- Analiza

- Novosti i instrumenti

- Vesti sa tržišta

- Asian session review: yen little changed

Asian session review: yen little changed

The yen fell in the beginning of the session, but in the course of trading recover lost ground against the backdrop of more positive than expected data on the trade balance of Japan. Total Japan's trade surplus in June amounted to ¥ 692.8 billion, above analysts' expectations of ¥ 494.8 Bln. The previous value was revised from ¥ -41 billion to ¥ -40,6mlrd.

Exports fell -7.4% in June, year on year, after falling 11.3% in May. Analysts had expected a decline to -11.6. Exports to the US fell by 6.5%, exports to Asia fell 10.6% and 10.0% in China.

Imports fell by -18.8% while analysts had expected a drop to -19.7%. The previous value was -13.8%

The adjusted trade surplus amounted to Y 335.0 billion in June, after rising to Y269.8 billion in May.

In June, Japan's exports were lower than expected, but the trade surplus is due to a large fall in imports

Also today, the Government of Japan in its quarterly report, observed a light easing of moderate economic recovery. Has also left an overall assessment of the economy unchanged, but reduced the assessment of business confidence in the government also noted that Brexit increased global economic uncertainty.

The coincident index - the composite indicator that tracks the current state of the Japanese economy in May was 109.9, lower than the previous value of 112.0 and indicates a decline in economic activity in Japan. The index of leading indicators in May amounted to 99.7 after 100 in April.

Since the beginning of the trading session, the US dollar continued to rise against the euro, by updating the monthly highs, which was caused by correction of positions before the weekend, and very good data from US business activity. According to analysts recent US data increases the likelihood of the Fed raising interest rates. This is unlikely to happen at the July meeting, but closer to the end of the year. Futures on the federal funds currently estimate a probability of 20% for a rate hike in September. Meanwhile, the chances increase in December to 40% compared with less than 20% a week ago, and 9% at the beginning of the month.

According to Reuters latest survey, just over half of the 100 economists expect the Fed to raise rates in the fourth quarter to 0.75 percent compared with 0.25-0.50 percent currently. The change is likely to occur in December, as the November meeting of the Central Bank will begin in just a few days before the election on 8 November. The rest of the respondents forecast growth in the third quarter, most likely in September.

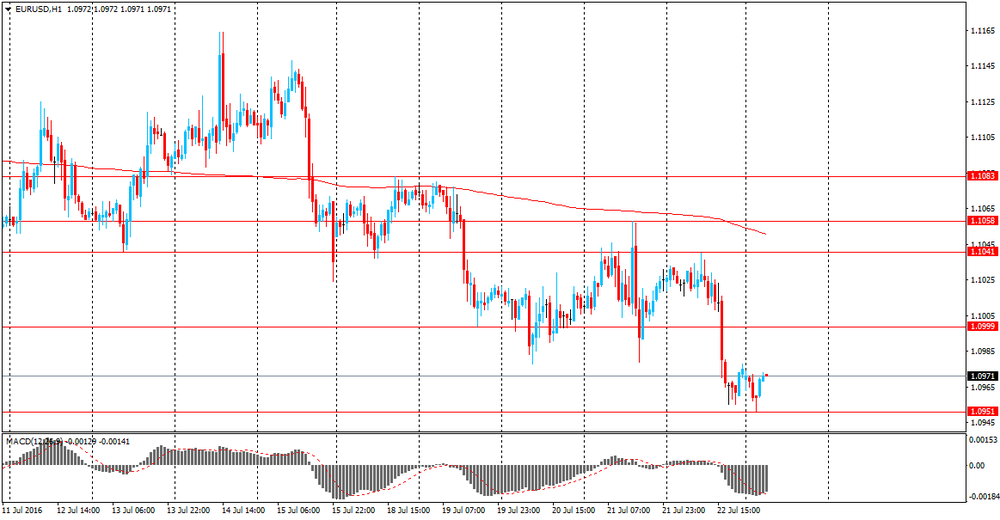

EUR / USD: during the Asian session, the pair was trading in the $ 1.0950-75 range

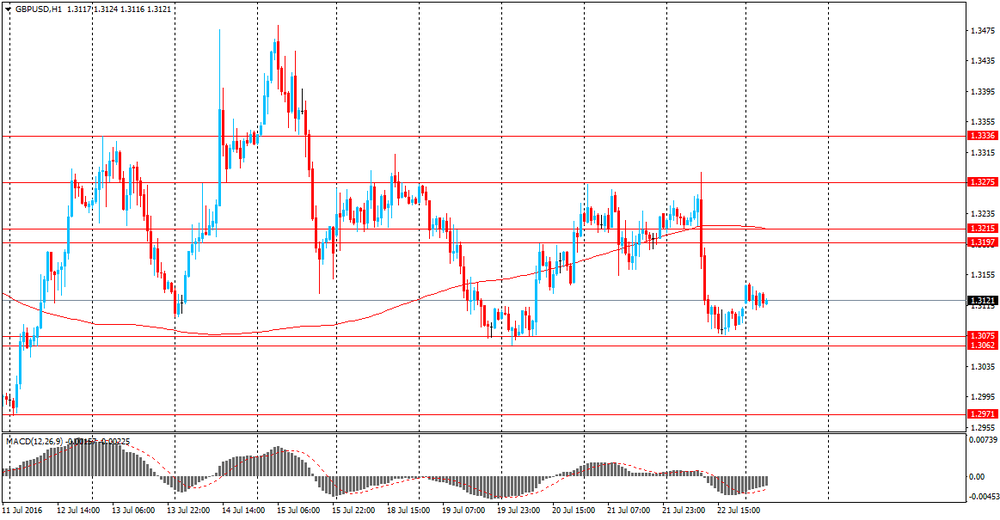

GBP / USD: during the Asian session, the pair was trading in the $ 1.3110-30 range

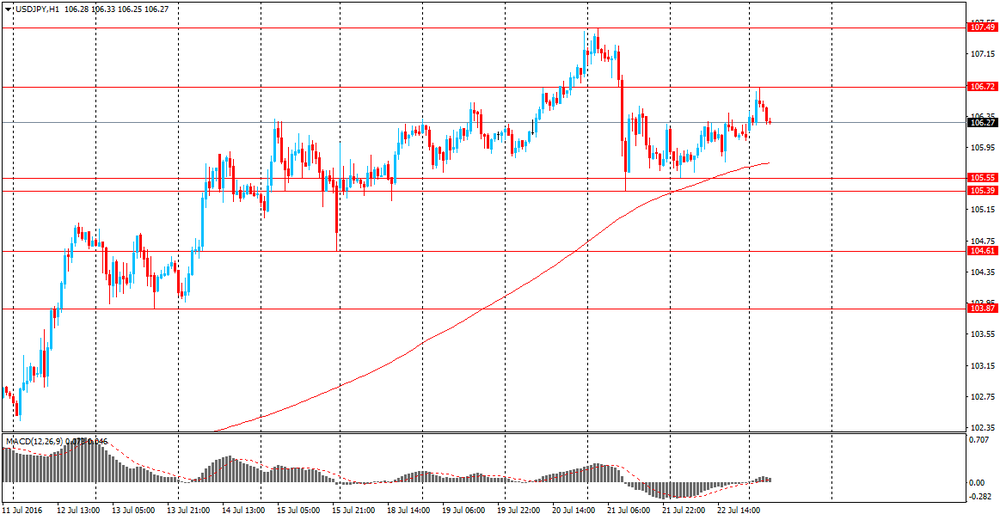

USD / JPY: during the Asian session, the pair was trading in 106.10-15 range

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.