forecasts, the euro zone manufacturing PMI index fell to 52.0 from 52.8 in June, and the index for the services sector worsened to 53.5 from 54.5.

The Japanese yen traded in a narrow range around yesterday's lows. Bank of Japan Kuroda, denied the possibility of "helicopter money", thereby weakening the expectations of radical stimulus measures. "There is neither necessary nor possible", - said Kuroda.

Recent statements by Kuroda largely repeated his earlier statement that the government and the central bank should make decisions on fiscal and monetary policy, rather than a coordinated action within the framework of "distributing money" program. Kuroda said that if necessary, he will strengthen the measures namely - a wide-ranging program of asset purchases and negative rates. "We have a very strong policy framework", and I do not think there are significant limitations for further easing, Kuroda said.

Also holding back the further growth of the yen was today's preliminary data on the index of business activity in the manufacturing sector of Japan. Business activity in July was 49.0, higher than the previous value of 48.1 and analysts' expectations of 48.3. Despite the small increase the PMI index still remains below 50. The new export orders fell at the fastest pace in more than three and a half years and amounted to 44.0. The appreciation of the yen was leading to a decrease in global competitiveness.

Canadian dollar depreciates during today's session amid lower oil prices. Brent crude fell 0.3% to $ 46.34 per barrel.

Today at 12:30 GMT, Canada will release retail sales data for May and a report on consumer prices for June. The sales are expected to remain unchanged, while consumer prices to rose by 0.1%.

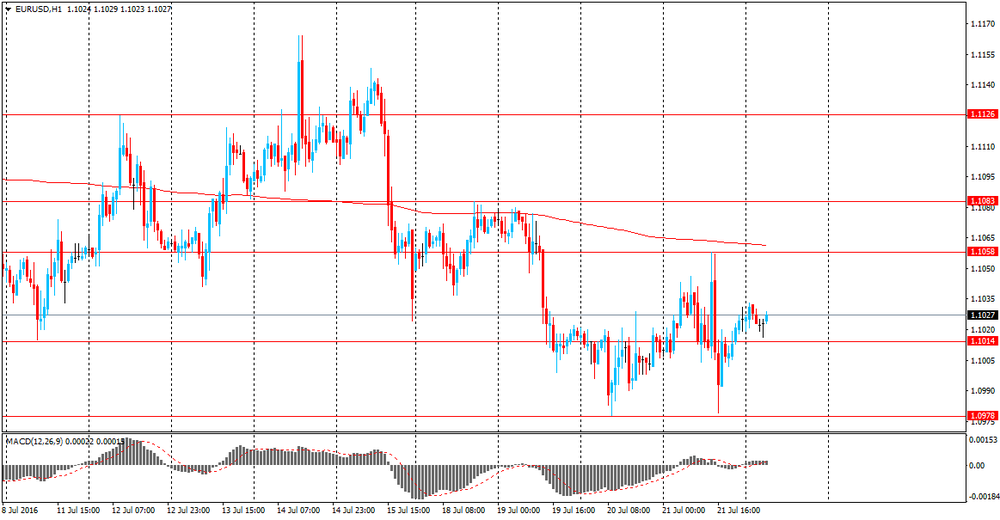

EUR / USD: during the Asian session, the pair was trading in the $ 1.1015-25 range

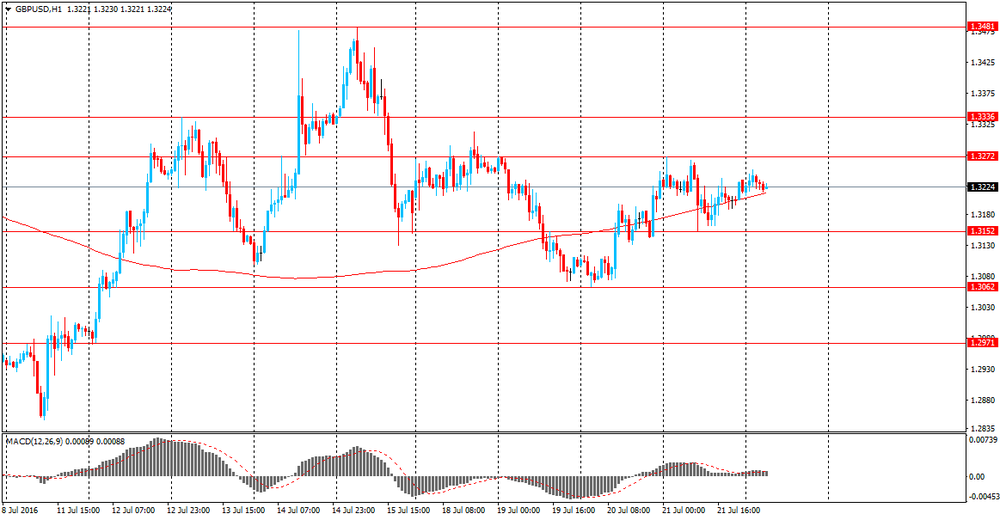

GBP / USD: during the Asian session, the pair was trading in the $ 1.3210-30 range

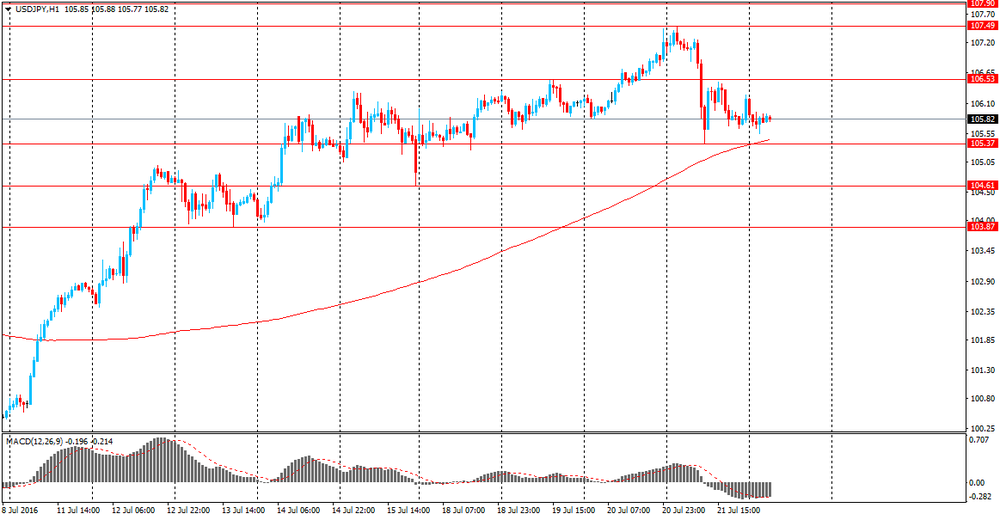

USD / JPY: during the Asian session, the pair was trading in Y105.55-80 range

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.